Colonial Pipeline Resumes Operations; US Refining Capacity Returns

The new year took a rocky start as refineries return to normal operations and markets catch up from severe winter weather diminishing demand and refining capacity. Let’s take a closer look at some of these trends and how they are affecting the US economy.

With the completion of repairs from an estimated 60-barrel spill of diesel fuel at Colonial’s Witt booster station last Tuesday, Line 03 of the pipeline has resumed normal operations as of Sunday evening. Line 03 is the main line for transporting gasoline and distillate from North Carolina to New Jersey and is a key source for the Central Atlantic region of the US, with a capacity of 885,000 barrels per day. Thankfully, the product spill had little impact on gas prices in the NY Harbor market as stocks built up during the slow seasonal demand.

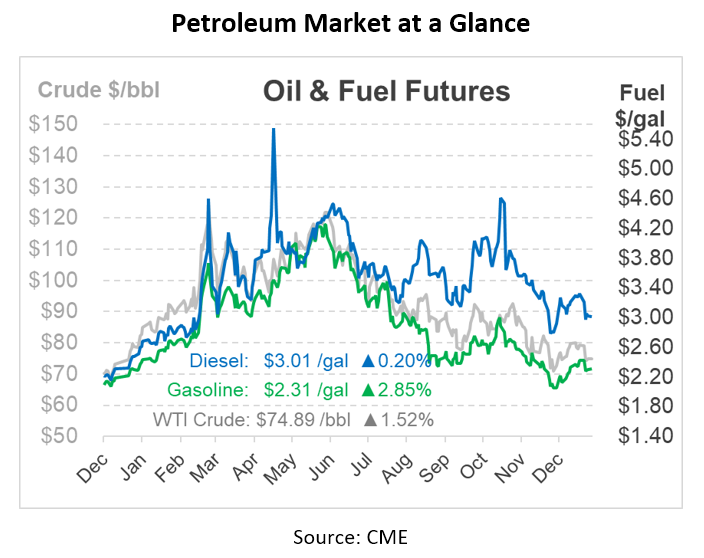

The severe winter storm that hit around Christmas put a damper on ULSD futures, which typically are slow in January. Record low temperatures, paired with snow and ice warnings, kept drivers off the roads throughout the US, causing prices to fall. Entering the winter, temperatures were a major consideration for fuel prices – a chilly winter would cause increased heating oil demand and natural gas-to-oil switching for power. So far, outside the cold snap over the holidays, it’s been a surprisingly mild winter, which has been good for keeping fuel prices lower. Goldman Sachs remains bullish despite warm weather rumors because of China’s talks of fully reopening from their bout with COVID restrictions.

Refining capacity is re-starting after the holiday winter storm, so markets are hoping to finally see a build in fuel inventories, which is typical for this time of year. Last week, the EIA reported a 12.6% drop in refinery utilization, sending overall throughput below 80% of total capacity. A large part of the refinery downtime occurred on the Gulf Coast, Midwest, and the Rockies. As a result of the refinery outages, fuel inventories fell at a time when they would normally rise. Although most refineries have resumed normal operations, some are still down or have some components offline.

In December, FUELSNews covered the Biden Administration’s plans to seek bids for the replenishment of the SPR after it dropped to record lows since the 1980s. After taking bids for the replenishment to begin in February, the Biden Administration has decided to wait to take action. The administration claimed that the proposals were too high, and some did not meet the project specifications. We can expect this project to be delayed by at least another month as they figure out new parameters around the bidding process.

The SPR is meant to serve as an emergency supply of crude oil when there are disruptions in the market. When the stockpile is depleted, it could be more difficult to address these situations or supply shortages, which in turn could harm the US economy.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.