Natural Gas News- June 30, 2022

Germany Hopes to Import LNG from Canada to Speed Transition Away from Russian fuel

German Chancellor Olaf Scholz used a meeting with Canadian Prime

Minister Justin Trudeau to push for closer energy ties as his ruling

coalition in Berlin races to find alternatives to Russian fossil

fuels.Germany hopes to import liquefied natural gas from Canada to

help replace the Russian gas it still relies on for more than a third of its

imports, down from about half before the invasion of Ukraine. Germany

and Canada have been discussing options for an LNG terminal on

Canada’s east coast to export to Europe, German officials said. Meeting

Monday on the sidelines of the Group of Seven summit in Bavaria,

Scholz and Trudeau discussed how to maintain pressure on President

Vladimir Putin and cut reliance on Russia for energy. “The two countries

will cooperate even better than they already do,” Scholz said, standing …

For more info go to https://bit.ly/3a3kF4r

U.S. Natgas Down 7%; Freeport LNG Outage Leaves More Fuel for Storage

U.S. natural gas futures dropped about 7% on Thursday to a 12-week

low, as the shutdown of Freeport’s liquefied natural gas (LNG) export

plant in Texas allowed utilities to stockpile more fuel than expected even

as hotter weather had generators burning more gas to keep air

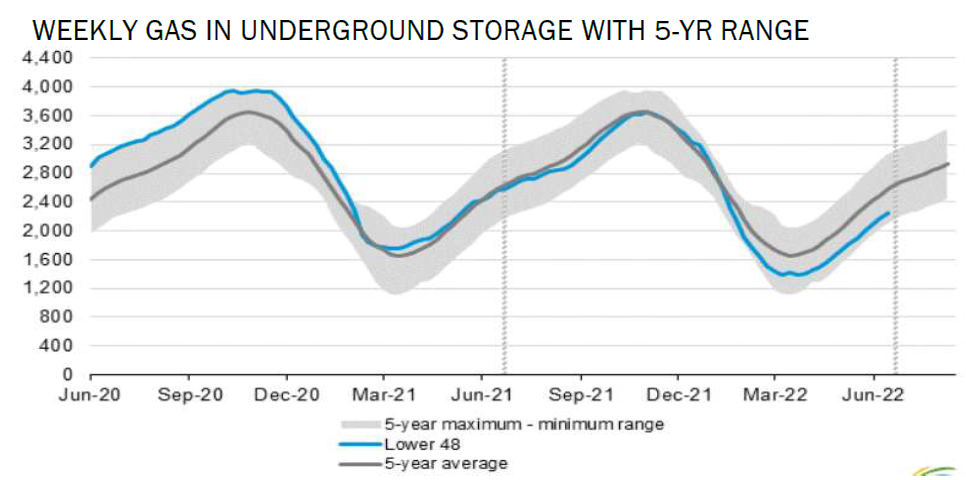

conditioners humming. The U.S. Energy Information Administration (EIA)

said utilities added 82 billion cubic feet (bcf) of gas to storage during the

week ended June 24, exceeding the 74-bcf build analysts forecast in a

Reuters poll and increases of 73 bcf in the same week last year and a

five-year (2017-2021) average increase of 73 bcf. Last week’s build

boosted stockpiles to 2.251 trillion cubic feet (tcf), or 12.5% below the

five-year average of 2.573 tcf for this time of the year. Freeport, the

second-biggest U.S. LN… For more info go to https://bit.ly/3a3kF4r

In The Midst Of Recession, How A Hot Summer May Impact Commodities

In a recent interview on Bloomberg TV (see here), I painted a longer-term

bearish view in commodities. In fact, I began becoming concerned three

weeks ago about the potential wash-out in cotton, grains, natural gas

and other commodities; even Bitcoin (BTC-USD). Why? A flight to safety

by investors who I expected would “cash in” on profits in many markets.

This has indeed already happened, and now potential weather problems

are beginning to help some commodities like natural gas (UNG) and

soybeans (SOYB) rally back. My concerns about how a potential global

recession could have on commodities are featured in my latest issue of

Climatelligence. Natural gas prices bottoming on upcoming big-time

heat. One of the most volatile and difficult commodities to trade for

months has been natural gas. Following a stellar 100% p… For more info

go to https://bit.ly/3a3kF4r

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.