Week in Review – December 2, 2022

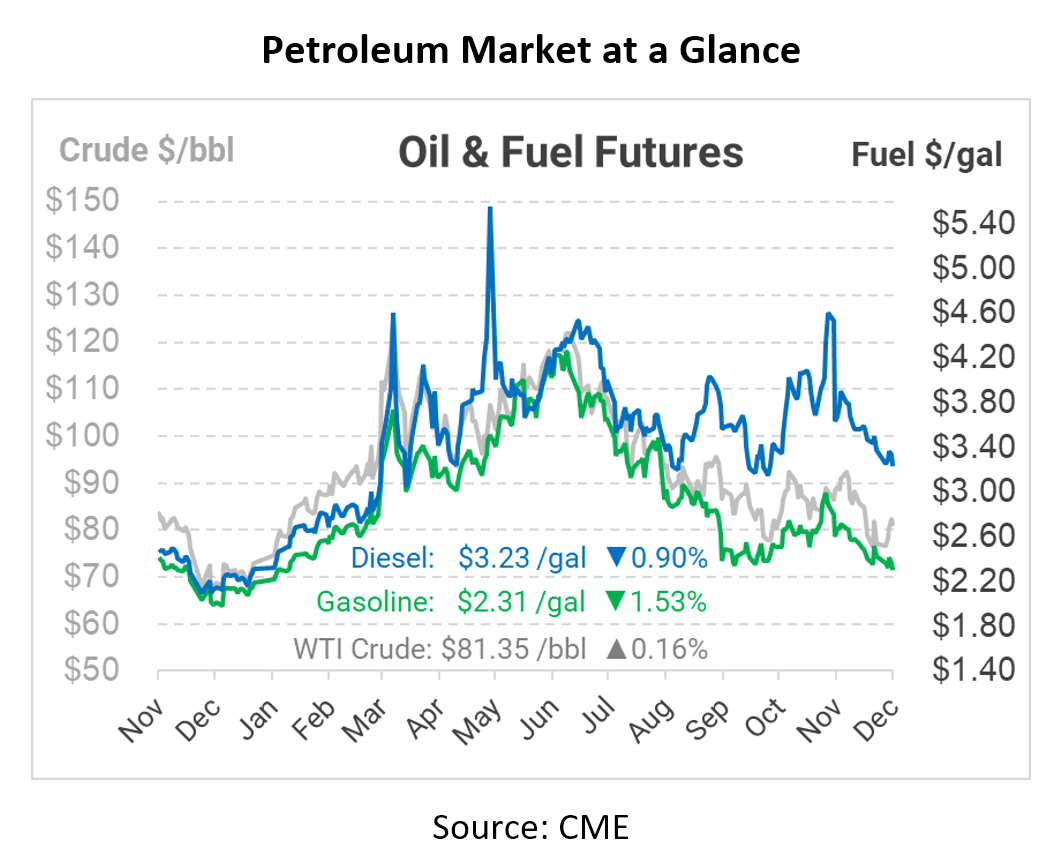

On the heels of a weak holiday trading period, oil prices are trending a bit higher this week, though fuel prices remain suppressed. Crude oil is back above $80/bbl, but diesel remains around $3.25. The mixed results reflect themes in the EIA’s weekly market report, which showed a huge draw from crude oil inventories but solid gains for gasoline and diesel stocks.

With the EU ban on Russian oil quickly approaching, crude oil prices are moving higher. Europe is closing in on a $60 price cap for Russian oil, meaning that EU companies would not be able to insure or transport oil sales between Russia and other countries unless the price is below $60. Of course, the price of Russian Urals crude oil traded at $58 earlier this week, already below the proposed cap price. The agreement also includes a mechanism to ensure Russian oil remains 5% below Brent if oil prices drop. Ahead of sanctions, Russia increased its production to an 8-month high in November.

Yesterday afternoon, the US Senate voted to avert a rail strike, requiring rail companies and unions to ratify the deal brokered by the White House in September. The deal will give workers higher pay, but the Senate did not find the 60 votes required to pass a separate measure that would have given workers more sick time.

China, the world’s largest fuel importer, seems to be on the cusp of loosening its Zero-COVID policy, which would boost oil demand. Together, the US and China account for over a third of all global oil demand, so changes there have major implications for global markets. Although China’s leadership has held tightly to its Zero-COVID approach, they are slowly beginning to loosen restrictions, such as allowing citizens to quarantine at home rather than in government facilities (though magnetized door sensors will be used to ensure people do not leave their house). Eventually, looser restrictions will mean more mobility, leading to higher fuel demand.

Prices in Review

Crude oil opened the week at a meager $75.93 on Monday, the lowest opening price for oil since January. Following this low, prices began to rally, with steady gains throughout the week. Crude opened at $81.47 this morning, a gain of $5.54 (+7.3%).

Diesel saw a rally similar to crude’s early in the week, but later trading saw a break away from crude markets. Diesel opened at $3.2581, and opened this morning at $3.2535, a small decline of half a cent. A build for diesel inventories helped reversed the higher prices frm Monday and Tuesday.

Like diesel, gasoline also ended the week flat/lower. Gasoline opened at $2.35 on Monday, climbing above $2.40 during the week before dipping lower Thursday. On Friday, the product opened at $3.3494, hardly changed from the opening price.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.