Week in Review – January 27, 2023

It’s been a relatively calm week for oil markets, with some turbulence in pockets of the market, such as diesel prices. Overall, crude oil traded sideways for much of the week, though today’s trading is bringing a sharp dip lower. Most of the news this week has been bullish for oil, with labor strikes in France continuing to threaten oil output and the US Dollar trending at the lowest level since last April this week. However, that’s not helping diesel markets, which are posting 10-cent losses heading into the afternoon.

Like the rest of the market, diesel’s news this week has been broadly bullish. Refinery outages overseas mean less global supply availability, so the French strikes could have global implications. The EIA reported a small draw from diesel inventories, suggesting that supply is not keeping pace with demand. Yet prices are plummeting, perhaps a reaction to Europe’s move towards a $100/bbl price cap on Russian diesel. Although Europe will still ban Russian imports, the price cap would allow European companies to continue shipping and insuring deliveries to non-EU countries. It’s unclear who would buy that diesel, though – China is already an exporter of diesel fuel, so their strategy of absorbing cheap Russian crude may not apply for diesel. We’ll have to see what happens after the Feb 5 embargo hits.

Adding to bullish support, China’s reopening continues. Though their market saw low trading volume due to the Chinese Lunar New Year, the health statistics show some promising results. The country reported that COVID-19 deaths and hospitalizations are down 70% from the peaks seen in January, suggesting that reopening can continue to move forward. Stronger demand from the world’s largest oil importer has kept a floor under crude prices, inspiring confidence that global demand for oil could reach the record levels predicted by the IEA.

On the other hand, more Chinese demand could prompt OPEC to step in with more supply. Right now, markets expect the oil cartel to maintain its current export quotas at the February meeting. Energy officials have indicated they plan to take a “wait and see” approach with China, keeping production steady until more demand materializes. But if Chinese consumption does take off, OPEC could increase output (at least, on paper) to counteract higher demand.

Prices in Review

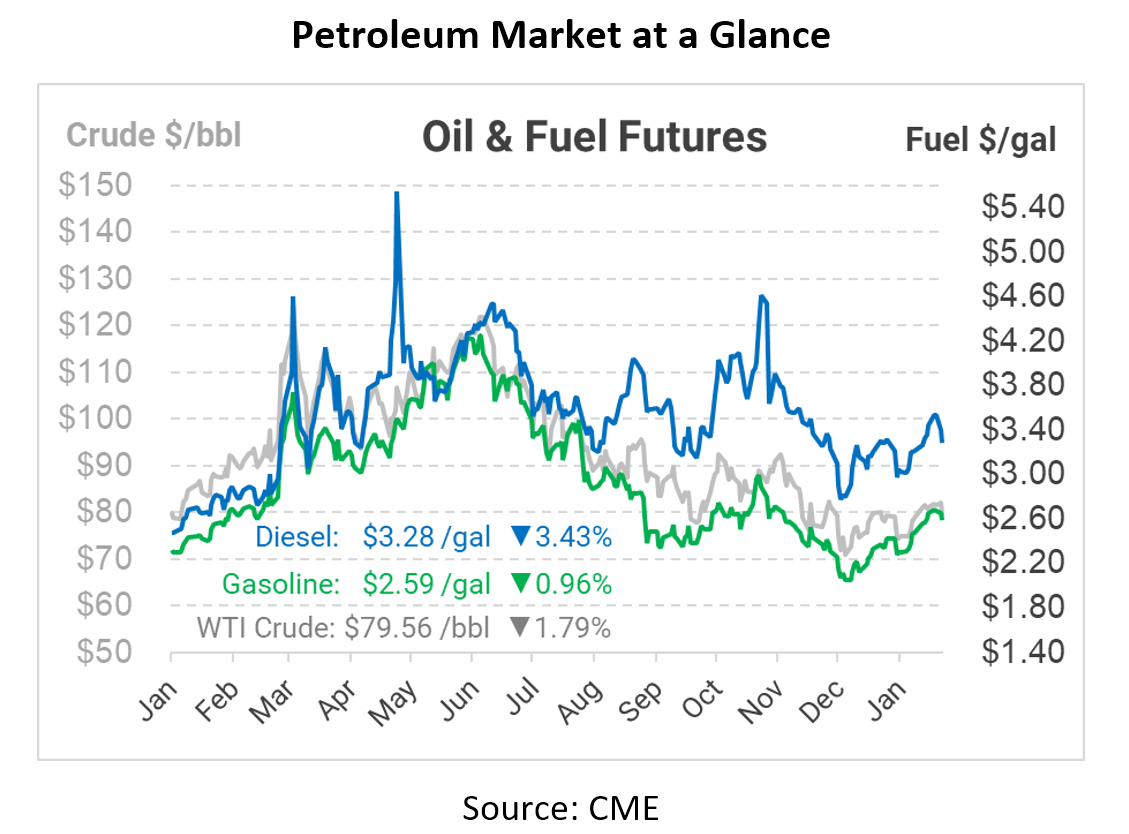

Crude oil prices opened on Monday at $81.79, staying at that level for most of the week. After fluctuating between $79 and $82, crude opened Friday at $81.22, with further losses coming later in the day.

Diesel began the week at $3.4731, climbing almost 10 cents on Monday and moving even higher Tuesday before crashing back down. Prices continued falling, with the product opening at $3.3974 on Friday, a loss of 7.6 cents (-2.2%).

Gasoline opened the week at $2.6528, reaching as high as $2.71 before turning lower. Gasoline opened Friday at $2.61, a loss of 4.3 cents (-1.6%).

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.