Regional Fuel Markets Show Tight Supply Despite “Weak Macro”

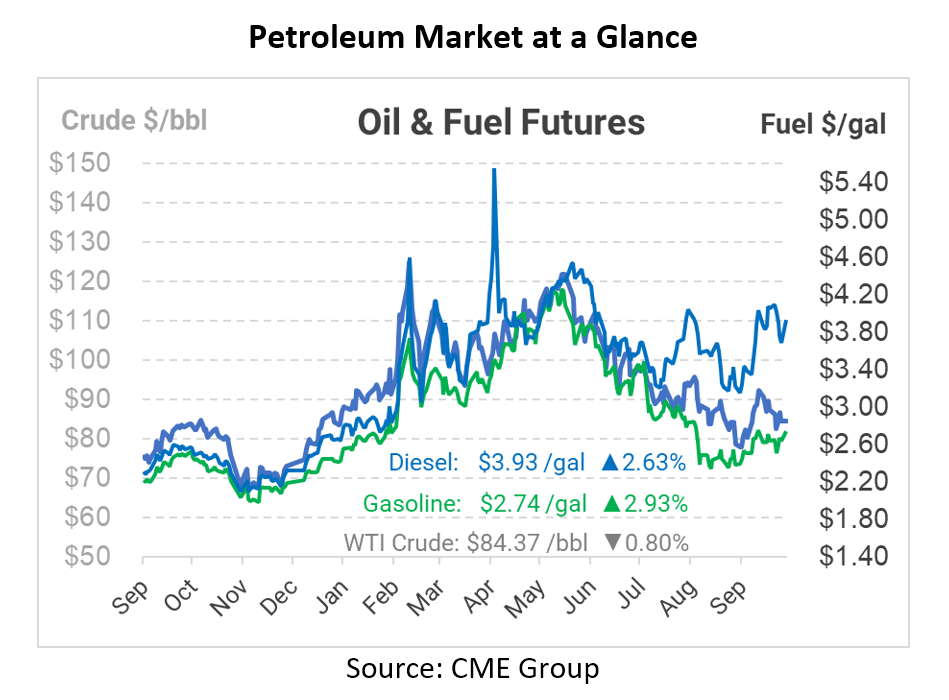

Oil markets continue facing uneven trading, with crude oil trading sideways while diesel prices are up 10 cents per gallon. The market situation has been described by Goldman Sachs this way: “Commodities remain stuck between a strong micro, weak macro and poor liquidity.” While fuel markets (the “strong micro”) are extremely tight, the broader market’s emphasis on a recession (the “weak macro”) has caused prices to be lower than fundamentals might imply. Adding in volatile market conditions that have shifted investors towards bonds and other investments away from unpredictable commodities (the “poor liquidity”), and you get fewer transactions and bigger swings at each turn. Overall – expect both macro and micro fuel markets to be volatile in the future.

Around the country, some regions are facing much higher prices. Regional basis, the difference between a region’s prices and the NYMEX, have seen extreme volatility. New York Harbor is currently trading 40 cents higher than the NYMEX – even though NYMEX contracts are deliverable to the same place. The only difference is time – basis is tied to today’s prices, while the NYMEX is based on fuel deliverable next month. Other regions have seen wide fluctuations, such as Los Angeles, which saw prices swing from 60 cents over the NYMEX to 30 cents below. Chicago basis, which covers most of the Midwest, has moved from -30 cents to +20 cents and back down.

Extreme variations in basis make fuel supply challenging – typically, higher local prices are caused by refinery outages or big surges in demand. As the market tries to resupply a region, it can shift prices the other way, causing a rapid price drop. Lower prices cause an imbalance in the other direction, leading to underinvestment and a spike higher again. This dynamic has been playing out for different regions around the country, adding complexity and making deliveries more challenging.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.