What Is It – Fuel Price Index

Welcome to our continuing Wednesday FUELSNews series: “What Is It?” Each week, we’ll pick a fuel industry topic to explain, so you can learn more about the market and what drives it. Want to suggest a topic? Email the author, Alan Apthorp, at aapthorp@mansfieldoil.com. Thank you for the great suggestions so far – we’ll be adding topics on the RVO, renewable fuels, and different fuel terminal types in the near future. Keep the suggestions coming!

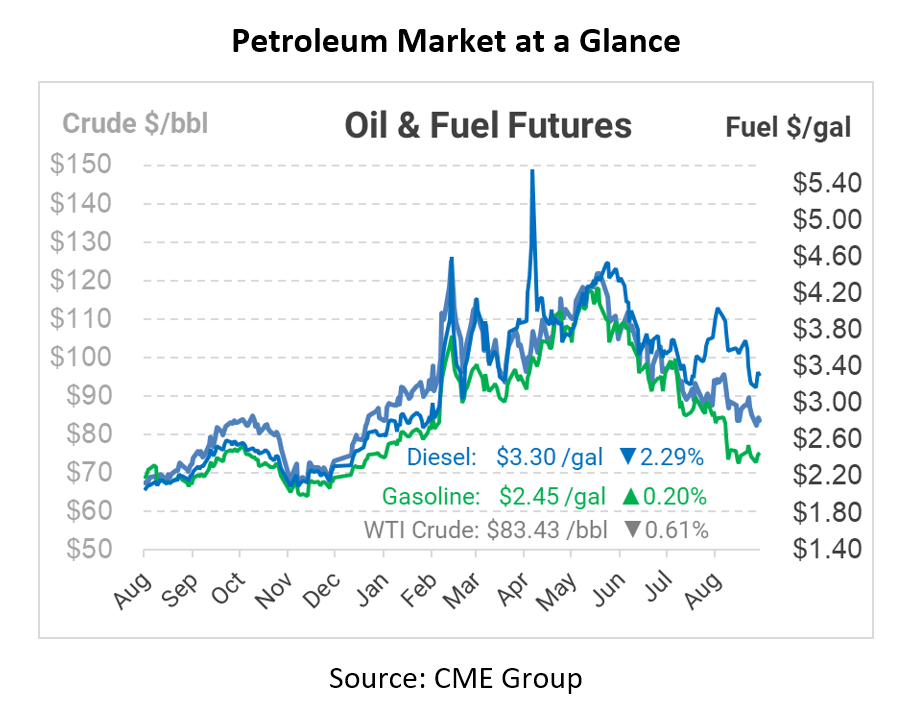

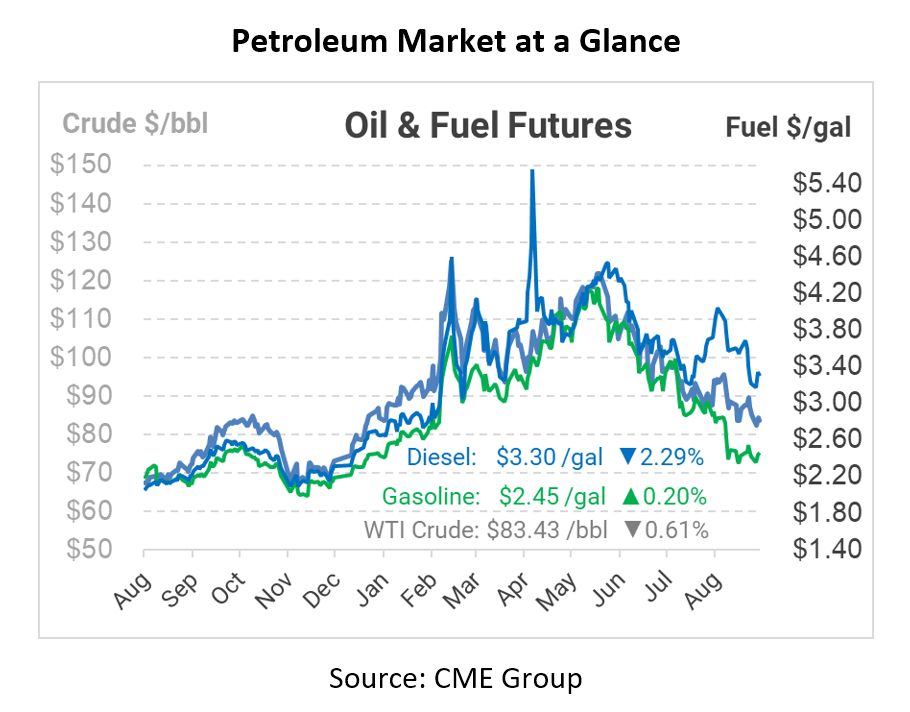

Fuel prices change every day – and sometimes multiple times a day. Whether you’re budgeting fuel or trying to gauge your buying over the past year, it can be almost impossible without a standard. Did you do well, or did you overpay? Some market fluctuations are unavoidable – unless you locked in a fixed price, you’ve almost certainly paid more for fuel in 2022 than you planned. So how do you measure success? Many fuel consumers choose to use a fuel price index to validate their purchasing.

What Is a Fuel Price Index?

Price indexes can take a few different forms, but generally they provide insights into what a “normal” price of fuel is in a given area. Among the most popular fuel indexes are: OPIS, Platts, DTN, and Argus. The index could be based on a particular city (or “rack” market – OPIS and DTN offer this type of pricing) or for a region (such as Gulf Coast or New York Harbor – Platts, Argus, and OPIS each have these pricing feeds). Though few fuel contracts are based on it, the EIA’s weekly retail data is also a price index that is heavily utilized in setting fuel surcharges for transportation companies.

