Tragic Accident in Philadelphia Causes Fatality and Motorist Chaos

The fuel industry is mourning today following Sunday’s tragic accident in Philadelphia. The driver of a gasoline tanker lost control of the vehicle, resulting in a large fire that destroyed a key section of a bridge along I-95. A body found in the wreckage is presumed to be the driver. The bridge, a key conduit used by over 160,000 motorists per day, will be out of commission for several weeks for repairs. The Mansfield team’s hearts and thoughts are with the family of the driver and all those impacted by this unfortunate event.

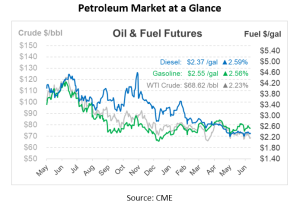

In fuel market news, crude prices are up this morning over $1/bbl, but investors are treading carefully, anticipating key policy decisions by central banks and digesting bleak economic data from China. Notably, WTI and Brent crude both registered a gain of over $1/bbl from their yesterday’s low of $66.80 and $71.58, respectively. Prices still lingered near their lowest since early May, indicative of a market still wary of a softening supply-demand equilibrium.

For markets, all eyes are on US inflation data and awaiting the Bureau of Labor Statistics consumer price data release later today. Market participants are hopeful for a pause to rate hikes this month as the Fed has increased rates for the previous ten consecutive months. These hikes have bolstered the US dollar, rendering dollar-denominated commodities like oil costlier for those holding other currencies.

Despite recent lackluster economic growth in China, they threw a curveball by unexpectantly slashing short-term interest rates. This was viewed as part of a broader set of stimulus measures being contemplated to rejuvenate economic growth.

Post Labor Day holiday, there was a notable demand for travel, but recent industry data showed a slight slack in trends due to seasonality. International flights, particularly to Asian destinations like Macau, Hong Kong, Singapore, and Korea, were on the rebound. However, experts in the industry anticipate healthy travel demand during the upcoming summer season despite macroeconomic uncertainties.

Moreover, OPEC maintained its forecast for global oil demand growth in 2023, marking the fourth consecutive month without alterations. Nonetheless, the consortium warned of escalating uncertainties and a potential deceleration in global economic growth during the second half of the year. The trading landscape is set to receive more insights with the impending release of oil demand forecasts from OPEC and the EIA, both due on Wednesday.

The Energy Information Administration (EIA) disclosed in their June Drilling Report that they anticipate crude production to ascend by a meager 8 kbpd between June and July. The regions contributing to this increase include Bakken, which is expected to ramp up by 7 kbpd, Niobrara, with an increment of 4 kbpd, and both the Permian and Anadarko regions, each contributing an additional 1 kbpd. Conversely, Eagle Ford is anticipated to witness a decline, tapering off by 5 kbpd. Furthermore, there has been a reduction in the total number of drilled but uncompleted wells (DUCs) from April to May, dwindling by 30 to stand at 4,834 wells.

This article is part of Daily Market News & Insights

Tagged: fuel industry, Philadelphia, Tragic Accident

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.