Week in Review – March 31, 2023

Markets this week have seen fluctuations stemming from continued uncertainty in global politics and production concerns out of Iraq. Legislative developments in the energy sector have also sparked interest this week with discussions of cutting energy costs for Americans.

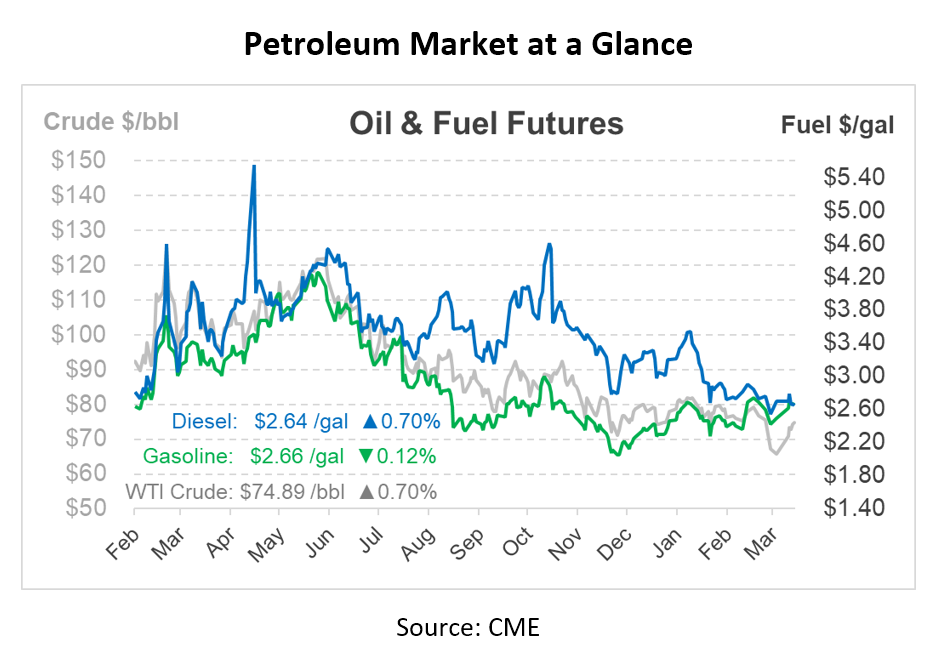

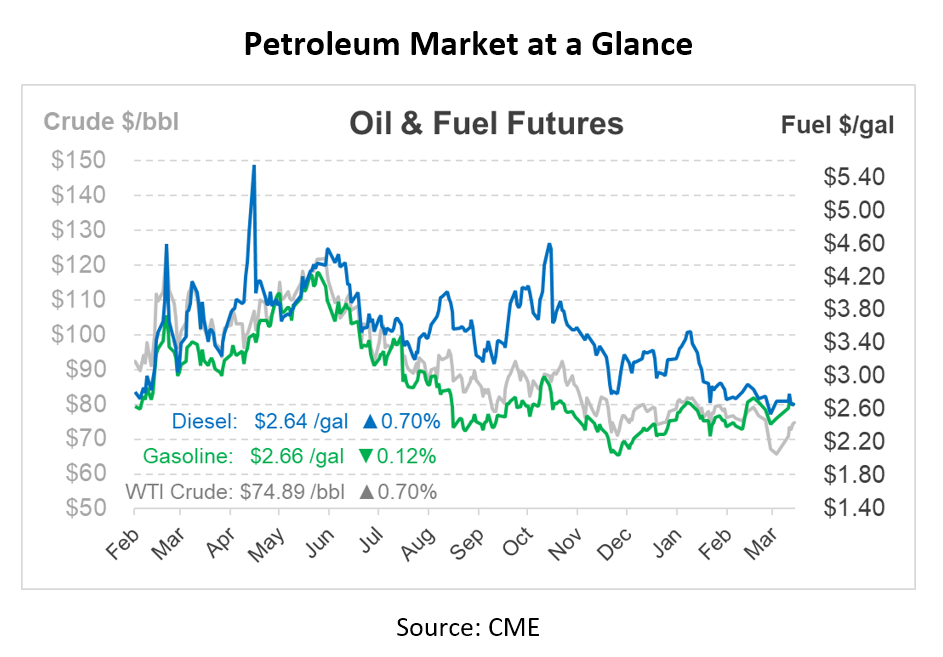

Crude oil futures are trading up 40 cents/bbl this morning, with oil prices on track to finish almost $5/barrel higher for the week. Equity futures and rates remain stable ahead of today’s February Personal Consumption Expenditures (PCE) report, while the US dollar strengthens.

Wednesday’s US Energy Information Administration report indicated that crude oil inventories continued to decrease. Crude imports had an average of 5.3 million bpd, experiencing a decline of 847,000 bpd from the previous week. Consequently, stockpiles reached their lowest point in two years.

The slowdown in Iraq’s oil production intensified as Gulf Keystone Petroleum, another oil producer, announced plans to reduce production in Iraqi Kurdistan last night. The Kurdistan Regional Government said they would return to Baghdad next week for talks to restart crude shipments. According to Bloomberg, no agreements were reached this week to resume Iraqi exports from Turkish ports.

In legislative news, the U.S. House of Representatives passed the Lower Energy Costs Act yesterday. The bill aims to increase US oil and gas production and exports to reduce energy prices. The Lower Energy Costs Act focuses on limiting reviews of future fossil fuel projects, increasing fossil fuel production, and reducing energy costs for Americans. The bill also proposes to repeal the Greenhouse Gas Reduction Fund, which concentrates on lowering the cost of renewable energy. Despite passing in the House with a 225 – 204 vote, the bill faces an uncertain future in the Senate. If it manages to pass the Senate, President Biden is expected to veto it.

In other headlines, OPEC+ announced its intention to maintain the current oil policy due to the reduced oil price environment. As the week concludes, the oil market and related legislative developments continue to shape the global energy landscape.

Prices in Review

According to OPIS MarginPro data, the U.S. national average for this week’s gross rack-to-retail gasoline margins was 34 cents/gal. This figure is lower than the previous week’s 35.9 cents/gal but represents an increase from the average of 26.9 cents/gal seen just four weeks prior.

Crude opened the week at $69.42 and saw steady gains. This morning, crude opened up at $74.37, a jump of $4.95 or 7.13%. The halt in oil exports from Iraq for almost a week contributed to the surge in oil prices.

Unlike crude, diesel experienced some losses this week due to ongoing economic worries. Diesel opened the week at $2.715 and hit a high of $2.7647 on Tuesday. This morning, diesel opened at $2.64, a drop of nearly 8 cents or -2.76%.

Gasoline trended up with crude this week with marginal gains. On Monday, gasoline opened at $2.5908 before hitting a high on Wednesday of $2.7183. This morning, gasoline opened at $2.65, a 6 cents or 2.285% gain.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.