Oil Prices Stabilize Amidst Lingering Supply Uncertainties

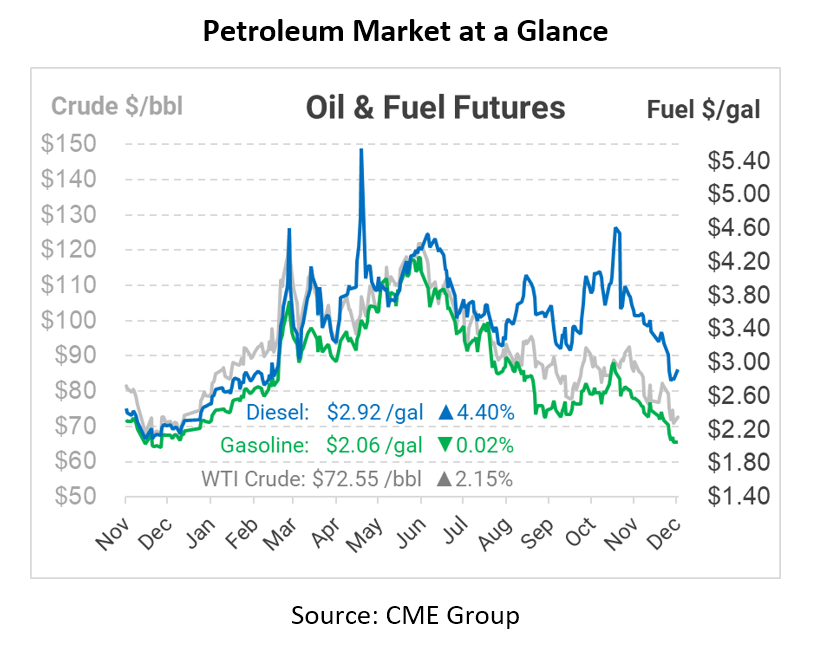

After nearly a month of falling oil prices, the market has stabilized despite a weakening economy and continued pipeline uncertainties. For most of 2022, crude oil futures went soaring following Russia’s invasion of Ukraine, while daily travel and fuel demand also picked back up. We saw prices peak at over $100/bbl and now are seeing prices below $70/bbl.

Meanwhile, the Russia and Ukraine war resulted in significant price volatility throughout the year. In response to the EU and G7 price cap of $60/bbl on Russian crude, Russian President Putin hinted that further OPEC production cuts might be coming. Putin said, “I’m not saying now that this is a decision, but if necessary, we’ll think about possible production cuts” and further stated he has “already said that we simply won’t sell oil to those countries.”

China’s COVID restrictions have counteracted last week’s Keystone Pipeline shutdown as crude futures have fallen to record 2022 lows. TC Energy shut down the Keystone Pipeline last Wednesday in response to an oil leak in a Nebraska creek and has not yet set a date for reopening. “We have not confirmed a timeline for restart and will only resume service when it is safe to do so, and with the approval of the regulator,” TC Energy said in a statement Sunday. Although the company announced force majeure, later reports have noted that the leak is now contained and that an estimated 14,000 barrels were spilled in the accident. Supply disruptions were not a concern for this shutdown because other pipelines also feed these refineries. Should the shutdown continue for an extended period, the Gulf Coast markets could see reduced exports.

This morning, AAA recorded retail gasoline prices to begin the week at $3.26/gal, while the most common price seen at pumps across the nation is roughly $2.99/gal. The remainder of this week will be unpredictable as influencers like the Keystone Pipeline linger. On Wednesday, the December Federal Open Market Committee meeting will be held to decide on a federal reserve rate before entering 2023. Tomorrow we can expect a release of the most recent U.S. consumer price index. These factors will ultimately determine the future health of the U.S. economy and fuel prices.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.