Week in Review – Dec 23, 2022

Analysis by Alan Apthorp

FUELSNews will not be published on Monday, December 26, or Monday, January 2, due to the holidays. We wish you a happy holiday season and a bright and merry New Year!

It’s been a relatively quiet week for fuel markets heading into the holidays, but that’s not stopped the market from drifting higher throughout the week. Economic data has shown continued strength in the US, with Q3 consumer spending up 2.3%. Jobless claims were also below market expectations. Fuel prices are up roughly 15 cents for the week, reacting both to the improved economic outlook and falling inventories reported in this week’s EIA report.

The US showed a sharp 5-MMbbl draw from crude inventories, likely a result of continued outages of the Keystone Pipeline. Although the pipeline is transporting crude from Canada to Illinois refineries, the segment running down to Oklahoma remains offline. Keystone said that cold weather has slowed repairs, now targeting Dec 28-29 for a restart of the southern segment of the line.

The EIA also reported that refinery utilization ticked down sharply, from 95.5% two weeks ago to just 90.9% this week. The slowdown could be tied to falling prices over the past two weeks or to logistics challenges tied to the Keystone Pipeline outage. With refiners slowing throughput, diesel inventories halted their recent string of increases, with stocks falling slightly this past week.

Overseas, Russia is planning to reduce output by 600-700 thousand barrels per day early next year, promising not to sell oil to any country imposing a price cap on its oil. A Russian official stated that Germany and Poland had bid on Russian crude for 2023, which both countries labeled as “false.” Reuters reports that Russian Urals crude exports may fall by as much as 20% in December due to EU sanctions.

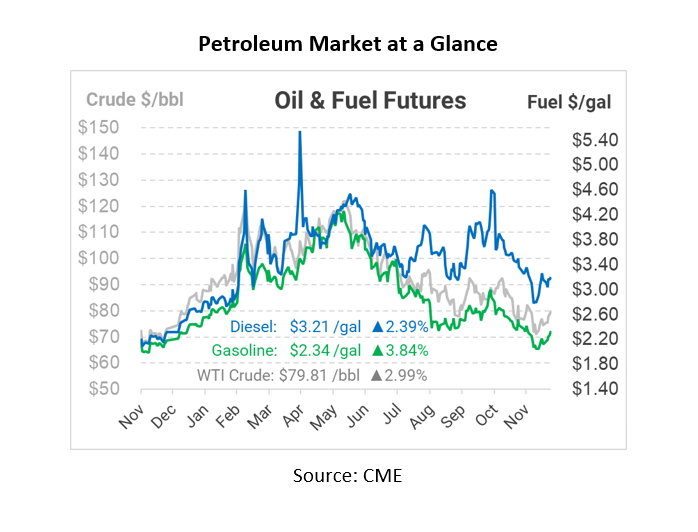

Prices in Review

Crude oil began the week at $74.50, right in the middle of the $71-$79 range that has dominated prices for the past few weeks. Prices rose steadily through the week, peaking at $79.90 before dipping lower Thursday afternoon. On Friday morning, crude opened at $78.18, a gain of $3.68 (+4.9%).

Diesel’s journey this week was a bit more volatile, with early losses followed by end-of-week gains. Diesel opened at $3.1264 on Monday but sank to just above $3/gal on Tuesday. Prices then rallied after the EIA posted a crude inventory build. By Friday morning, diesel was opening at $3.1536, a gain of 2.7 cents (0.9%).

Gasoline’s pathway looked similar to crude, with steady gains each day except Thursday. Starting at $2.1442 on Monday, prices steadily rose throughout the reach. On Friday, gasoline opened at $2.2654, a gain of 12.1 cents (+5.7%).

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.