Did Gasoline Prices Really Fall 50 Cents? (It Depends…)

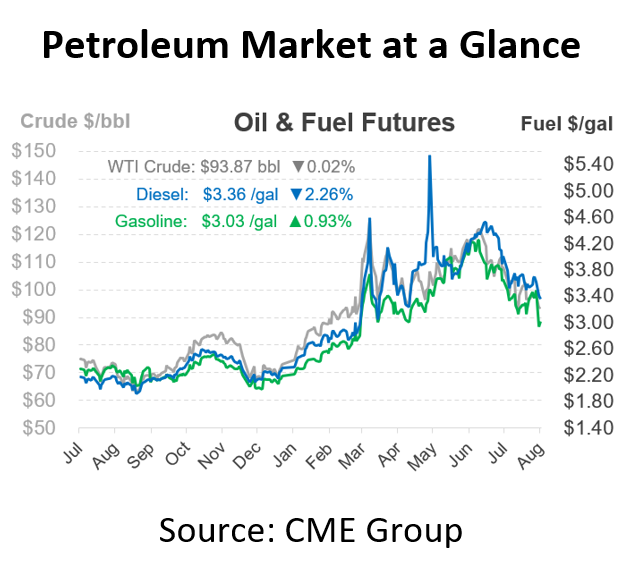

Yesterday saw the entire petroleum complex close significantly lower. Crude oil fell by nearly $5/bbl, and fuel prices saw roughly 10-cent losses. One could say that prices are actually down much more. On Friday, gasoline closed at $3.49 when the August future contract expired; yesterday, the September contract closed at $2.99. That’s a 50-cent drop within a few days, far more than diesel’s 18-cent drop. Of course, those lower prices may not materialize immediately for fuel buyers. Today, let’s unpack why.

To understand the drop, it’s important to clarify what futures contracts are – and what they are not. The oil industry and financial world focus on the NYMEX RBOB Gasoline prompt month contract as the foundation for prices. Every commodity sale involves three components –what, where, and when. For bulk fuel purchases, the answer might look something like: “Gasoline with 10% ethanol is being delivered to my tank tomorrow.” But for a global futures contract, the NYMEX RBOB Gasoline contract means: “Gasoline without ethanol delivered to New York Harbor sometime next month.” On the last trading day of the month (for July, that was last Friday), the upcoming month’s contract expires and rolls to the following month.

After the contract expired on Friday, the contract rolled from August futures to September futures. Markets seemed to expect summer demand to taper off after August, bringing weaker demand in September as the economic downturn unfolds. There’s also a seasonal drop for gasoline prices tied to changing EPA regulations on Sept 15, but that usually doesn’t get priced in until the October contract starts trading.

Although the market was sharply lower yesterday, certain regional markets shouldn’t expect to see quite so much weakness in the short-term. Physical spot gasoline prices (the price of fuel coming out of a refinery) in New York Harbor are still closer to $3.50, even though the future price is lower. That means markets are reflecting tight supply today, but expect much lower prices next month. The problem is confined to the East Coast; Gulf Coast physical prices are $2.80, 20 cents under the NYMEX. Even in California, CARBOB prices (which doesn’t include all the extra West Coast taxes and environmental fees consumers pay) are only 20 cents over the NYMEX.

East Coast prices are extremely high as market conditions tighten. Gasoline inventories along the East Coast are substantially below even the pre-COVID range, and have been lower throughout the summer. As we head into a portion of the year when inventories typically fall, markets fear that refiners will fall further behind, creating extreme tightness in physical supply. For that reason, even though the NYMEX is posting 50-cent declines in fuel prices, the East Coast (especially the Northeast) can expect fuel prices to reman high for the near future.

This article is part of Daily Market News & Insights

Tagged: crude, crude prices, Daily Market News & Insights, demand, fuel prices, gasoline, oil prices

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.