Week in Review – June 16, 2023

Crude oil prices started the week on a lower note as Brent crude hit a six-month low and settled at levels not witnessed since December 2021. This plummet was driven by a myriad of factors including a weakened economic outlook, concerns over China’s demand growth, possible interest rate hikes from central banks, and increasing supply.

As the week progressed, crude oil prices took a turn and began their ascent. Despite crude fluctuating some this week, both Brent and prompt WTI are on track to finish the week relatively unchanged.

The Federal Reserve decided to pause its aggressive interest rate hiking cycle this week. Despite this pause, the Fed sent a stern message that further rate hikes could be impending. The market, however, appears nonchalant as the focus remains more on the immediate relief than potential future rate increases.

China’s refinery activity ramped up in May to its second-highest record. This was backed by the bullish statement of Kuwait Petroleum Corp’s CEO who expects Chinese oil demand to continue its upward trend in the second half of the year. China also decided to cut rates and hint at further stimulus measures, which contributed to the positive sentiment in the oil market. This was an encouraging sign for the global economy which could potentially translate into higher oil demand.

One of the key developments in balancing the supply side is OPEC and its allies’ voluntary crude output cuts implemented in May, along with an extra cut by Saudi Arabia in July. This decision is expected to tighten supply and increase oil prices in the face of rising demand.

As Russian refineries resume operations post-maintenance, seaborne exports of fuels, including diesel and naphtha, are projected to rise this month. The first ten days of June already saw a 51k bpd increase in shipments of refined crude products as compared to May. These exports remain under the microscope as Russia had earlier pledged to cut oil production by 500k bpd in response to sanctions.

Stateside, the U.S. saw a rally in refined fuels. The NYMEX gasoline crack jumped to its highest in over two months. Meanwhile, the NYMEX heating oil contract enjoyed a robust 5% climb on June 15th, to settle at the highest level since April.

Prices in Review

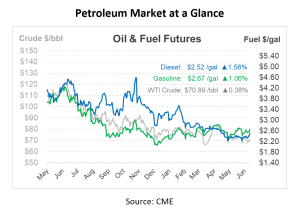

Crude opened the week at $70.27, before dropping to its lowest on Tuesday at $67.31. This morning, crude opened at $70.55, an increase of 28 cents or 0.3985%.

Diesel opened on Monday at $2.3607, and trended with crude in that it dropped to its lowest for the week on Tuesday at $2.3147. This morning, diesel is up at $2.4825, an increase of 12 cents or 5.16%.

Gasoline opened the week at $2.6014, and fell on Tuesday to its lowest of the week. This morning, gasoline opened at $2.6504, and increase of nearly 5 cents or 1.884%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.