RBOB Contract Hits Record High Despite Recession Fears

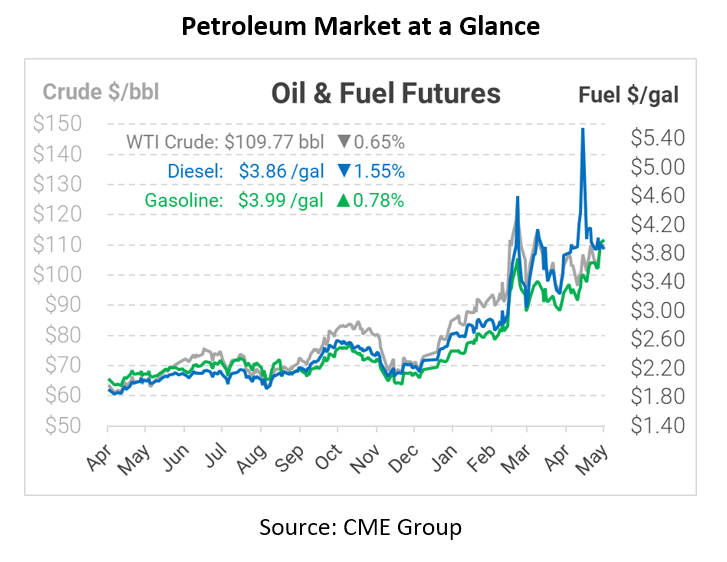

Last week ended with a huge increase in gasoline prices, propelling the lighter hydrocarbon above diesel fuel costs for the first time since September 2021. Typically, gasoline prices climb in April as summer gasoline formulations become required, but diesel prices have been so elevated that gasoline’s gains have seemed meager by comparison. With US gasoline demand ramping up for the summer, though, it seems yet another supply crunch could be on the way. RBOB contracts briefly traded above $4/gal this morning for the first time in history.

This morning crude oil is trading down as fears of a global recession cloud the market. Chinese lockdowns in major cities continue to hurt the Chinese economy and put a staggering halt to fuel demand in the area. Today crude oil was down $0.72, diesel was down $0.0609, and gasoline was up $0.0308. China, the world’s second-largest economy, is hurting badly. Energy is taking a hit in the region as well as shopping, factory output, and much more.

As 46 cities in China continue to be on strict lockdown, many citizens say that the government is censoring the “harsh” and “inhumane” conditions of being locked into their homes with nowhere to go. Last month retail sales fell 11% from the year prior, and factory production fell 2.9%. Similar to retail sales, an astonishing 11% less crude oil was processed by the Chinese in April, the lowest since the peak of COVID-19 in March 2020. Some good news coming from the lockdown is that according to city officials, Shanghai wants to reopen the city by June 1. If this were to happen, energy demand would be lifted as 26 million people would once again be able to travel freely.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.