Off the Rails: Rail Strike Threatens Fuel, Renewables, DEF, and US Economy

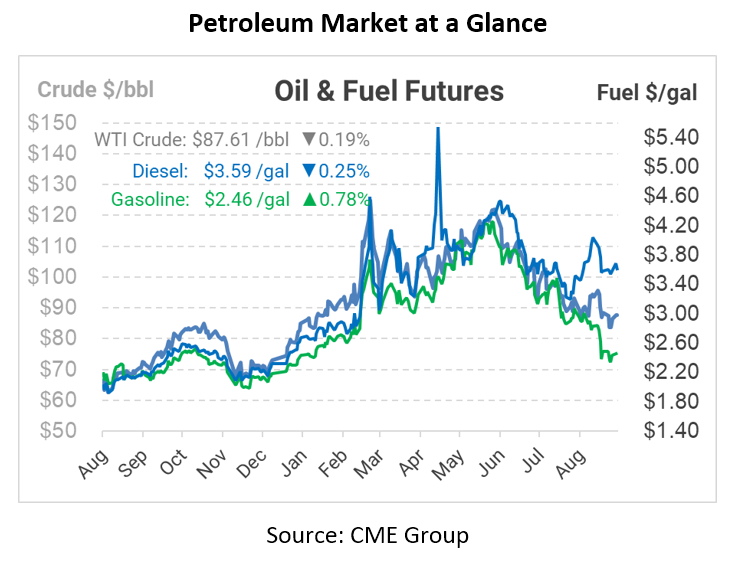

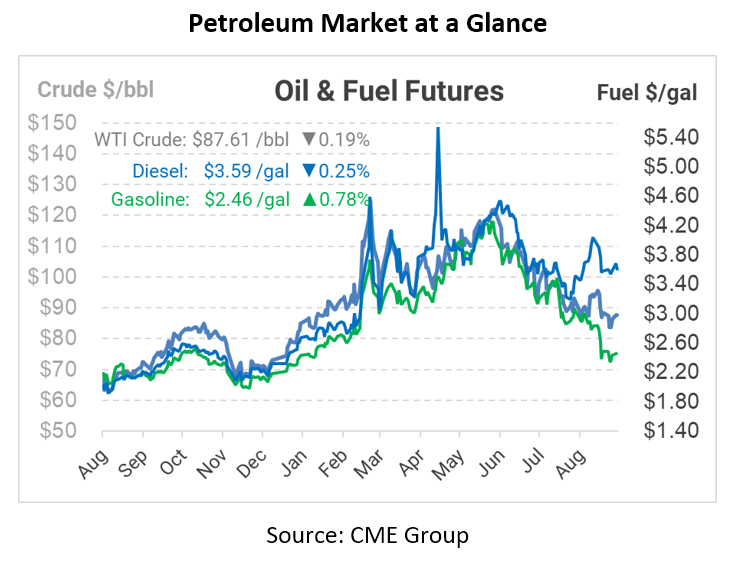

Inflation has slowed down a bit from its June peaks of 9.1%, with August showing year-over-year inflation at just 8.3%. Falling fuel prices have been a big contributor. Gas prices, which rose above $4.20 in June, have fallen by $1.80, and diesel is down by $1/gal. But now, there’s a new risk that threatens to exacerbate supply chain shortages, cause labor challenges, and trigger new inflation: a railroad strike.

Some 60,000 workers are expected to go on strike on Friday if concessions are not made regarding time off and labor expectations. The expected cost to the US economy is over $2 billion per day. Some major rail systems have already halted deliveries or ceased accepting hazardous material transport requests ahead of the expected strike. Today, we’ll explore how we got here, the impact on fuel and DEF markets, and what this means for transportation markets.

How Did We Get Here?

This isn’t the first time that labor unions and rail companies have faced off. Railroad workers are often on-call seven days a week, and labor reps argue that workers are working 12-hour shifts and being penalized for taking sick time or personal leave. While rail companies argue that the tough schedules are necessary to keep trains running efficiently and prevent shortages, the US Surface Transportation Board notes that large rail companies have cut staff significantly in recent years.

Back in July, confrontations were coming to a head. To prevent a national crisis, the Biden administration imposed a 60-day cool-off period and proposed a resolution that split the difference in negotiations. The recommendation included pay raises of 24% from 2020-2024, 14% of which would apply retroactively and cost rail majors hundreds of millions in back-pay. Five of the twelve rail labor unions tentatively accepted the administration’s proposal and several others are on board, but two large unions representing engineers and conductors are still holding out. If a deal is not reached by Friday, some 60,000 workers could go on strike, hampering rail shipments around the US in the first national rail strike in 30 years.

Biden’s cool-off period expires at midnight Friday morning, at which point the executive branch won’t have any further ability to intervene. Congress could pass legislation to force a reconciliation, but partisanship in DC will likely prevent any meaningful action (and both sides have opposed political intervention anyways). That leaves direct negotiations between the labor unions and rail companies. Rail companies are making plans in case the strike occurs, and a large majority of union members reportedly support striking.

What This Means for Fuel & DEF

Many industries are bracing for an impact: rail companies haul 28% of the US’s freight, hauling products ranging from food and goods to energy commodities to automobiles. For the energy industry, a rail strike would hamper crude by rail shipments, which in June accounted for 289,000 barrels per day according to the EIA, 40% of which is crude shipments from Canada. Canadian oil producers, and the US refineries reliant on their imports, will be the biggest loser in the oil space. In general, the US’s fuel market is more reliant on pipelines than rail transport, so the strike’s impact on fuel markets would be challenging but not detrimental. What’s true for fuel, though, is not necessarily the case for other critical commodities.

According to the Association of American Railroads, 65-70% of ethanol is transported across the country by rail, a number which is likely analogous for other biofuel products. In 2018, that meant 11.3 billion gallons of ethanol moved by rail! Further up the supply chain, the feedstocks supplying the biofuel manufacturing plants – corn, soybean, etc – may also be shipped via rail. Biofuel supplies could be disrupted during a rail strike, especially along the West Coast, where significant quantities are shipped in from the Midwest.

Diesel Exhaust Fluid is another major commodity at risk. The majority of DEF leaving production facilities for packaging is shipped by rail. A single railcar of DEF holds enough product to support 5 million miles of trucking. DEF is already suffering from outages caused by rising European natural gas shortages, which caused one major DEF importer to dramatically raise its US prices. With the market already facing tightness, a rail strike could be devastating for national DEF supplies.

What This Means for Transportation

The American Trucking Association sent a letter to Congress urging them to keep the peace, adding that it would take 460,000 additional long-haul trucks to pick up the slack if all 7,000 long-distance freight trains were idled. In an industry already constrained by a driver shortage, even a small increase in transportation would be very difficult to manage. A rail strike would also require redeploying existing truck assets from their normal intermodal routes to more long-haul trucking.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.