What Is It – Argus

Have you ever been curious as to how your fuel supplier settles on pricing and how it compares to the market rate? Our continued series on fuel price indexes has covered several pricing strategies and types of indexes, but there are still a few more to unpack. Today we will be covering Argus, how it helps fuel procurement customers make wiser purchasing decisions, and how it compares to other cash indexes.

What is Argus?

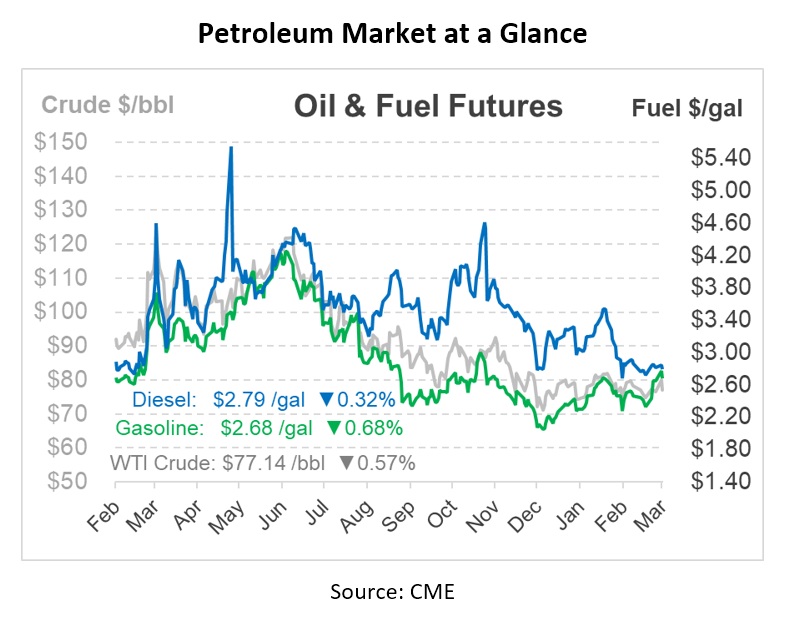

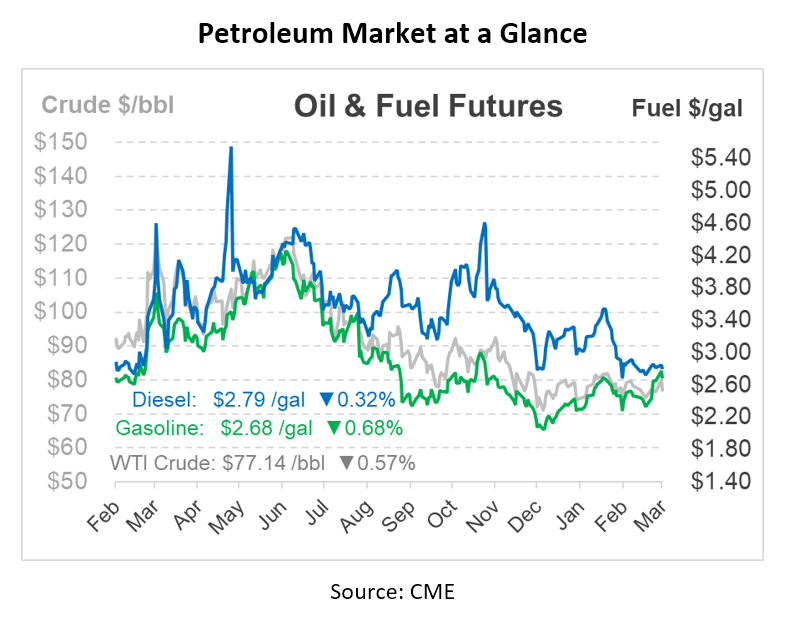

The Fuel Pricing Index is a price benchmark for the global refined oil products market, produced by the energy and commodities pricing and analytics company Argus Media. The index provides a reference price for a range of refined oil products, including gasoline, diesel, jet fuel, and other products, in different regions around the world.

Argus is based on assessments of physical trading activity in key markets, as well as supply and demand factors, freight costs, and other market fundamentals. It is widely used by market participants, including producers, traders, and consumers of refined oil products, as a reference point for pricing and risk management.

The Argus index is also used by financial market participants, such as hedge funds and banks, as a benchmark for oil price derivatives trading. The index is published daily, and its methodology is transparent and subject to regular review to ensure its accuracy and reliability.

How does Argus pricing work?

Argus pricing typically works by providing price assessments for specific energy and commodity markets. To produce its price assessments, Argus relies on a combination of market intelligence, proprietary data, and direct input from market participants. For example, the company may gather data from energy and commodity traders, producers, and consumers, as well as shipping and logistics companies, to develop its assessments.

Argus uses a variety of pricing methodologies, depending on the market and the specific product. For example, in the oil markets, Argus may use a market-on-close (MOC) methodology, in which it collects bids and offers from market participants and uses this information to derive a closing price for a specific product.

In some cases, Argus may also use an index-based pricing methodology, in which it produces a reference price for a specific market or product based on a basket of underlying prices. Once Argus has produced its price assessments, it disseminates them to market participants via a variety of channels, including its website, email alerts, and data feeds. Market participants may use these price assessments to inform their trading and risk management activities, as well as for valuation, benchmarking, and other business purposes.

For example, suppose you are a buyer of diesel fuel in the US Gulf Coast and you need to know the current market price in that region. Turning to the Argus price assessment, the price may be $2.0997/gallon. Using this price can help you negotiate with suppliers or make better informed decisions based on the current market conditions for diesel in the US Gulf Coast.

What is the difference between Argus and Platts?

You may remember FUELSNews covering Platts and are wondering about the difference between the two indexes. Argus and Platts are both providers of energy and commodity price assessments, market analysis, and business intelligence. They both offer a wide range of benchmarks and indexes covering various energy and commodity markets. For the downstream fuel market, a major similarity is that both are used at the spot market level, not at the local rack level. However, there are some differences between Argus and Platts.

The two companies have some differences in their methodologies for producing their price assessments and benchmarks, resulting in minute price differences each day. Over the long-term, these tend to even out, but they can create short-term differences. They also have different regional strongholds, with Argus pricing being dominant in Europe and the NY Harbor barge market. Platts, on the other hand, is utilized more often for purchases in the middle of the US and in the Gulf Coast market.

OPIS pricing is another consideration. While their rack pricing is based on local prices rather than regional spot prices, the OPIS Spot price is similar to both Argus and Platts.

Making the Choice

Ultimately, the choice between Argus, Platts, and OPIS Spot may depend on the specific needs and priorities of the user, as well as the specific markets and regions of interest. If you are unsure of which pricing index to utilize as a basis for your budgeting, contact a Mansfield representative and let our team help you save money and make better business decisions.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.