EU Fuel Sanctions Coming Soon – Will Markets Be Ready?

FUELSNews will not be published on Monday, Jan 16 in observance of Martin Luther King, Jr Day. Publications will resume on Tuesday, Jan 17.

With Europe’s embargo on Russian fuel quickly approaching, markets are scrambling to take stock of different factors to see what the impact will be. On one hand, a warm winter has (so far) helped prevent large drawdowns from diesel and heating oil supplies in Europe. On the other hand, the economy is showing signs of improvement and therefore higher fuel demand, with the US trying to navigate a “soft landing” and Europe’s economy looking stronger than before. How will this all shake out for fuel markets? Let’s take a look at the upcoming sanctions and their effect on the marketplace.

On February 5, Europe will ban imports of Russian refined fuels, and markets are particularly interested in how diesel fuel will be impacted. The crude oil ban came and went without much disruption since global crude markets are fairly liquid. Russia exported more crude to China and India, while the US and the Middle East sent more crude to Europe.

Diesel markets, however, aren’t quite as easily changed. Russia accounted for 60% of European diesel imports last January, though that number has fallen to roughly 40% given Europe’s hostility towards Russia. The US, India, and the Middle East have all increased exports to Europe, and Bloomberg argues that China could fill in the rest of the gap.

That’s good news for Europe, but Russian diesel barrels will still need to find a home. In February and March, the country is expected to reduce its refining throughput by 500 kbpd due to delayed maintenance and sanctions. China and India both increased their crude purchases after November; they may not do the same with diesel. If Russian diesel disappears from global markets, it would create tight diesel markets. In affluent markets that can afford it, such as the US and Europe, that will mean higher prices. In low- and medium-income countries, there could be physical shortages.

Ultimately, fuel markets are in uncharted territory. Markets may find a way to adapt to sanctions after Feb 5. Or, Russian fuel could simply fall out of the global supply chain. Either way, it’s worth paying close attention to the market over the next few weeks as global suppliers cope with the changes.

Prices in Review

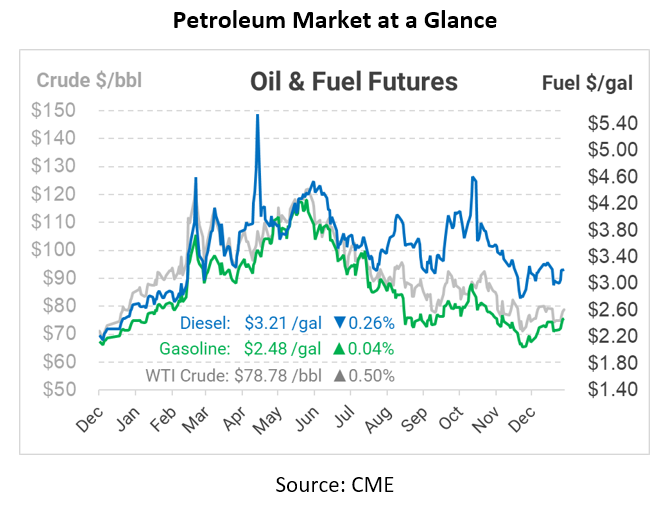

Crude oil has seen an upward trajectory this week. The market blew off the EIA’s staggering report of a 19-MMbbl build as a winter storm fluke, focusing instead on positive economic data that suggests better demand ahead. Beginning the week at $73.47, prices rose sharply on Wednesday, staying higher for the remainder of the week. This morning, crude oil opened at $78.32, a gain of $4.85 (+6.6%).

Like crude oil, refined fuels have been trending upwards this week. Diesel began the week at $3.0054, climbing more than 20 cents (+7.3%) throughout the week to close at $3.2241. A slight inventory draw of 1.1 million barrels contributed to the gain. According to Mansfield’s Supply SVP Andy Milton: “Seasonally speaking, diesel inventories do tend to decline in the first quarter, so the rate of decline will be important.”

Gasoline opened on Monday at $2.2510 but soared higher on Wednesday despite a 4-million-barrel build. Markets are noting very low gasoline supplies – typically gasoline inventories are 240-260 million barrels in January, but this year stocks only have 226 million barrels. The Gulf Coast and Midwest are especially low on supplies. Given tightness, gasoline picked up 20 cents this week, leading the market with a 9.1% gain.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.