Week in Review – May 19, 2023

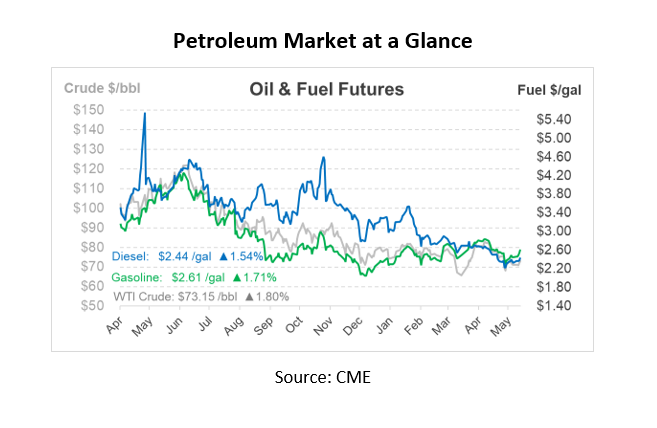

Oil futures are on an upward trajectory this morning thanks to global economic shifts, especially the ongoing US debt ceiling crisis. If these prices hold steady, we could see a weekly rise of more than 3%. Significant positive momentum was noted mid-week as crude prices reached weekly peaks. This spike followed President Biden and House Speaker McCarthy’s disclosure of their collaboration to address the debt ceiling situation. Their promising negotiations appear to lend a supporting hand to the crude market, with a potential agreement expected as early as this weekend.

However, yesterday’s update from Dallas Fed President Lorie Logan added some uncertainty. Logan suggested the upcoming decision regarding a pause in rate hikes is not yet clear-cut, thus sparking fears of a potential hike next month. Fed Chair Powell’s comments later today are highly anticipated as market participants seek guidance on the future course.

Markets are keeping a close eye on China’s demand recovery, following weaker-than-anticipated economic data earlier this week. Encouragingly, an upsurge in refinery activities has been observed due to the expected surge in demand.

The UK has levied another round of sanctions against Russia today. These sanctions, targeting companies linked to Ukrainian grain theft and those involved in Russian energy exports, primarily aim at Russia’s substantial energy and arms shipping sectors. Further punitive measures against Russia are expected to be announced during this weekend’s G7 summit in Japan.

Moving to environmental concerns, the wildfires in Alberta, Canada, are escalating. The fire count reached 92, up from 91 the previous day, prompting several companies, including Chevron, Paramount Resources, Crescent Point Energy, and Kiwetinohk Energy, to halt production and evacuate their staff. Forecasts predict more challenging conditions, with hotter, dryer weather expected over the weekend. This continuing wildfire crisis poses a considerable risk to Alberta’s oil sands production, with a significant portion of the province’s production now in areas of severe or extreme wildfire danger. Consequently, nearly 300,000 bpd of production have been shut down.

In terms of inventory statistics, the EIA reported an unexpected crude build of 5.0 million barrels for the week ending May 12th, marking the second consecutive week of unplanned builds. Meanwhile, gasoline saw a draw of 1.4 million barrels, and distillates saw a negligible build. These figures indicate that crude inventories are around the five-year average for this period, while gasoline and distillate inventories are below by 6% and 16%, respectively.

India is contemplating restocking its strategic crude oil reserves, which could lead to them joining the US in rebuilding depleted stockpiles. The plan involves an estimated 9.2 million barrels of crude imports, with the specifics of grades and timing, including the decision to purchase from Russia, yet to be finalized.

Prices in Review

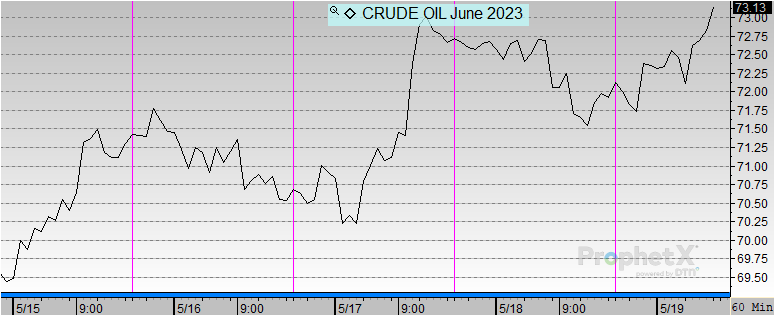

Crude opened the week at $70.04 and gained momentum on Tuesday before slightly dipping on Wednesday. This morning, crude opened at $71.94, accounting for a nearly two-dollar increase or 2.713%.

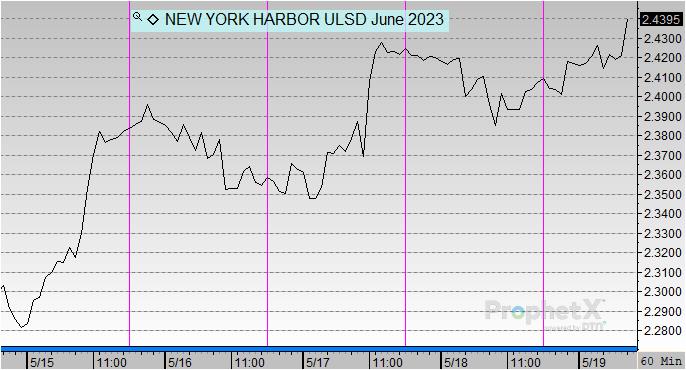

Diesel also saw steady increases this week, opening at 2.3050 on Monday, and climbing to its highest on Thursday of $2.4227. Diesel opened this morning at $2.4094, an increase of ten cents or 4.53%.

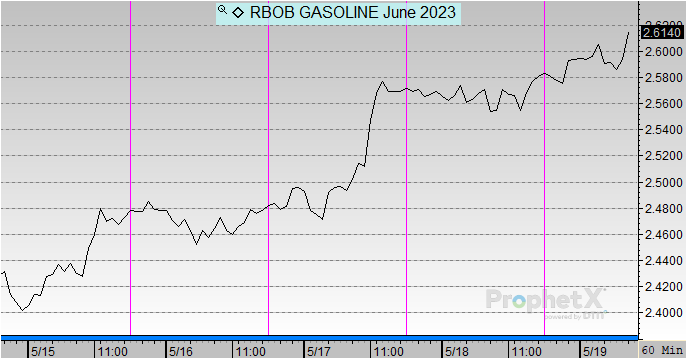

Gasoline trended in line with crude and diesel this week, with increases throughout the week. Gasoline opened this morning at $2.4252 and reached its highest point this morning at $2.5751. This accounted for an increase of almost 15 cents or 6.18%.

This article is part of Daily Market News & Insights

Tagged: Biden, China, crude, crude prices, Daily Market News & Insights, demand, diesel, fuel prices, gasoline, Inventories, oil prices, Russia, Supply

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.