Rising Demand & Looming Uncertainties Set the Stage for June’s OPEC+ Meeting

As the global economy embarks on the road to recovery, strong demand for oil products is powering a surge in oil prices. However, looming uncertainties, such as a potential U.S. default and the upcoming OPEC+ meeting, continue to cast shadows on the trajectory of the oil markets.

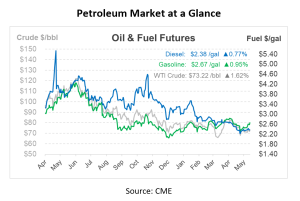

It appears that a surge in US gasoline futures is helping to lift crude oil from its recent slump, ahead of the pivotal OPEC+ meeting. The bullish trend has seen WTI and Brent prices escalate to $72 and $76 per barrel, respectively. Meanwhile, the ongoing debt ceiling talks in the US involving House of Representatives Speaker Kevin McCarthy and President Joe Biden may cause temporary turbulence in oil prices. As negotiations continue, all eyes are slowly shifting to the impending OPEC+ meeting in June.

While the future of crude oil continues to experience the occasional hiccup, wildfires raging in Canada’s Alberta region have caused an estimated halt of 260k bpd in production. Despite the setbacks, oil prices are showing resilience. The prompt June 2023 WTI contract closed at $71.99/bbl, marking its highest level since May 11th, while Brent prices followed suit. However, both WTI and Brent still trade approximately $7/bbl lower on a month-over-month basis.

Meanwhile, Russia continues to maintain strong crude exports, contradicting Kremlin’s assertions of production cuts. Saudi Arabia’s Energy Minister Salman Al-Saud forewarns that further cuts could be discussed in the forthcoming OPEC+ meeting.

Traders and investors alike are on tenterhooks as Prince Abdulaziz bin Salman, Saudi Arabia’s Energy Minister, issued a warning to crude short sellers in anticipation of the OPEC+ meeting. In contrast, other members of the group see no need for further action, confident that global oil inventories will tighten as China’s economic recovery gathers momentum.

Russian seaborne shipments continue their upward trajectory for the sixth consecutive week, with flows up 15% since the first week of April. President Putin’s statement that Russia’s actions are in line with the need to maintain stable global prices adds to the intrigue.

On the debt ceiling front, US Treasury Secretary Yellen has issued a stern reminder to Congress regarding the critical state of the Treasury’s funds, expected to deplete by early June. While no deal was reached over the past weekend, the chances of securing a comprehensive deal by early June remain hopeful at 70%, according to Goldman Sachs. If a permanent solution eludes the parties involved, a temporary extension could serve as the next probable course of action.

As we march toward the middle of 2023, the global oil industry finds itself caught in the whirlwind of rising demand, potential production cuts, and geopolitical uncertainties. The upcoming OPEC+ meeting and the resolution of the US debt ceiling issue will play pivotal roles in charting the course for the rest of the year.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.