Gasoline Dominates Headlines, but Diesel Is the Real Challenge

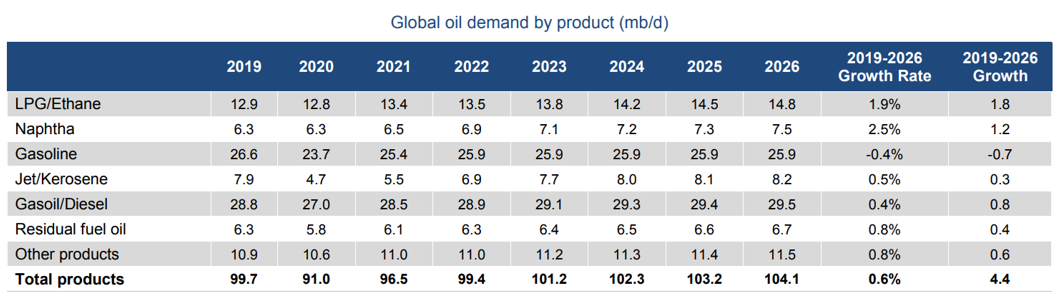

It’s common for the mainstream media to comment on gasoline prices – something which impacts most consumers every day. But if you live outside the US and Canada, diesel might be the product you’d use more often. In the US, gasoline demand tends to be 2-2.5x higher than diesel demand; in the EU, diesel demand is 3x higher than gasoline demand. Worldwide, diesel tends to have a slight edge over gasoline, a trend which the IEA forecasts to continue for the next several years.

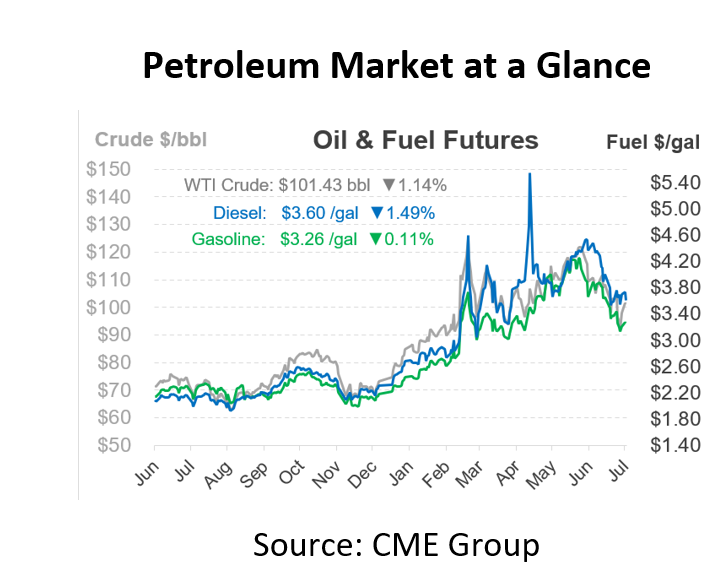

If you work in transportation or other fuel-intensive industries, diesel supplies and prices may be a common topic. If not, your focus may be on gasoline. Right now, however, diesel is becoming increasingly important no matter what end of the barrel you consume.

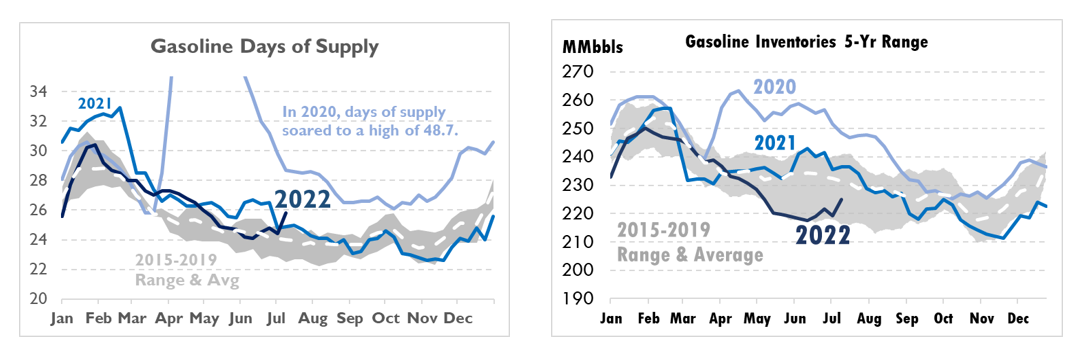

With refiners around the world maximizing their limited output, fuel supplies are beginning to improve. But diesel inventories are lagging far behind gasoline. Low gasoline demand has caused days of supply to improve significantly, pushing levels above the pre-COVID average and 2021 seasonal levels. Inventories aren’t quite back to the pre-COVID level, but they’re getting close.

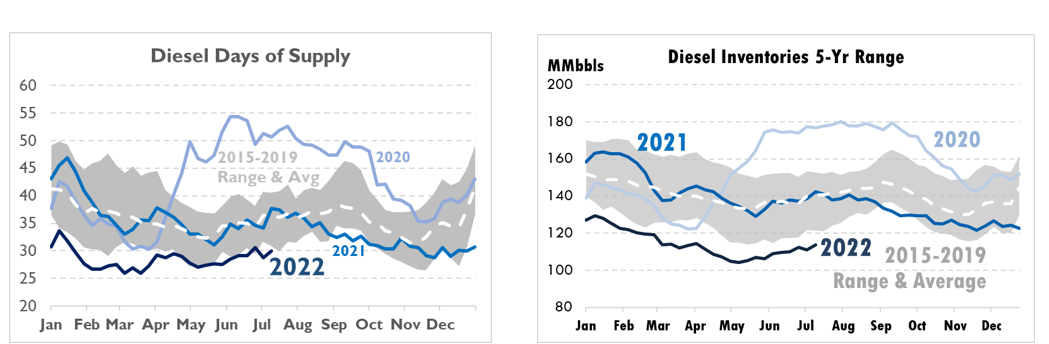

While gasoline supplies are improving, diesel remains far behind pre-COVID levels. Although stocks were close to the average last year, strong demand and increasing exports worldwide have drained US inventories. Days of supply remains below the pre-COVID range, and inventories are almost 30 million barrels below the average.

Tight diesel supplies will ripple throughout the petroleum supply chain, becoming the main driver of high fuel prices. Refiners will try to catch up – creating plenty of gasoline as a by-product – but will struggle with finding enough capacity. European consumers will pay the highest price, since they consume so much diesel for personal consumption. US and Canadian consumers will see fewer challenges, but domestic transportation companies will be competing for tight diesel supplies. For buyers everywhere, tight diesel markets will keep upward pressure on all energy costs, impacting both energy prices and the price of goods transported by ship, plane, train, and truck.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.