What Is It – Diesel Exhaust Fluid (DEF)

Welcome to our continuing FUELSNews series: What Is It Wednesday. Each week, we’ll pick a fuel industry topic to explain, so you can learn more about the market and what drives it. Want to suggest a topic? Email the author, Alan Apthorp, at aapthorp@mansfieldoil.com.

If diesel is the hero of the transportation fuels world, then Diesel Exhaust Fluid (DEF) is its emission-lowering sidekick. Every truck manufactured since 2010, and off-road equipment since 2015, requires DEF to reduce its nitrous oxide (NOx) emissions. To understand the DEF market, it’s important to understand what DEF is, why we use it, and how to buy it most effectively.

What Is DEF?

Diesel Exhaust Fluid (DEF), known in Europe as Adblue due to its bluish tint, is a non-toxic liquid that removes over 90% of nitrous oxide (NOx) pollutants from diesel fuel emissions. NOx is one of six non-natural greenhouse gases and a major component of air pollution and smog, causing asthma, respiratory damage, and heart diseases.

DEF is made of 32.5% ultra-pure commercial grade urea (carbon dioxide mixed with ammonia) and 67.5% deionized water. DEF is used in Selective Catalytic Reduction (SCR) engines, which are the only widely-available engines that meet the EPA emissions regulations that took effect on January 1, 2010 for over-the-road vehicles. Nearly all cars, trucks, SUV’s, and buses manufactured after that date require DEF. These same NOx requirements took effect in 2015 for Tier IV off-road equipment, including construction, agriculture, and stationary power.

How Does It Work?

DEF is not a fuel additive! DEF is stored in its own tank on the truck, which ranges from 5 to 25 gallons in size.

DEF is injected by a dosing unit into the exhaust stream, after the fuel has already been burned in the engine. The ammonia molecules in DEF combine with NOx to form two harmless substances: nitrogen and water vapor.

A NOx sensor located in the exhaust stream reads NOx levels in the treatment area, and controls how much DEF is released into the exhaust. If your engine is burning too much NOx, the engine will raise the treatment rate automatically.

What Drives DEF Prices?

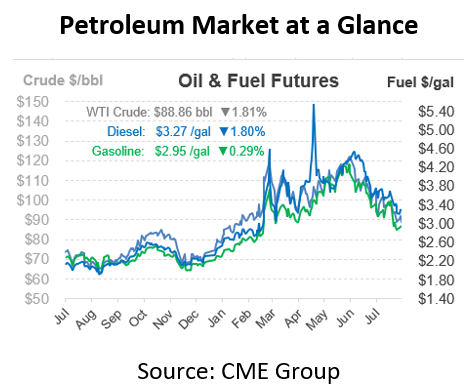

Like most commodities, DEF is subject to significant fluctuations in price. Since it’s only two ingredients, and water isn’t particularly expensive, DEF prices are largely driven by two factors: urea prices and logistics.

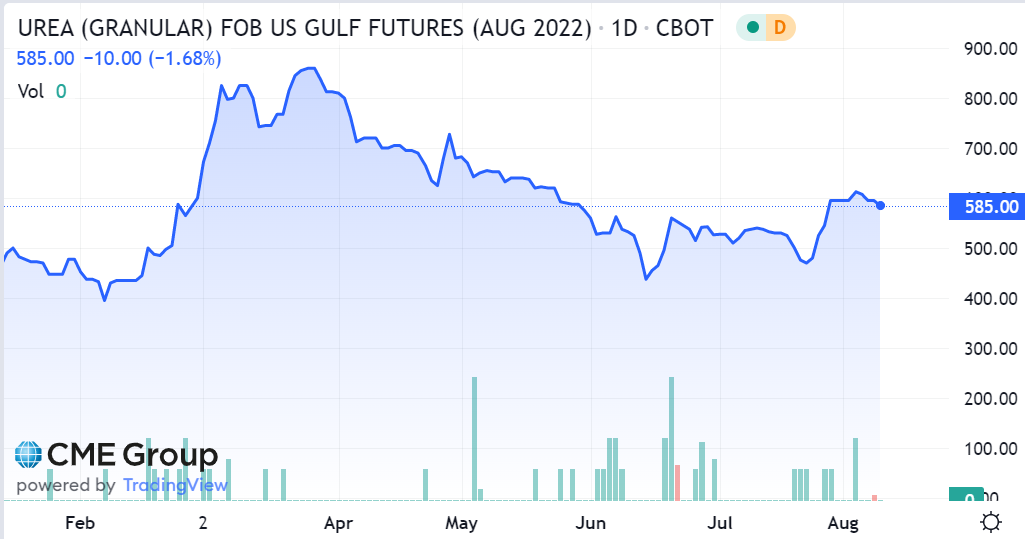

The common financial tool used for tracking US urea prices is the New Orleans (NOLA) Urea price. Prices have been particularly volatile in 2022, with price swings from $400 up to $800+ per ton. Although the NOLA index is a useful tool, its utility has declined due to extreme volatility and supply chain constraints.

