Fuel Prices Rise Despite Economic Concerns

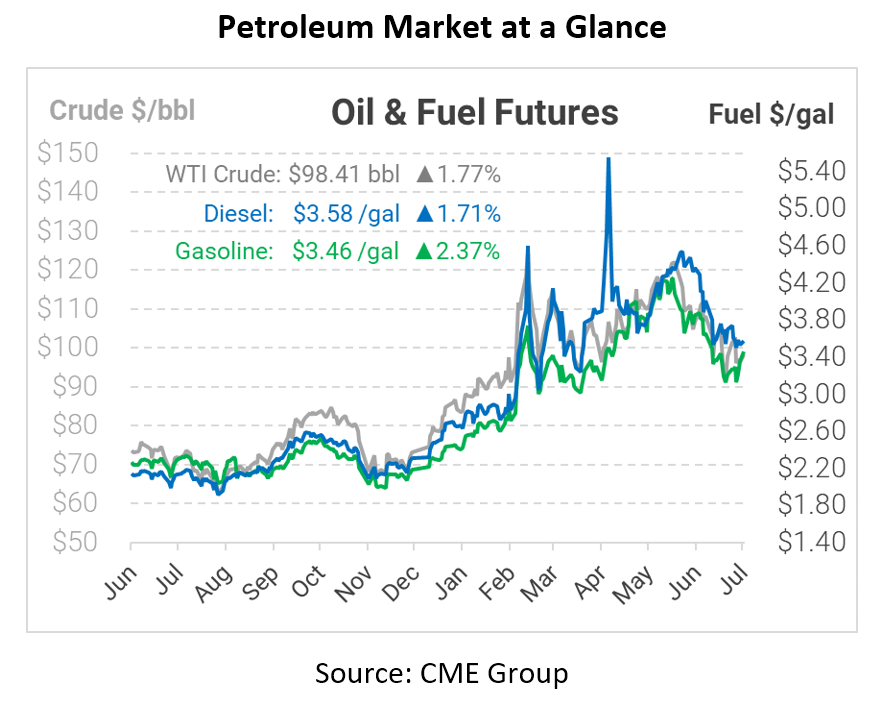

Fuel markets are climbing to their highest levels in a week, undoing losses seen last week. Crude oil is again approaching the $100/bbl threshold, putting fuel prices close to $3.50/gal. Markets expect the Federal Reserve to raise interest rates by 0.75% tomorrow – less than the full 1% increase previously expected but still higher than many other countries. Today’s rally has been buoyed by broader market gains and a US dollar decline, but plenty of concerns remain.

This week, a combination of improved supply and weakening economics could weigh on markets. China reported its quarterly GDP data, which showed stunted 0.4% growth compared to 2021. The stat shows a severe contraction in activity for a country that typically grows 5-6% each year. COVID-19 lockdowns certainly played a role, along with a more general slowdown in activity. The IMF today forecasted 3.2% global growth this year, a sharp downward revision from April’s 3.6% forecast. The agency added that the global economy contracted in Q2 due to China’s COVID restrictions and Russian sanctions.

Adding bearish news, Libya’s National Oil Company (NOC) has reportedly increased its production above 1 million barrels per day, up from half that just a few weeks ago. The country formed an agreement between protesters and regional leaders to restart closed facilities, enabling more output. The nation has faced significant instability over the past few years, so markets should take the added production with a grain of salt.

On the bullish side, sanctions on Russia continue tightening global oil markets. Russian exports are down 480 kbpd from June, and even China and India have reduced purchases. The US is pushing for a price cap on Russian oil, allowing countries to buy Russian crude only if sold below a certain level. The cap would allow Russian oil to continue flowing without funding Putin’s war machine. The plan faces two challenges: getting Russia to sell at low costs and enforcing the cap among other countries. If Russia balks and shuts off supply, global prices could rise. On the other hand, poor enforcement could mean that China and India buy oil at whatever Russia will sell for, perpetuating the status quo. Depending on which case becomes a reality, we could face extremely tight markets or more of the same over the next few months.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.