Week in Review – June 30, 2023

Oil futures are slightly down this morning, indicating a potential quarterly loss of over 6% and marking the industry’s fourth consecutive quarterly decline. The downward trajectory this week began amidst concerns surrounding the global economic outlook and a slow recovery in Chinese demand. The Energy Information Administration (EIA) reported a larger than expected draw in US inventories, prompting a partial recovery in oil prices on Thursday. Positive export data and a strong jobs report from the US further contributed to the price increases. Nevertheless, the Federal Reserve’s announcement of at least two interest rate hikes to curb inflation dampened overall sentiment, despite Saudi Arabia’s supply cuts and expectations for increased summer demand.

June witnessed a forecasted three-month low in European gasoline shipments to the US, with volumes expected to drop by 17% compared to May, reaching around 350k bbl/d. This decline coincides with a significant decrease in stockpiles on the East Coast, which are now well below seasonal averages for the region. The ongoing summer driving season in the US could further strain supplies, potentially exacerbating the situation.

In a notable development, several EU member nations have announced their intention to propose a joint exit from the 1998 Energy Charter Treaty, an international energy agreement. The treaty, signed by 50 member countries, including EU nations, was initially designed to stimulate investments in the energy sector. However, concerns have emerged within the EU regarding the treaty’s compatibility with the bloc’s investment policy, law, and energy and climate goals. Cyprus, Hungary, and Slovakia have joined Denmark, France, Germany, and Luxembourg in planning their exit from the treaty, reflecting growing reservations among European nations due to climate-related concerns.

In the upcoming week, market participants will closely monitor shipping reports to assess whether Saudi Arabia follows through on its commitment to trim output by 1 million b/d starting this Saturday. This reduction forms part of the country’s efforts to stabilize oil prices and address market imbalances. Traders will be keenly observing these reports to gauge the effectiveness of Saudi Arabia’s production adjustments.

Prices in Review

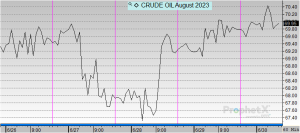

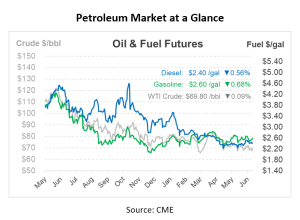

Crude opened the week at $69.84 and traded within a $1/bbl range all week. This morning, crude opened at $69.82, down two cents or -0.02864%.

Diesel opened the week at $2.426 and traded within 10 cents all week. This morning, diesel opened at $2.425, a decline of less than one cent or -0.001%.

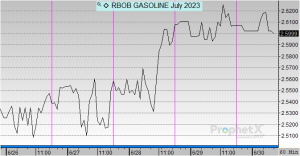

Gasoline opened the week at $2.5382 and traded within 10 cents throughout the week. This morning, gasoline opened at $2.6025, an increase of nearly 7 cents or 2.533%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.