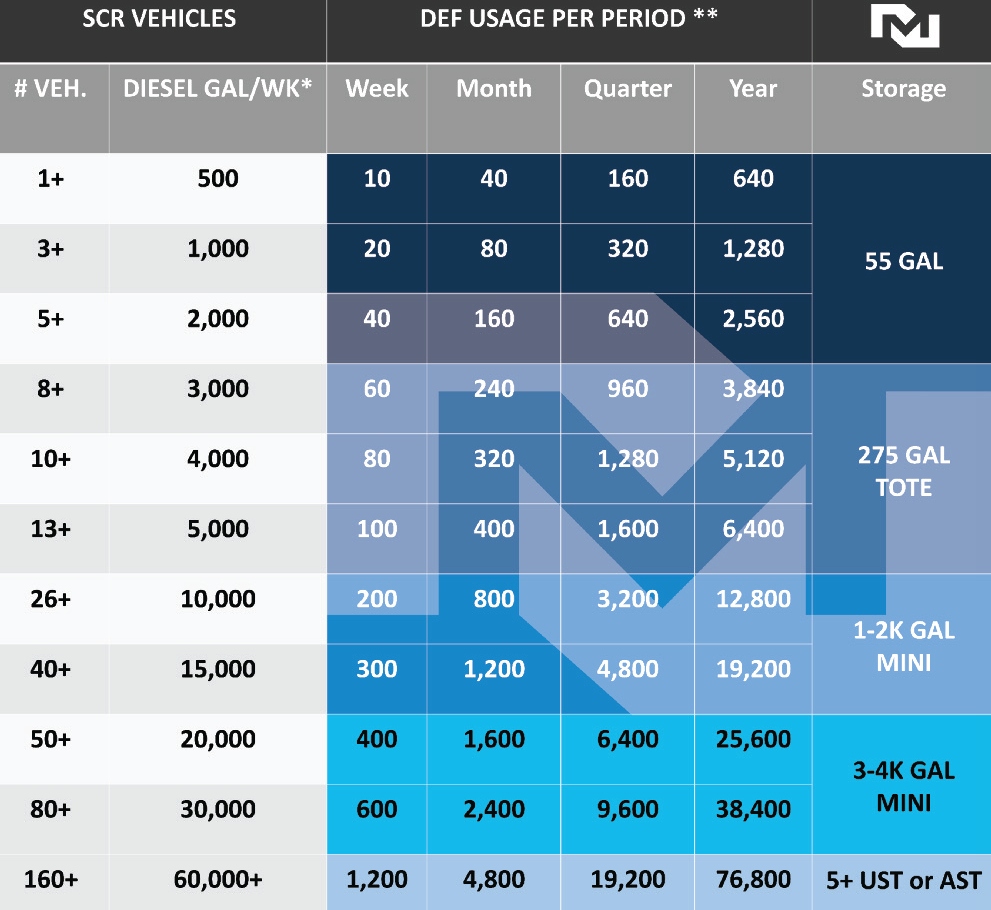

Logistics play a key role in DEF prices. Unlike fuel markets, where savings of 5-10 cents are outstanding, improving DEF logistics can reduce costs by $.50-$1.00 per gallon. Retail purchases of packaged DEF are the least economical buying method. The best way to buy DEF is in bulk, either by 330-gal tote or in equipment installed at your facility. Larger deliveries bring economies of scale, so the bigger the tank,the better. See below for an estimate of how to lower costs with storage.

How Much DEF Should I Use?

You will not need to replenish DEF every time you refill with diesel fuel. The DEF consumption will be approximately 3% of your diesel fuel consumption, so for every 100 gallons of diesel consumed you would need 3 gallons DEF.

DEF consumption is estimated to be roughly 2-3% of fuel consumption for over-the-road vehicles and 3-5% for off-road applications. For every 100 gallons of diesel fuel consumed, DEF consumption will be around 2-5 gallons. Consumption will vary significantly for engines subject to frequent stops and high idle times, such as solid waste trucks or delivery vehicles.

Along with that consumption, though, comes improved fuel quality. Engine manufacturers expect Tier IV (off-road) equipment to improve fuel efficiency by up to 5% compared to non-SCR engines. Newer engines also bring superior engine performance, power, and durability.

What Causes DEF Supply Chain Problems?

Because DEF has many of the same compounds as fertilizers, most DEF producers are primarily agricultural fertilizer companies. These production facilities have required maintenance periods that require shutting down operations, like petroleum refineries. Typically, the planned turn-around time for maintenance is four to six weeks; however, the actual average turn-around can be closer to nine weeks.

These extended turn-around times often cause temporary regional DEF shortages. Suppliers who do not keep sufficient inventories of DEF to weather these disruptive times will be unable to deliver should a local plant be down for maintenance. Pair this with the overall lack of DEF infrastructure in the US, and it becomes critical that companies actively manage the risks associated with DEF supply outages.

Over the past year, urea markets themselves have been heavily constrained. China has limited its export of urea internationally, keeping supply off the market. Because natural gas is necessary to convert ammonia to urea, high energy costs in Europe have contributed to supply shortages as well.

How Do I Store DEF?

As DEF continues penetrating North American fleets, fleet managers are having to adapt their procurement techniques to their needs. What is the optimal way to purchase DEF? There’s no one-size-fits-all standard for DEF storage, but fleets can often adapt general rules of thumb based on the size of their fleet.

Finding the optimal storage size is crucial. Having storage that’s too big or too small poses its own unique risks. Err on the higher side if you must, as DEF has a long shelf-life. While larger storage containers have higher costs, these costs can be covered by the reduced price you’ll pay for DEF.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.