Russia Attack Brings Oil & Financial Volatility

On Tuesday night, markets shuddered in fear as a Russian rocket fell on Polish soil, killing two. As a NATO member, Poland has the right to invoke Article 5, in which an attack on one NATO member is treated as an attack on all members. That would put the US in direct, military conflict with Russia, a frightful proposition.

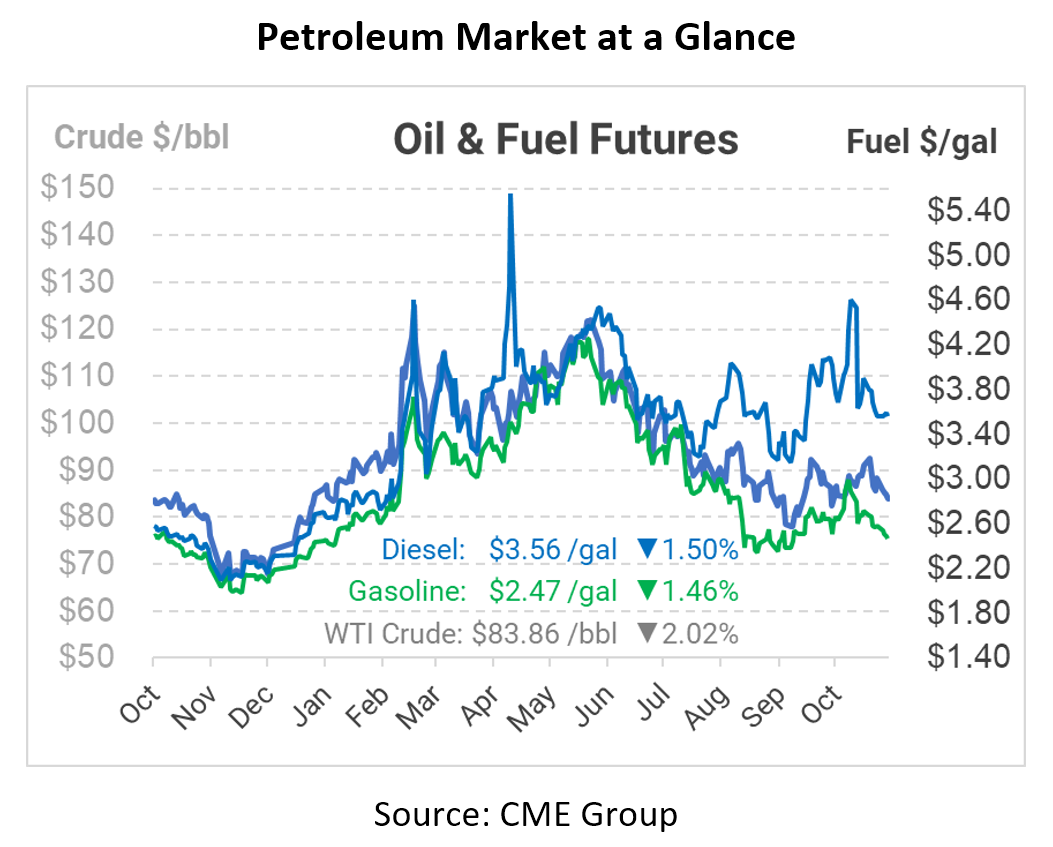

By Wednesday morning tensions cooled – the rocket appeared to be fired by Ukraine in defense against Russian missiles. Although the US and Europe have still assigned ultimate responsibility to Russia, the issue will not bring escalations in the Russia-Ukraine war. Crude oil leapt $3/bbl on the news, but settled the next morning.

Nearby, infrastructure supporting the Druzhba Pipeline was also apparently hit by Russian forces, causing the pipeline to lose power and halt operations. The Druzhba brings oil into Western Europe from Russia, and has been exempted from sanctions since countries like Hungary and Poland have no option but the pipeline for oil supplies. Repairs were completed quickly, allowing oil to begin flowing again.

On the economic front, Goldman Sach’s investment research team released their 2023 outlook, reporting a meager expected 1.8% GDP growth globally. The bank expects the US economy to narrowly avoid a recession, but other countries will not be so lucky. The forecast also includes continued interest rate hikes, with rates hitting a peak of 5.0%-5.25% in May. That could mean continued pressure on financial markets including commodities, and lower prices next year.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.