Natural Gas News – May 11, 2023

Natural Gas News – May 11, 2023

Texas Natural Gas Prices Turn Negative

Mild spring weather with low gas demand combined with pipeline maintenance to drag spot natural gas prices at the Waha hub in West Texas into negative territory this week. Next-day prices for Wednesday at the Waha hub in the Permian closed on Tuesday at -$0.35 per million British thermal units (MMBtu), per data from Refinitiv cited by Reuters. The last time prices at Waha sank to below zero was in October 2022, as spot prices were facing pressure from the unfortunate combination of unseasonably warm weather, flourishing production, and takeaway capacity constraints. Back then, intraday pricing levels were in negative territory, but the settlements in those days were in positive territory. On Tuesday, however, Waha spot natural gas prices settled in negative territory, for the first time since October 2020, according… For more info go to https://bit.ly/42qvkfu

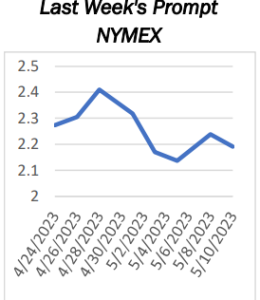

Natural Gas Sits Near the Lows- Risk – Reward Is Critical

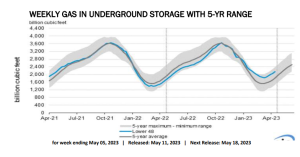

In June 2020, nearby NYMEX natural gas futures fell to $1.44, a quarter-of-a-century low. The energy commodity found a bottom, and Russia’s invasion of Ukraine caused an explosive rally in European natural gas prices and increased the demand for U.S. LNG exports, lit a bullish fuse under the U.S. natural gas futures that took the price to a fourteen-year high a little over two years later, in August 2022. Meanwhile, an unseasonally warm European winter and plenty of natural gas supplies have pushed the price down to not far over the June 2020 lows in early May 2023. Natural gas is heading into the 2023 summer, with the price hovering over $2 per MMBtu.… For more info go to https://bit.ly/3O1kBUd

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.