Week in Review – November 4, 2022

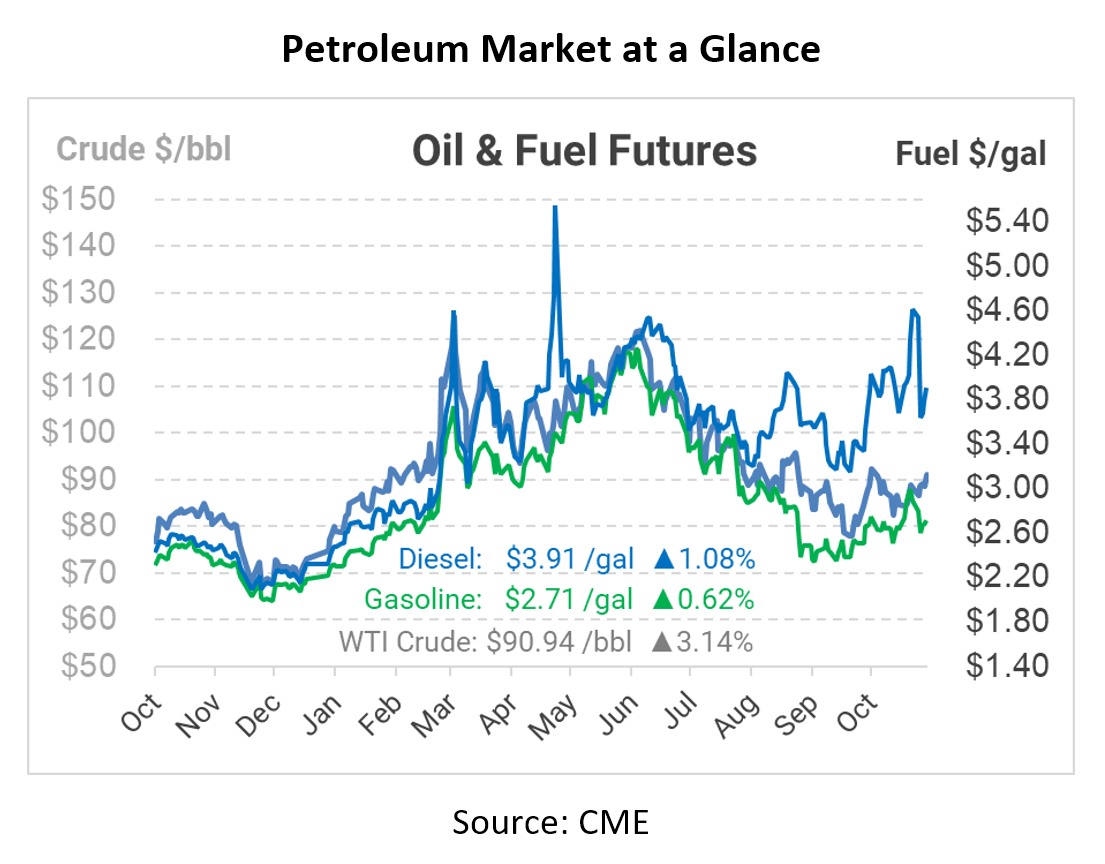

Oil markets are generally up this week, with mixed news throughout the week keeping markets in limbo. WTI Crude is back above $90/bbl this morning, though it’s been slow in moving higher this week. Strong economic numbers are keeping the overall market higher today, bringing higher prices as the week closes.

Among the key factors driving markets this week:

- The Federal Reserve increased interest rates by another .75%, bringing the Federal Funds interest rate range to 3.75%-4.0%. Higher interest rates help curb inflation by lowering economic growth, and some economists are predicting a 2023 recession if rate hikes continue. The Fed seems on track to continue raising rates, though their latest guidance has hinted that future hikes may be less aggressive than the rapid changes seen this year. On the positive side, job growth remains strong, with job growth outpacing expectation.

- China may be moving away from its zero-COVID policy. Some health and economic officials have hinted that a change in the country’s COVID policy could be coming soon, though other accounts have mentioned 5 or 6 months before any change occurs. Official statements fom Chinese health officials, though, continue to support zero-COVID policies. Given the economic strain those policies have when shutting down major cities, markets are waiting to see if China will change its approach, which would mean more fuel demand and higher prices.

- The EIA released their weekly petroleum inventory numbers, which showed functionally no change for diesel markets. Overall, the report was bullish for crude and gasoline. Diesel saw a small increase for inventories, which is good but not enough of a build to change the current diesel supply challenges. Refinery utilization increased, which bodes well for future fuel production.

Prices in Review

Crude oil is opened the week at $88.39, in line with its previous trading from the past few weeks. Prices generally fluctuated within a few dollars of that range, with a slight bent higher. On Friday, crude opened at $87.90, slightly lower; however, morning trading sent prices well above $90 to close the week.

Depending on how you track diesel prices, you may have seen a giant plunge or a slight increase in prices. The November contract expired at the end of the month, so the futures market rolled to the new “prompt” month of December 2022. Below, the black line shows the November contract expiring, and the blue line shows the trading price of the December 2022 contract. This result is called backwardation – the 75 cent drop in prices is causing volatility that makes supply challenging. NYMEX futures opened the week $4.50 (Nov 22) and $3.76 (Dec 22). Prices traded flat on Wednesday when the EIA’s report showed only a tiny build, but later supportive economic news helped the product trade higher. On Friday, diesel opened at $3.86, up roughly ten cents for the week.

Gasoline’s drop was less dramatic when the Nov 22 contract expired. Opening at $2.91 (Nov 22) and $2.55 (Dec 22), the product appears to have fallen roughly 30 cents. However, the November contract’s closing price near $2.80 is not far from current trading levels. Gasoline opened Friday morning near $2.70, bringing an increase in prices for the week.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.