Only 10 Days Remain for Europe to Replace Russian Diesel Exports

Due to technical errors, yesterday’s FUELSNews article was not sent. Please enjoy yesterday’s What Is It article along with today’s newsletter.”

Seaborne diesel shipments from the largest foreign supplier to the European Union will be forbidden entirely in less than a week. Approximately 220 million barrels of diesel-like products were imported by the EU from Russia last year, according to data gathered by Bloomberg from Vortexa Ltd. In an effort to penalize Moscow for the war in Ukraine, practically all of those imports will be prohibited starting on February 5.

Where will the supply come from?

Experts are anticipating that other sources can eventually fulfill the needs of the remaining Russian supplies. The Middle East is the most accessible area where Europe can obtain more diesel because of its proximity to the Mediterranean Sea. The only issue with this route is if the Suez Canal became blocked at any point, preventing fuel shipments. The area also expects a drastic increase in refining capacity as new refineries are coming online to produce millions of barrels. The US and India have also aided Europe in their supply needs by increasing their exports. However, China is the frontrunner as the most prospective resupplier to Europe. China’s exports of diesel have risen substantially over recent months. Regardless of whether a percentage of the entire shipment makes it all the way to Europe, it still increases local supplies as barrels from other producers are freed and can travel to Europe.

The first Chinese fuel export quota for 2023 increased by about 50% from the same time last year. Experts claim that China’s export capacity could topple 600,000 barrels a day, which is what the EU nations faced losing with Russia. Skeptics are reminding European countries that China is notorious for giving precedence to its environmental policies rather than exporting fuels – leaving the question in the air as to whether China will be reliable for the supply or not.

What if Europe can’t find enough resupply?

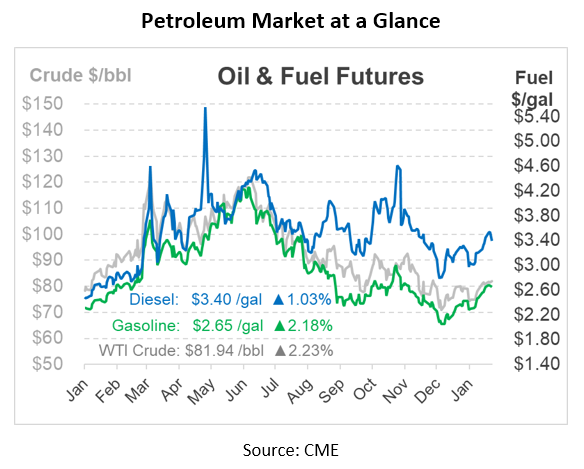

Although Europe has several prospects for replacing its supply, a much broader issue is at hand. Will the EU sanctions drive Russian exports to vanish from the market completely? If that happened and Russia reduced its refining capacity, it might restrict supplies globally and possibly raise prices. In February and March, FGE projects a decline of 510,000 barrels a day in crude refining from Russian facilities.

Intermediary countries could also lend a hand with the impacts of the EU sanctions. Countries like Turkey, who are not members of the EU, would have the possibility to import massive volumes of Russian diesel to supply its local market. In turn, the diesel produced at its home refineries could be exported to the EU.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.