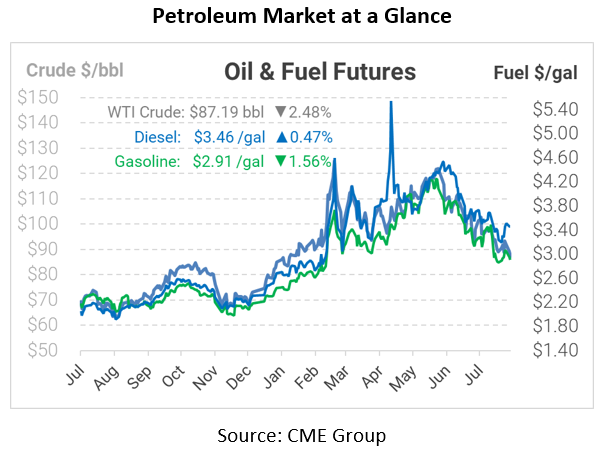

Iran Supply, China Demand, and Russian Price Caps – A Bearish Week for Oil

News this week has been solidly bearish, both for oil supply and economic demand. On the oil supply front, Iran submitted their response to the nuclear deal proposal. European negotiators have hinted that a deal is closer than ever, though some issues remain. Although Iran’s position is not public, news outlets have pointed to Iran’s concern with the deal’s permanence. Specifically, it seems Iran wants to be compensated if a future US president withdraws unilaterally from the agreement. US officials have also claimed Iran is overreaching by seeking removal from the Foreign Terrorist Organizations list. There’s plenty more work to be done before a deal comes to fruition, but there’s hope that both sides are getting close to an agreement.

On the demand side, the world’s second-largest consuming country and largest fuel importer, China, is seeing signs of a severe slowdown. Their crude demand fell 9.7% year-over-year, sinking to the lowest since March 2020. Moreover, the country reported that young people aged 16-24 face a record 19.9% unemployment. Demand has cratered, leading the country’s central bank to slash interest rates and pushing Chinese Premier Li to encourage provinces to promote growth locally.

Finally, the US and Europe are pushing ahead with a price cap on Russian oil. Current sanctions will ban all Russian oil purchases by the US and EU countries and prevent western companies from facilitating sales to other countries. For example, a European-operated crude tanker (or an Asian tanker insured by a European bank) could not move Russian oil to, say, China. Under a price cap scenario, those shipments would be legal if the crude price is below a certain threshold. That prevents Russia from capitalizing on high prices while averting catastrophically high oil prices. So far, the US has not set a specific price target, but US and European officials are in talks with Asian counterparts to set a fair limit.

This article is part of Daily Market News & Insights

Tagged: China, Iran Nuclear Deal, Price Cap, Russia Sanctions

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.