Is China the Solution to the Diesel Shortage?

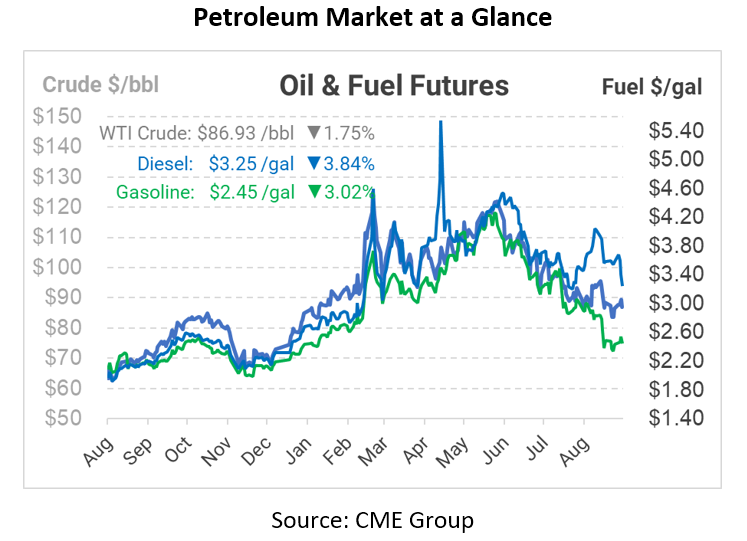

Fuel markets are cooling off this morning, with diesel leading the complex lower. The rail strike has been averted, with a deal signed to give workers higher pay and more time off to appease concerns. Over the past three trading sessions, diesel has fallen more than a quarter. A hefty 4.2 million barrel build for US diesel inventories certainly helps. But another culprit is back in the spotlight – China. And this time, it’s not just their economy sending prices tumbling.

China is the world’s largest importer of oil products, and once that oil is imported, it tends to stay in China. Unlike the US, where crude oil flows in from other countries and refined products flow out, China has laws that cap how much fuel is exported. However, China is now mulling a large increase in export quotas that would allow Chinese gasoline and diesel to hit the global market. In 2022, China has averaged 1.95 million tons of refined fuel exports per month (app. 0.5 million barrels per day). The new policy would increase that by 2.5x to 5 million tons per month (app. 1.25 MMbpd).

The measure is a win-win for the Chinese economy. China has remained neutral on the Russia-Ukraine conflict, giving them access to Russian oil that’s trading at a fraction of prevailing international oil costs. But with COVID lockdowns shrinking domestic demand, the country doesn’t actually need all that extra cheap oil it’s importing. By increasing its exports, China would 1) get an economic boost from the sales, 2) help keep global oil prices lower (leaving the world with more money to spend on Chinese products), and 3) allow refiners to increase utilization from just 75% of capacity, making them more efficient.

This article is part of Daily Market News & Insights

Tagged: 2022, Diesel Shortage

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.