Week in Review – October 21, 2022

Fuel markets have been fairly sideways this week, with some big swings up and down but no major trends. That is, except for diesel, which fell 40 cents this week during 4 straight daily losses. There were three big items in the headlines this week:

- China’s economy is looking a bit stronger. The country chose to hold interest rates steady, bucking the trend of other countries hiking rates to curb inflation. In addition, China’s decision to increase export quotas has resulted in stronger economic activity as refineries increase throughput. Although diesel exports have pushed prices lower, the broader trend of economic strength gave markets some confidence this week, pushing prices a bit higher early in the week.

- The White House is trying all it can to lower prices – but it’s not enough. On Wednesday, President Biden announced plans to release an additional 15 million barrels from the Strategic Petroleum Reserve. Although the release somewhat offset OPEC+’s 2 MMbpd cuts, it won’t be enough to keep markets fully balanced. In addition to the withdrawal, the White House announced a plan for refilling the reserve once prices fall below $70/bbl. The administration is also considering measures such as an export ban or NOPEC legislation to counteract high prices.

- The diesel shortage continues. Diesel volatility continues, with prices sinking 40 cents after rising in previous weeks. Backwardation remains strong, and basis values around the country are uneven. With diesel inventories near historic lows, all eyes have been on the EIA’s weekly inventory report. This past week, the EIA showed diesel stocks rising very slightly, and markets are taking the lack of a draw as good news.

Prices in Review

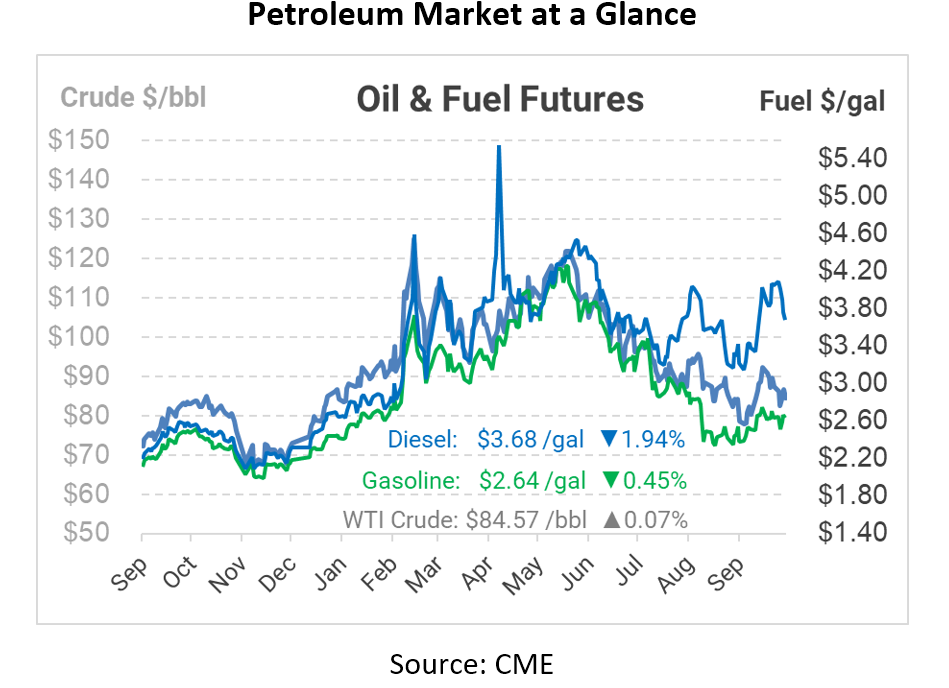

Crude oil opened the week at $85.59, and prices stayed within a relatively small range throughout the week. Prices hit a low around $82 and a high near $88, but settled within a dollar of $85/bbl every day except Tuesday. This morning, WTI opened at $85.07, hardly changed from the beginning of the week.

Diesel followed a very different path this week. Opening at $3.9981, the product rose as high as $4.11 before plummeting on Wednesday after the EIA’s report. Prices fell each day this week by 10-15 cents at a time. This morning, diesel opened at $3.7579, a loss of 24 cents (-6%).

Gasoline generally mirrored crude oil, with a bit wider of a range in between. Gasoline opened at $2.6361, then fell almost 10 cents early in the week. Later on, the product zoomed 20 cents higher, only to fall back again late on Thursday. Gasoline opened at 2.6503, hardly changed from the opening price.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.