A Fitting End to a Hard Year – Fuel Supply Challenges around the US

Analysis by Alan Apthorp

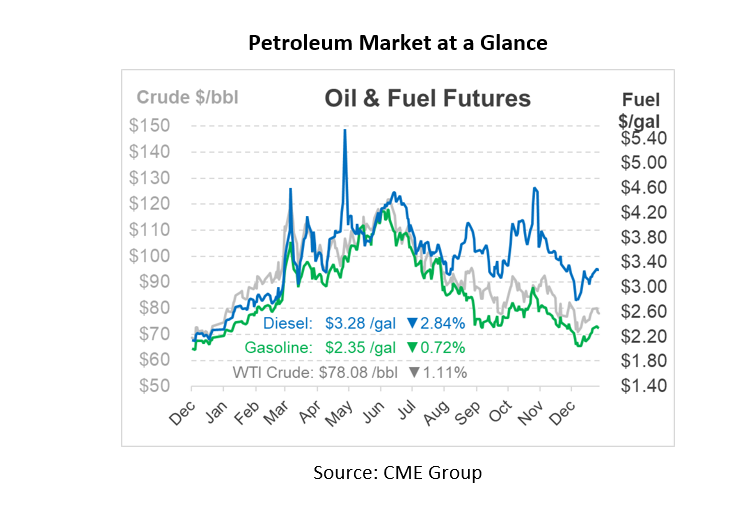

In an unsurprising twist that anyone could have seen coming – 2022 is ending with some fuel market challenges. It’s a fitting end for a year that has been rife with war, volatility, and supply shortages. Let’s explore some of the challenges facing markets currently.

In southern California, a refined fuel pipeline has been shut since December 20 due to a gasoline leak. Typically, the pipeline is the main supply source for San Diego, carrying products from LA refineries southward. The pipeline company expects the pipeline to resume operations on Saturday. In the meantime, San Diego is facing elevated prices due to tight supply.

In the Gulf Coast area, over 20 refiners with combined throughput of 6 MMbpd saw reduced operations due to the recent winter storm. PADD 3 refinery utilization plummeted nearly 20% below prior week levels. Platts estimates that a cumulative 20 million barrels of refined fuels have been removed from the market due to outages, including 6 million barrels of diesel and 10 million barrels of gasoline. Although this week’s EIA report may not reflect a significant effect, next week’s storage report could show a steep diesel and gasoline inventory draw, paired with a sharp crude oil build. Fortunately, the price impact from the outages has been mostly limited – though the market may be waiting for next week’s EIA report to see how big the impact is.

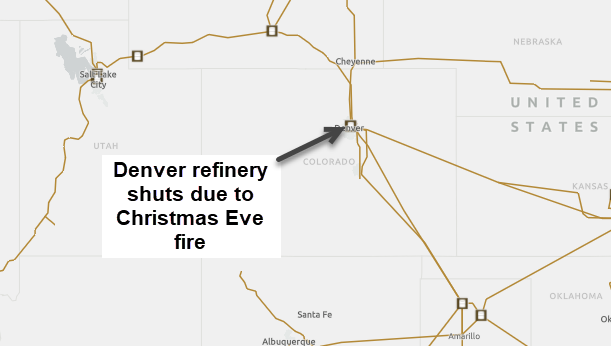

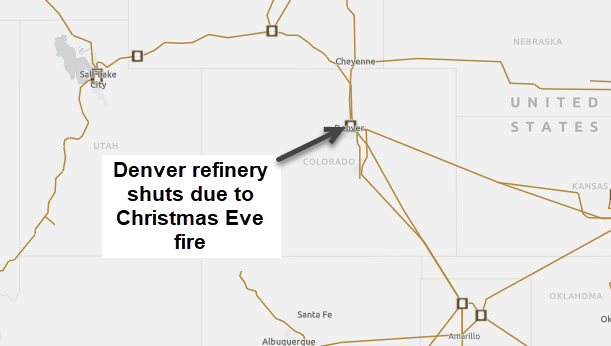

In Colorado, a market largely isolated from the rest of the country except by some small pipelines, the key state’s only refinery closed on Christmas Eve due to a reported fire. This marks the third time the refinery has closed down since August. A second fire occurred on Tuesday during the plant shutdown. Currently, there is no ETA on a refinery re-start.

This article is part of Daily Market News & Insights

Tagged: Colorado, refined fuels, refinery, refinery outage, Refinery Utilization

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.