Week in Review – June 9, 2023

Prompt oil futures began the morning with an upward swing of 30 c/bbl after trading lower in the overnight session on Thursday. This occurred against the backdrop of equity futures going down and a strengthening dollar.

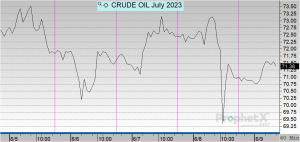

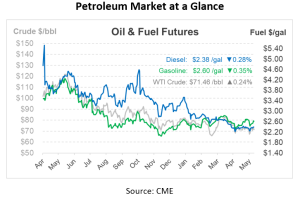

The highlight of the week was the roller coaster ride that crude futures took on Thursday, particularly in light of speculations regarding the U.S. and Iran. It was initially reported that the two countries reached an agreement on sanctions relief, which caused crude futures to plunge over $3/bbl. However, the White House soon clarified that the reports were incorrect, leading prices to recoup almost $2/bbl before settling down at $1.24/bbl for WTI at $70.95 and $0.99/bbl for Brent at $75.96.

The market’s reaction was driven by speculations that Iran could re-enter the global market with more than 2 million bpd of crude. The alleged agreement entailed Iran reducing its uranium enrichment in exchange for sanction relief, allowing the export of up to 1 million barrels per day and access to frozen funds abroad. The White House denied these reports, labeling them as “false and misleading,” but not before the markets reacted.

The fluctuations effectively erased the gains that had been gradually building since the beginning of June, returning prices to levels closer to those seen at the end of May.

Another significant development this week was China’s crude inventory reaching a two-year high at 966 million barrels, surpassing the 5-year average of 858 million barrels. This increase is attributed to refiners enhancing crude purchases in anticipation of a rapid post-Covid economic recovery.

The inventory build-up has been compounded by stagnated consumption and processors going idle for maintenance. China’s industrial activity has remained slow, affecting diesel demand. Moreover, the expected recovery in travel demand, which would boost the consumption of jet fuel and gasoline, hasn’t picked up pace as anticipated.

As the U.S. heads into the summer season, which usually witnesses a surge in driving, the industry hopes for a pickup in demand. However, worries over China’s slow recovery in fuel demand and lingering global recession concerns could offset the expected benefits.

Prices in Review

Crude opened on Monday at $75.03 before its volatile week began. It dropped to its lowest on Thursday at $69.03 and opened this morning at $70.94, a decline of over $4 or -5.45%.

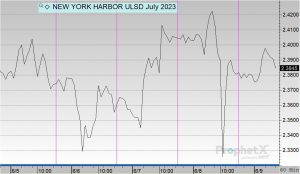

Diesel also experienced some declines this week, opening on Monday at $2.41. This morning, diesel opened at $2.3828, a decrease of just over two cents or -1.129%.

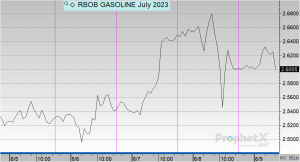

Gasoline opened the week at $2.5435 and experienced gains, unlike crude and diesel. This morning, gasoline opened at $2.6031, an increase of almost six cents or 2.343%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.