Week in Review – January 6, 2023

It’s been a tumultuous opening of the new year for oil markets. Crude oil fell nearly 10% in the first two trading sessions of 2023, marking one of the worst new year trades in a generation. Diesel prices also saw a 10% selloff early in the week, while gasoline only saw an 8% dip. The new year is already bringing its own unique challenges for fuel markets.

Around the country, fuel supplies are being impacted by unexpected events. In California, just as refineries began reopening from the winter storm, a bomb cyclone triggered power outages and flooding at fuel terminals in northern California, delaying deliveries. In Colorado, the state’s sole refinery will remain offline for months, requiring more fuel to be brought in from abroad. Refinery outages in the Midwest continue to impact prices in states like Ohio as well.

The Colonial Pipeline announced an outage for its refined fuel line delivering fuel from Greensboro, NC up to the Northeast. Thankfully, repairs are expected to be completed by tomorrow, so markets should not experience any significant outages.

The EIA’s data this week showed more of the impacts of the holiday winter storm, causing refinery utilization to plummet below 80% overall (usually its around 90+%). With refineries unable to convert crude into fuel, the report reflected an expected increase in crude stocks and a decline in refined fuel inventories, though the degree of change was quite mild given the overall impact on production was estimated to be around 20 million barrels of lost fuel output.

The EIA’s report also showed a sharp drop in fuel demand, which is called “product supplied” in the report. The 4-week average diesel product supplied was 12% lower than the same period the year prior, and gasoline was down 7%. The winter storm is responsible for as much as half of that decline, but declining demand remains a trend worth monitoring given prevailing economic concerns.

Prices in Review

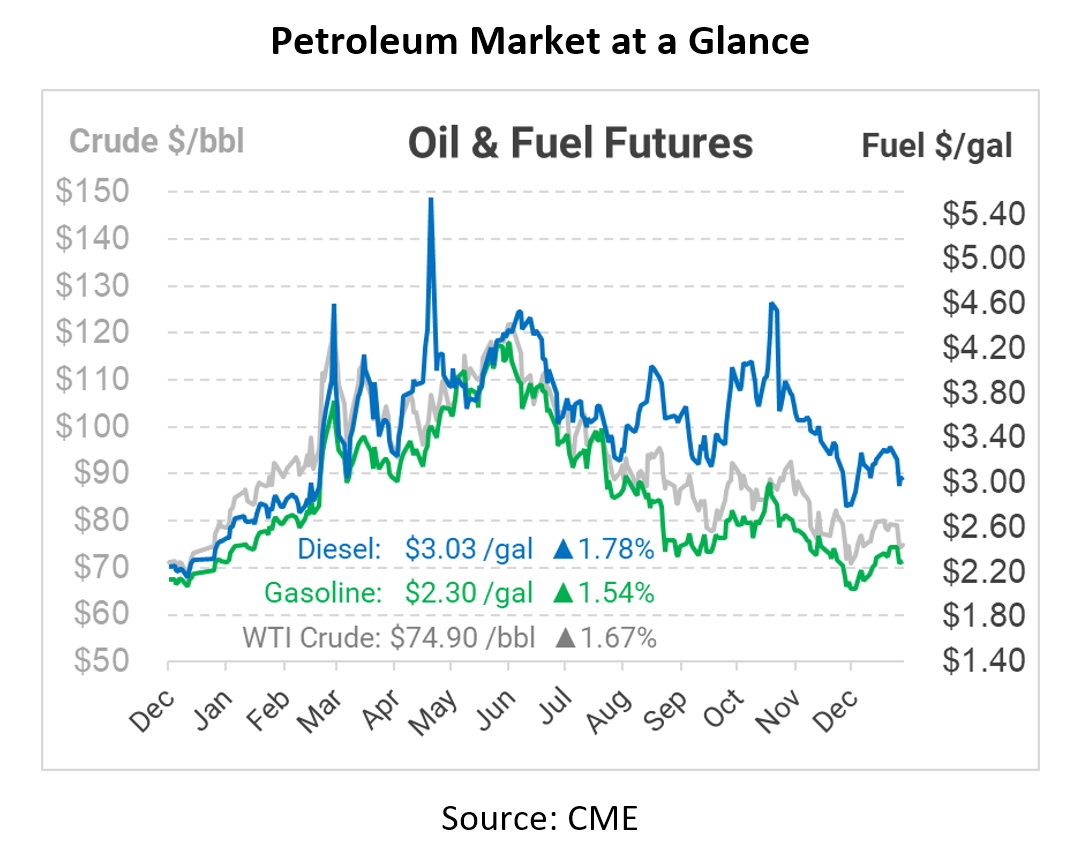

Crude opened the week on Tuesday due to the holiday weekend, with a starting price of $80.57. That price didn’t hold for long, and the product lost $3.50 that day. The market continued falling on Wednesday, reaching a low closing price of $72.84 before turning higher. On Friday, the Texas oil contract opened at $73.97, a weekly loss of $6.60 (-8.2%).

Diesel also plummeted this week, from an opening price near $3.30 on Tuesday to a low of $2.92 on Thursday. On Friday, diesel opened at $2.98, a loss of 32 cents (-9.6%).

Gasoline followed the rest of the oil complex lower. Opening at $2.49 on Tuesday, gasoline sank to $2.24 on Wednesday, a quarter-sized swing. Today, gasoline opened at $2.27, a loss of 22 cents (-8.9%) for the week.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.