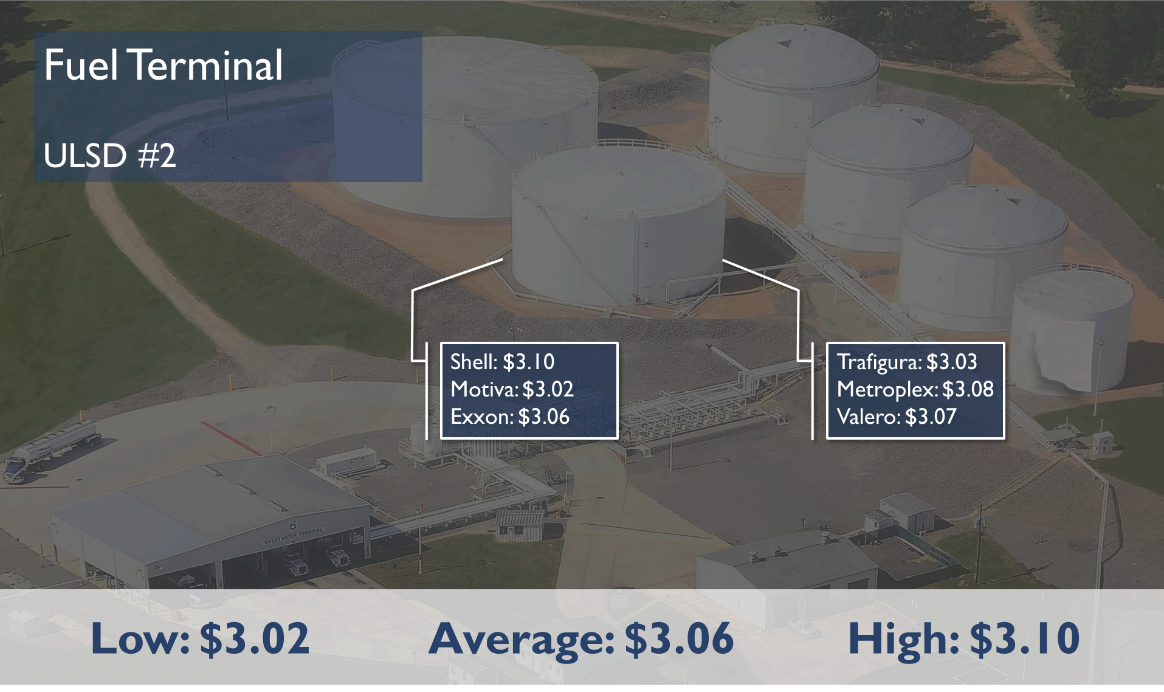

At its simplest, a price index is set by gauging multiple fuel prices in the same market. Let’s say that a certain market has six suppliers, with prices ranging from $3.02 up to $3.10. An index can tell you the average price of all the postings, and most indexes will also tell you the low and the high price as well.

Shows how a price index, such as OPIS, Platts, Argus, or DTN, is reported for a local market

The major pricing indexes have access to thousands of fuel prices daily, receiving pricing from dozens of different suppliers and customers within a market. Those prices are verified, tracked, and reported at specific times in the day and published to subscribers so they can validate prices.

Why Use a Price Index?

When you buy tens of thousands – or millions – of gallons of fuel, pennies count. Sometimes, your fuel supplier may have tons of extra supply and they’ll give you a discount, enabling you to buy very competitively. Other times, supplies may be tighter, and you could be paying closer to the high. How does your buying stack up over time? With an index price, you know how your supplier compares to the market rate, so you can gauge your buying.

How to Guage Success with a Price Index

Across the board, a large majority of index prices are based on the average price in the market. Unless you buy hundreds of millions of gallons a year, you may not be able to buy at or below the low, but you can get close. Many contracts use an “Average-Minus” approach, where your price is the prevailing market average price minus a differential.

If you don’t utilize a price index, you can purchase a subscription or potentially work with your fuel vendor to gauge how your buying compares to a local indexed price. Benchmarking – comparing your historical price to an index – is a good way to see how your current fuel supplier has been performing.

Just remember that even indexes can change over time. A market where you used to pay the average minus 2 cents may change, going up or down as low-average spreads change. That’s why it’s important to refresh your pricing periodically – there may have been a major supply shift (such as a local refinery closing down, or a big change in demand) that alters the market.

What If I Buy Spot?

