What Is It – Rack-to-Retail Spreads

Welcome to our continuing Wednesday FUELSNews series: “What Is It?” Each week, we’ll pick a fuel industry topic to explain, so you can learn more about the market and what drives it. Want to suggest a topic? Email the author, Alan Apthorp, at aapthorp@mansfieldoil.com. Thank you for the great suggestions so far – we’ll be adding topics on the RVO, renewable fuels, and gross/net gallons in the near future. Keep the suggestions coming!

There are lots of ways to buy fuel – you can buy it at a gas station, by the truckload, delivered directly to your truck, or even by a “contract” (1,000 barrels, or 42,000 gallons, at a time!). But how do you know which method is right for you? Many growing fleets eventually find that it’s worthwhile to invest in a a fuel storage tank, so they can go from retail prices to wholesale economics. How much can they save? The answer lies in Rack-to-Retail Spreads, so let’s focus on those today.

What Are Rack-to-Retail Spreads?

Quite simply, rack-to-retail spreads are the difference between retail prices (minus taxes) and a local rack price. Removing taxes is important, since retail prices are inclusive of taxes but rack indexes generally do not include tax.

Let’s look at an example. If the average price of diesel fuel in northern Texas was $4.50, the area had $0.444 diesel taxes, and the local rack price was $3.50, then the rack-to-retail spread for that market would be:

$4.50 – $.444 – $3.50 = $0.556

Put another way, on that day, a fleet buying fuel by the truckload would save around 55.6 cents compared to filling up at a truck stop. Those savings add up fast!

What’s Normal for R2R spreads?

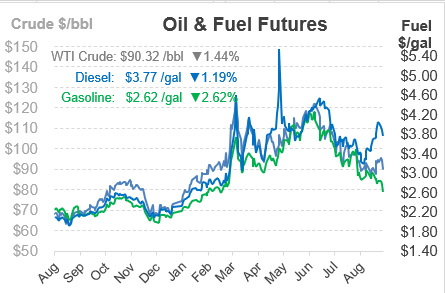

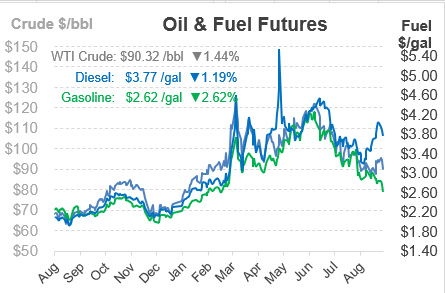

Rack-to-retail spreads tend to fluctuate over time, but they do have some normal zones where they typically stay. During times of low volatility, such as 2017-2019, R2R spreads tend to hover around 25-35 cents for diesel, and around 20 cents for gasoline. However, significant price volatility can impact R2R spreads, causing major swings. Since 2020, diesel R2Rs have been consistently above 40 cpg, while gasoline has been above 30 cents.

R2R and “Sticky Pump”

While wholesale fuel prices can be as volatile and fast-moving as the financial markets they’re based on, retail prices tend to move slower. Retail stations are hesitant to quickly yank their prices up and down, fearing consumer confusion and lost market share. For that reason, retail prices tend to remain steady even during times of major price volatility, a phenomenon we call “sticky pump.”

When wholesale prices rise rapidly, retail stations are often a bit slower to increase their prices, fearing that their competitors won’t raise prices as quickly. This is why, during times of rising prices such as early 2019, rack-to-retail spreads were relatively low. Of course, retailers do have to make a profit, so once margins go low enough they’ll start passing through those rising prices to get margins back to healthy levels.

When rack prices fall, we see the opposite effect. In 2020, when pandemic restrictions led to huge demand losses and cratering prices, rack-to-retail spreads soared to $1/gal temporarily. Retail stations don’t want to lower prices just to bring them back up again, so they hold prices higher until they know the trend is solidly downward. With volatility high during the 2020-2022 period, retail stations have kept prices steady near market highs to avoid jerking prices up and down. Most consumers don’t understand market volatility, so they might start to panic if they saw prices rise and fall 75 cents in one week.

How Should R2R Inform Your Fleet Strategy?

Rack-to-retail spreads can be an important factor if your company utilizes a fleet card. Of course, fleet cards have certain unparalleled advantages – you can fuel anywhere, with places to fill up conveniently located at just about any highway exit. But if your fleet tends to stay within a small area and can afford to return to one location for fueling, installing a bulk tank can very often present large savings.

Let’s say your fleet buys 500,000 gallons in the Atlanta area. With diesel rack-to-retail spreads upwards of 50 cents right now, then a bulk tank installation could save you $250,000 per year in fuel expenses – meaning a quick ROI on the installation costs.

If you’re buying LTL (less-than-truckload) or mobile fueling fuel, you may not get the full benefits of rack-to-retail sprads, but you might still receive some. For example, if your rate for filling a 1,200-gal tank is OPIS Average + $.15, and rack-to-retail spreads are 50 cents, then you’re saving 35 cents per gallon. Mobile fueling may bring a higher premium, with prices comparable to retail prices, but you’ll save on drive labor since they won’t have to fill up at a gas station.

Overall, there’s no one-size fits all solution. Contact a Mansfield fuel expert if you’d like specific guidance for the best approach for your fleet. But given expanding spreads between retail fuel and wholesale prices, it may be worth asking about installing a bulk tank on your lot and capturing deep fuel savings.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.