Shifts in Global Petroleum Markets: Russia’s Rising Role and the Ongoing Crude Export Disputes

Global markets have been experiencing fluctuations as a result of various economic and geopolitical factors. From shifts in crude oil futures and market sentiment to the ongoing disputes and strategic moves of major oil-producing nations, the landscape of the industry continues to evolve. As key players such as Russia, China, and India navigate this changing environment, their decisions significantly impact oil production, exports, and global market dynamics. Regional tensions and labor disputes further contribute to the complex nature of the industry, exemplified by the North Sea offshore workers’ strike that recently came to a head.

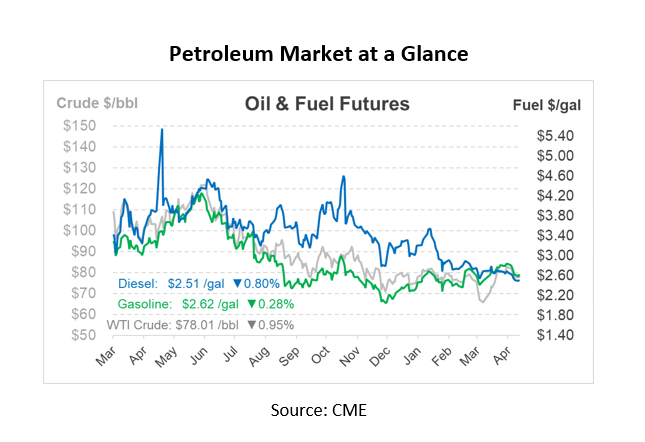

Crude oil futures experienced a decline of more than 75 c/bbl this morning. This downturn comes as the market adopts a risk-averse attitude in anticipation of numerous earnings releases today. The US consumer confidence for April and the US corporate earnings from big tech corporations are set to release their reports later today. Markets are worried that consumer sentiment will take a hit due to falling stock markets and the rising dollar. Just yesterday, prompt crude saw an increase of over 80 c/bbl in a volatile session, with crude trading in a $2.50 per barrel range. Contributing factors to this increase include a depreciating dollar, marginally improved equities, and an optimistic market outlook fueled by impressive holiday travel numbers in China.

Meanwhile, Russian crude exports show no signs of slowing down, reaching new highs on a four-week average basis. Russian refinery rates remain consistent since the beginning of the year, hovering around 720,000 bpd. The ongoing crude export dispute involving Iraq, the Kurdish government, and Turkey continues to keep 450,000 bpd of supply out of the market.

Despite a temporary agreement between the Kurdistan Regional Government (KRG) and the Iraqi government to restart exports, progress remains slow. Even once the KRG and Iraq finalize their deal, anticipated for early May, the parties must gain Turkish government approval to resume exports, meaning potential for further delays ahead of their presidential elections on May 14th.

In April, China increased its imports of Russian crude, purchasing 265,000 bpd of Russian Urals, a 36% increase from March. China now accounts for roughly 20% of Russian crude exports in 2023, while India accounts for over 70% of Russian crude purchases.

India, one of the largest oil importers globally, has been diversifying its sources away from the Middle East in recent years. As a result, India is now importing approximately 1.6 million bpd in Russian crude grades, driven by discounts on Urals due to Western-led sanctions against Moscow. Although the Middle East still accounts for 55% of India’s imports, the nation is gradually reducing its reliance on OPEC, following a similar path to the United States.

In related developments, offshore workers in the North Sea are proceeding with a planned 48-hour strike over pay disputes, causing production halts at multiple oil and gas platforms. Unite Scotland, the union spearheading the strikes, is calling for increased wages, enhanced shift schedules, more generous vacation benefits, and heightened safety measures for offshore workers.

This article is part of Daily Market News & Insights

Tagged: China, crude, crude prices, Daily Market News & Insights, diesel, fuel prices, Russia, Supply

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.