Riding the Crude Wave: How Global Shifts in Demand Paint a Bullish Picture for Oil Markets

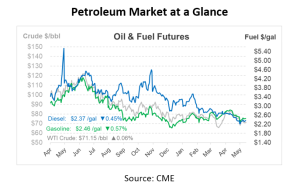

Crude futures remain in line with yesterday’s prices, continuing the upward trajectory from yesterday. However, the journey wasn’t a smooth ride; crude prices dipped by over 50 cents earlier in the day when China reported economic figures that fell short of expectations. But the market swiftly rebounded after the International Energy Agency (IEA) adjusted its global demand growth forecast upwards for 2023 by an additional 200,000 bpd, reversing some of the losses sustained.

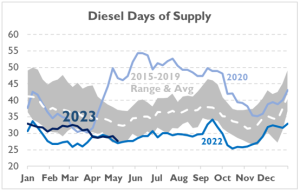

Diesel markets continue facing supply tightness, though you wouldn’t know it by looking at prices. Gasoline prices are now higher than diesel, suggesting a slowdown in diesel demand. That said, diesel inventories have slipped to levels not seen since last year; the EIA reported days of supply falling to 27.6 days last week, the lowest level of the year.

Diesel markets are typically comfortable at 35+ days of supply and are cautious in the 30-35 day range. Typically, when days of supply fall below 30 days, markets would react with concern; but that’s not the case currently. With supplies low yet prices also falling, it seems the market is pricing in a slowdown in freight and business activity.

Interestingly, despite the prevailing market apprehension about a possible default on US debt, crude prices rallied, gaining more than $1 per barrel in yesterday’s session. This marked the first rise in three sessions and was buoyed by the US’s plans to restock the Strategic Petroleum Reserve (SPR) and the impact of ongoing wildfires in Canada, which have halted at least 300,000 bpd of production.

Despite these recent gains, crude has experienced a more than a 10% drop year-to-date. Concerns about a potential recession have cast a shadow over the market, but it’s not all doom and gloom.

In China, oil refiners have been working at near-record levels, even with some facilities temporarily out of operation for seasonal maintenance. The nation processed nearly 15 million bpd in April, mirroring the volumes handled in March. China has ramped up its crude processing to cater to the anticipated resurgence in demand, following the easing of its Covid-19 restrictions.

Further afield, Russian seaborne crude exports have seen a steady increase, marking the fourth rise in the last five weeks up to May 12th. This growth has resulted in a 10% surge compared to the first week of April, setting a new record since the start of 2022. A majority of these flows are destined for Asia. Rising exports demonstrate that Russian crude is still finding its way into the global market, circumventing sanctions and alleviating supply concerns.

Adding to the evolving narrative of the global oil markets, the IEA and Goldman Sachs (GS) have made some adjustments to their 2023 balance, largely due to a surge in demand from emerging and developed markets (excluding China). This has been coupled with a drop in North American supply. These changes have outpaced a decline in China’s demand and an increase in Russia’s supply offering a slightly bullish outlook for oil prices.

Although predictions indicate a rise in global oil demand, the IEA and GS expect a dip in diesel demand due to manufacturing weaknesses, contrasted by a surge in jet and gasoline demand.

On the supply side, disruptions in Brazil, Iraq, and Nigeria have led to a decrease in April 2023’s supply. Despite this, the IEA anticipates a global oil supply rise in 2023. Among non-OPEC nations, a boost in Russia’s supply is balanced by reductions in the US, Canada, and other parts of the world.

The Organization for Economic Co-operation and Development (OECD) commercial stocks saw a drawdown in March, and they currently stand 5% below their 2015-2019 average, highlighting the continuous volatility in the global oil and petroleum markets.

This article is part of Daily Market News & Insights

Tagged: China, commercial stocks, Crude Futures, Diesel markets, Oil Refiners, Russian crude, US

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.