If you purchase fuel on a no-contract “spot” basis, you might be collecting your own simplified version of a price index. You may receive 3-5 price quotes (or more) per day from different suppliers, and you pick one of the lowest options based on a combination of price, quality, and reliability. Price index companies operate on basically the same principle – the only difference is the number of prices they receive. So, your spot pricing strategy may actually be exactly in line with this indexed approach! On occasion, based on your company’s volume and purchasing strategy, it may make sense to compare your prices to a major price index, to validate that you’re receiving enough prices to buy competitively.

When Price Indexes Don’t Work

In general, a price index is a useful tool for purchasing fuel. However, there are certain scenarios where even the industry standards for fuel pricing present some challenges.

Across the board, the difference between price indexes is pretty narrow. In a perfect world, every supplier would have the exact same price – but different strategies, supply positions, internal costs, and more can cause local prices to have different spreads.

Typically, buying based on a local rack index is best for typical end-user fuel buyers – if you have a site in Atlanta, it’s better to use an Atlanta-based price than a price for the entire Gulf Coast. Utilizing a regional index for a local site can lead to the indexes becoming inverted, either causing you to pay more per gallon or potentially forcing your fuel supplier to request a pricing change to avoid losing dimes or quarters per gallon. For very large suppliers, though, a regional index may be preferred depending on their purchasing patterns.

Local volatility can also lead even rack prices to be thrown askew. For instance, hurricanes can send prices into chaos because indexes include branded fuel (fuel sold from a refiner to their retail stations bearing the same brand), which isn’t available to the broader market. Called a “brand inversion”, this unusual, short-term dynamic can temporarily make the rack market average price non-representative of wholesale fuel prices in general.

This article is part of Daily Market News & Insights

Tagged: Fuel Price Index

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.