Week in Review – July 29, 2022

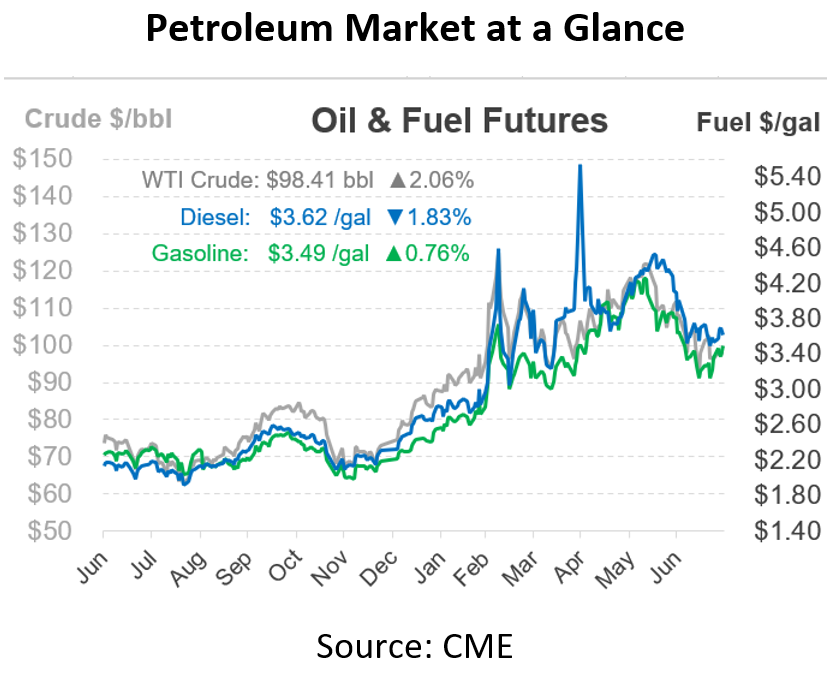

Fuel prices rallied this week, contrasting the gloomy economic news reported. Despite GDP contracting 0.9% in the second quarter, fuel prices are ending the week on a high note. Crude is back above $100/bbl – though just barely – and fuel prices are hitting their highest level in weeks. Particularly on the diesel front, prices are up nearly 30 cents since the beginning of the week, and gasoline has gained 50 cents since last week’s low.

The EIA posted a sharp drop in fuel inventories of all types on Wednesday, which propelled prices upwards. With fuel inventories already tight and the peak of hurricane season fast approaching, markets are concerned there won’t be enough supply to weather a severe refinery outage. Refinery utilization remains high at 92.2%, though that’s down from the 95% seen earlier this summer. Overall, despite a weak economy, fuel markets are tight enough to justify high prices.

Europe’s energy crisis is also weighing on American markets. The spread between Europe’s Brent crude index and the US’s WTI crude index has reached its widest point in years. Previous highs in 2019 were caused by pipeline issues that trapped WTI crude oil domestically, causing a brief oversupply. Generally, the two crude indexes trade within a few dollars of each other, but the spread is now over $10/bbl. That increase opens up and arbitrage for traders, who can ship oil to Europe for a few dollars per barrel and profit off the rest. Analysts expect the gap to close as more US shipments are sent abroad; exports are already at record highs, with further gains expected. Put another way – US consumers will have to pay more to close the gap and keep US oil at home.

Prices in Review

Crude oil opened the week at $95.10, followed by a volatile trading day on Tuesday that saw prices rise near $99/bbl before falling to $94/bbl. From there, markets slowly edged their way higher, with Friday morning bringing a sharp rally above $100/bbl before weakening in the afternoon. Crude oil opened Friday at $97.30, a gain of $2.20 (+2.3%).

Unlike crude, which saw only small gains this week, diesel prices are trading sharply higher. Prices opened at $3.47, moving slowly higher early in the week. On Wednesday, falling inventories caused a share 14 cent increase for the product. Prices peaked Thursday afternoon at 3.80 before retreating a bit. Diesel opened Friday at $3.71, a gain of 24 cents (+6.9%).

Like diesel, gasoline saw some big gains this week. Gasoline began the week at $3.2318, picking up 15 cents before the end of Monday’s trading session. After retreating on Tuesday, prices climbed steadily for the remainder of the week. Gasoline opened at $3.5489 on Friday, up 31.7 cents (+9.8%).

This article is part of Daily Market News & Insights

Tagged: crude, fuel prices, gasoline

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.