IEA: “Two Wild Cards Dominate” in 2023

Oil prices are trending a bit higher this week, with oil closing above $80/bbl for the first time in the new year on Tuesday and Thursday. Monday was a market holiday, but prices have seen plenty of movement the rest of the week. China’s economy continues reopening, prompting the International Energy Agency to forecast a global oil demand record this year. As they note in their report:

“Two wild cards dominate the 2023 oil market outlook: Russia and China. This year could see oil demand rise by 1.9 mb/d to reach 101.7 mb/d, the highest ever, tightening the balances as Russian supply slows under the full impact of sanctions. China will drive nearly half this global demand growth even as the shape and speed of its reopening remains uncertain.”

This week’s EIA report showed two sizable builds for crude oil and gasoline, leading markets to trend lower. However, diesel posted a 2 million barrel draw, a surprise compared to traders’ expectation of a build. Although refinery utilization across the US is a respectable 85%, the PADD 4 Rocky Mountains region is currently seeing less than 60% of refinery capacity being used. That’s putting pressure on fuel supplies, especially in Colorado. In Ohio, three refineries remain offline, though two are set for restarts in early February, providing some support for the local market.

Prices in Review

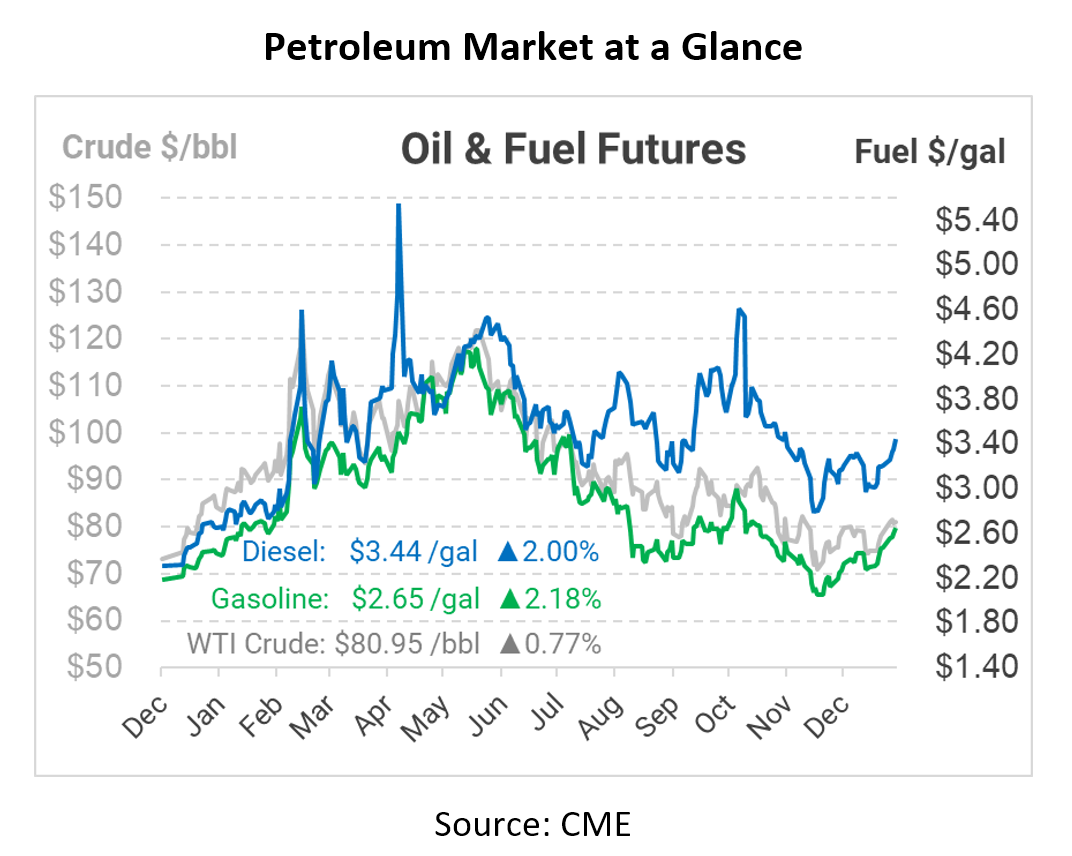

Crude oil opened the week at $80.10, climbing to a peak near $82 on Wednesday before crashing lower. The EIA’s report of a crude draw sent prices below $80 temporarily, but the market recovered on Thursday. On Friday morning, WTI crude opened at $80.60, largely unchanged from the beginning of the week.

Unlike crude oil, diesel has seen hefty gains this week. Diesel opened the week at $3.2676, trading flat for most of the week before rocketing higher on Thursday, after Wednesday’s report of an inventory draw. With just a couple of weeks until Europe’s embargo on Russian diesel takes effect, expect volatility in prices. Diesel opened Friday at $3.3856, up 11.8 cents (+3.6%).

Gasoline is a bit higher as well, though the product suffered the same bearish turn midweek as crude markets. Opening at $2.5375, gasoline rose near $2.60 before sinking to $2.49. On Friday, the market opened higher at $2.6037, a gain of 6.6 cents (+2.6%).

This article is part of Daily Market News & Insights

Tagged: IEA

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.