Week in Review – April 28, 2023

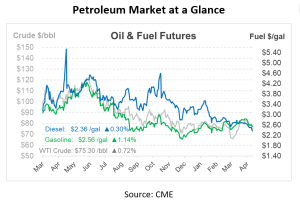

Oil prices are poised for yet another monthly drop as lackluster U.S. economic figures and concerns over future interest rate hikes dampen demand expectations. Ahead of the June 2023 Brent contract expiration, prompt oil futures rose slightly but are still on track for a weekly decrease exceeding 3%. Crude is also projected to have a monthly decrease of about 1%. This will be the fourth monthly decline for Brent and the sixth for WTI.

This week, crude prices erased all previous gains in response to OPEC+’s surprise production cuts. Deteriorating fuel demand and margins, coupled with risk-averse market sentiment, have pressured prices. Prompt WTI and Brent reached their lowest levels since late March, at $73.93/bbl and $77.39/bbl, respectively. Market participants are now closely watching the upcoming Fed meeting, with most anticipating another rate hike. Investors are concerned that inflation-fighting central banks may hinder economic growth and weaken energy demand in the United States, Britain, and the European Union. The U.S. Federal Reserve’s next policy meeting is scheduled next week for May 2-3.

At the same time, the International Monetary Fund (IMF) has cautioned both the European Central Bank and the Central Bank of England to be mindful of the financial stress that may arise from raising interest rates to curb inflation amid the recent banking crisis. The market is also tracking Chinese demand recovery ahead of the nation’s Labor Day holiday next week.

China’s top refiner Sinopec predicted a rise in demand for refined oil products of over 10% this year during a recent conference call. A quick rebound in mobility, higher fuel consumption, and government measures, according to Sinopec VP Huang Wensheng, have boosted demand through travel, infrastructure logistics, and agricultural operations.

The 15% decline in long-dated oil prices since mid-2022 has significantly impacted oil prices. Data from the Energy Information Administration (EIA) this week revealed that U.S. crude oil and gasoline inventories experienced larger-than-expected drops last week. This comes as demand for motor fuel increases ahead of the peak summer driving season.

Prices in Review

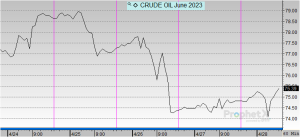

Crude opened the week at $77.97 before jumping to its high of $78.74 on Tuesday. This morning, crude opened at $74.91, a decline of over $3 or -3.925%.

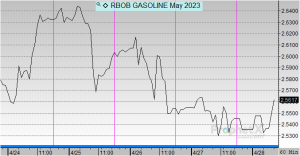

Unlike crude, diesel saw consistent drops throughout the week. It opened Monday at $2.5042 and this morning at $2.3535. This was a drop of roughly 15 cents or -6.02%.

Gasoline also saw marginal losses this week as it trended in line with diesel. It opened on Monday at $2.6016 before dropping to $2.5353 this morning. This accounted for a loss of almost 7 cents or -0.0663%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.