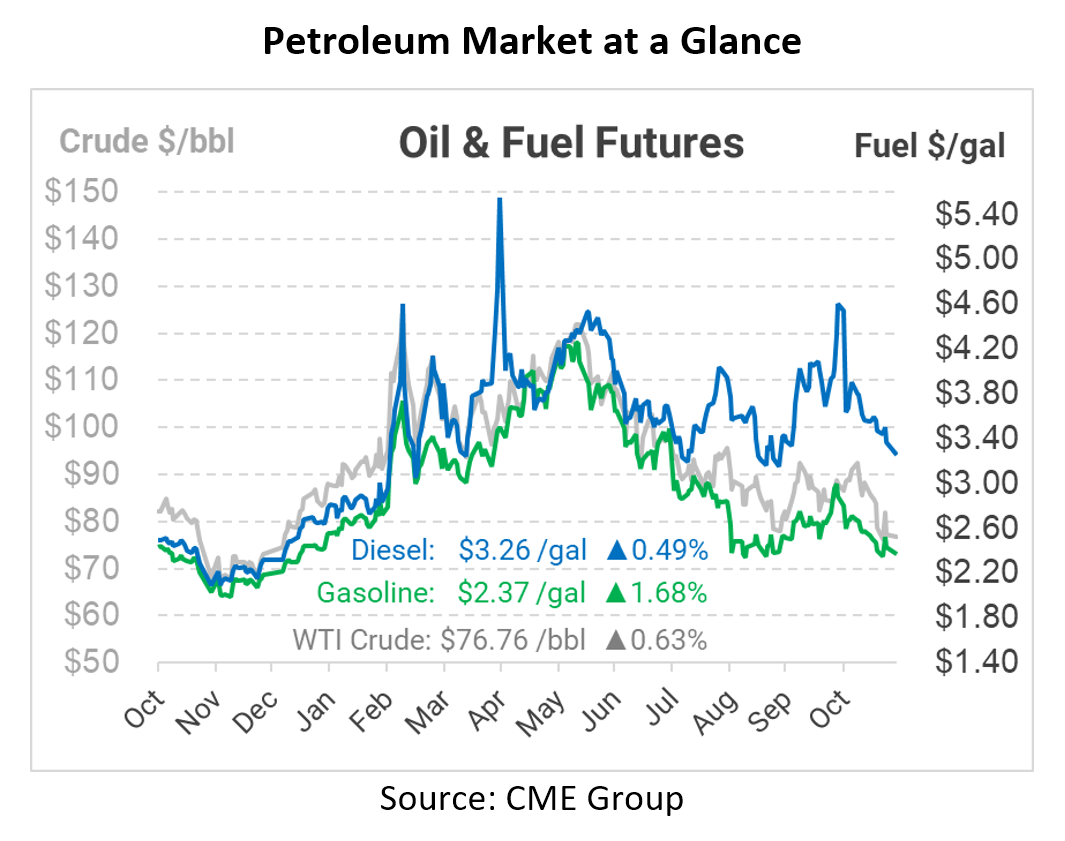

Diesel Down $1/Gal from Oct, Bearish Headlines

Last week, oil prices rallied briefly ahead of the Thanksgiving holiday, but prices are now trading solidly lower as US traders return to their offices after the long weekend. Diesel is among the biggest losers. Last week, the product was trading at $3.50; now, diesel is trading around $3.20. That’s a 30 cent downward move in the past week, and $1/gal below late-October prices. Compare that with gasoline, which has only lost roughly 15 cents since last week, while crude oil is down $5/bbl (roughly 12 cents per gallon). Diesel inventories rose by almost 2 million barrels last week, slightly reducing the persistent supply imbalance.

Along with the bearish news, some major banks are slashing their 2023 forecasts for oil. JP Morgan cut their 2023 price expectation for Brent crude to $90. Morgan Stanley cut their Q1 price forecast to $95, down from $100 previously. Still, Morgan Stanley sees risk skewing upwards, meaning it’s more likely that oil averages above $95 than below it. The bank also sees Brent oil surging back to $110 by the middle of 2023. Goldman still maintains a price forecast of $110 in 2023.

Headlines have been bearish, prompting price losses across the oil market. With OPEC+ considering a supply increase (undoing the cut from last month), markets are seeing price weakness as the year closes. Chinese citizen protests against COVID-19 restrictions created some political uncertainty, though China’s leadership has so far held strong in its zero-COVID policy.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.