Supply Chain Security – Considerations for the Energy Transition

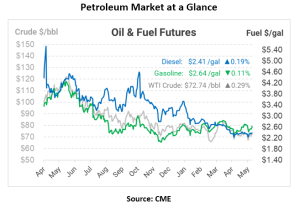

As fleets make the transition to lower-emission vehicles, there’s an important consideration that corporate risk teams should take into consideration – supply chain security. As a leading energy exporter, the US produces the vast majority of its energy at home, including oil, natural gas, and electricity. In that regard, all energy formats are domestically secure. But the materials that support our fleets are increasingly moving to untested supply chains.

As the demand for EVs increases, so does the demand for the materials required to produce them. This has led to concerns over the security of the supply chain for these materials, particularly for fleets in the US.

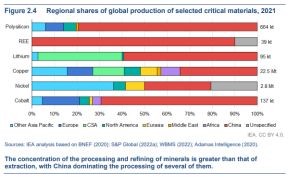

A report by the International Energy Agency (IEA) titled Energy Technology Perspectives highlights the importance of supply chain security for US fleets buying EVs. The report notes that over 60% of cobalt and nearly all rare earth metals, which are essential components of EV batteries, are produced in China. Although the raw materials are spread throughout other Asia-Pacific countries, China plays the key role of purifying and refining a large portion of global supplies. This dependence on a single source of supply poses a significant risk to the US fleet’s ability to acquire these materials, which could have serious implications for their ability to transition to EVs.

It’s been more than a year since the Russia-Ukraine conflict disrupted global trade flows and resulted in substantial sanctions on Russian goods. Since then, companies have had to re-evaluate their supply chains to ensure they can navigate global trade disruptions, leading businesses to bring supply chains closer to home. Beyond Russia, companies must have a strategy to secure their supply chains if trade ties are disrupted with other trade partners such as China.

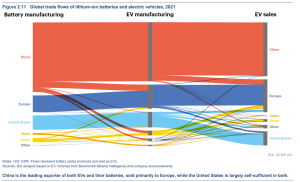

The good news is that the US is generally self-sufficient in battery and EV manufacturing. While Europe imports a large chunk of its supplies from China, the US actually exports a fair portion of its domestically produced EVs. Still, if those manufacturers cannot get the raw materials they need, that picture could change quickly. And although the US does not rely on Chinese vehicles, China’s market share gives them significant pricing power in the marketplace.

Ensuring the security of the supply chain for EV materials is crucial for several reasons. First, it is essential to avoid potential disruptions to the supply of these materials, which could lead to delays in the production of EVs and ultimately hinder the transition to a low-carbon economy. Second, it is important to avoid the concentration of supply in a single country or region, as this could lead to price volatility and geopolitical tensions.

Corporate risk policies must plan for unforeseen and low-probability events that can have major implications. Although there’s no reason to expect trade disruptions today with any countries, it’s important to have a plan in place to address possible future challenges.

Fortunately, there are other clean technologies such as renewable diesel and biodiesel that are domestically produced and offer the same or more carbon reduction than EVs. Incorporating these policies into your sustainability efforts can help you diversify your fleet while hitting your carbon goals. Visit Mansfield’s Sustainability page to learn more about the ESG solutions available to you right now.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.