How “Historic” Are Current Diesel Prices?

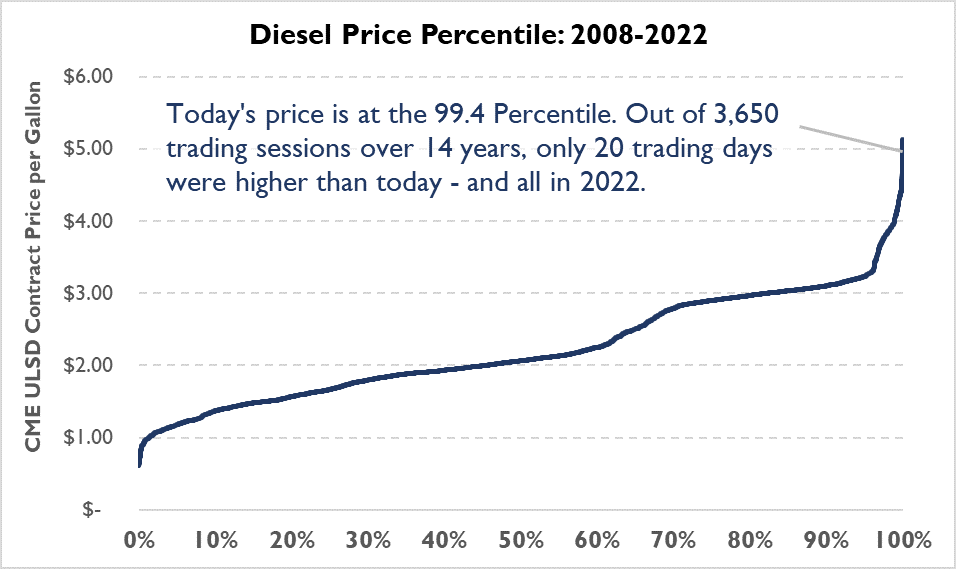

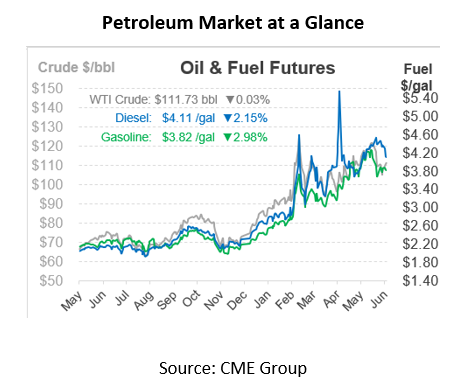

Diesel prices closed at their lowest point since June 1 yesterday, ending the day at $4.19. Just a few weeks ago, the CME diesel futures contract was trading more than 35 cents higher, so the decline provides a bit of relief from record-high prices. So how does today’s price stack up against historical prices?

Before 2022, the previous record high price for diesel futures prices was $4.10, set in July 2008 just before the astounding market crash and Great Recession. This year, prices have closed above that level on 30 different occasions. The new record high, set on April 28, is $5.13. So today’s price – although still above the previous all-time record- is almost a dollar below the most recent record.

But wait! To get a real understanding of historical prices, one must adjust for inflation. In current dollars, that $4.10 record set in 2008 is closer to $5.57 – 8% higher than the 2022 record of $5.13. While current prices are extremely high, and still at the 98th-99th percentile, they’re not quite at unprecedented levels. Still, with hurricane season approaching and refiners delaying maintenance, it’s quite possible we’ll see a perfect storm (no pun intended) that dampens US refining output and causes fuel prices to soar above the record. With zero slack in the supply chain, even a small refinery upset could trickle through global fuel prices. So be prepared – have an emergency fuel plan and a price risk management policy in place now to avoid crushingly high prices in the future.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.