Russian Crude Ban – EU Spills More Details

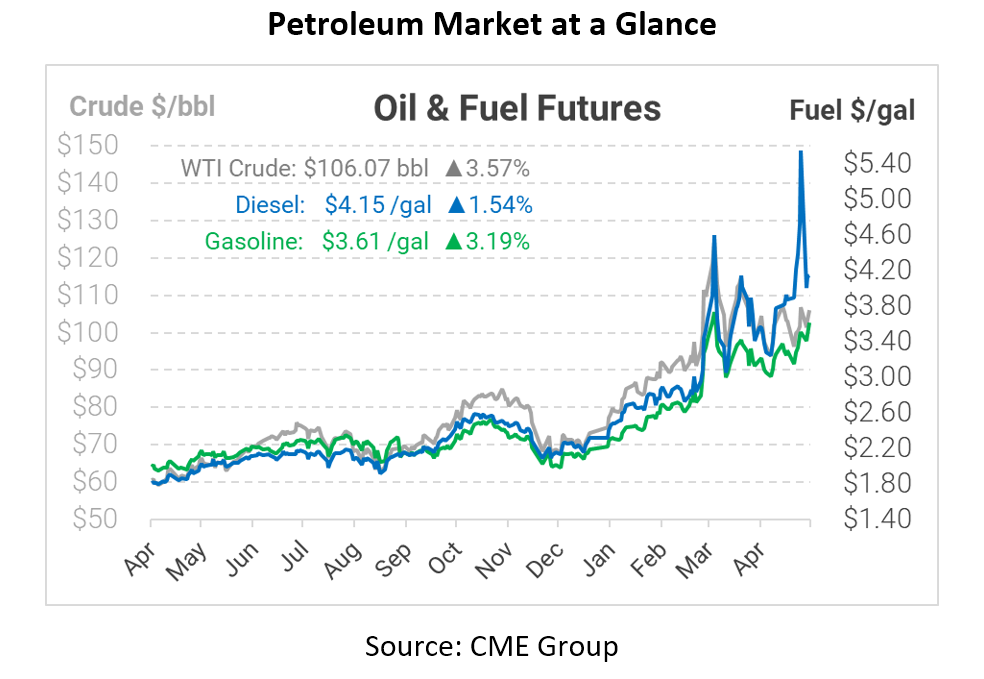

On Monday we talked about the possibility of the EU banning Russian crude altogether in response to the ongoing conflict in Ukraine. You can find that article here. Now, more details are emerging about this new ban on Russian product, sending prices upwards of +4% today.

Today the president of the European Commission laid out what will be a phased oil embargo on Russia. But that will not be all. The EU is also committed to sanctioning Russia’s top central bank in order to further isolate the country for the crimes they have committed over the past few months, specifically the executions of civilians taking place in small towns in Ukraine. One positive that traders will take away from this is that the crude ban does not go into effect for another six months. This transition time will smooth the change for a region that relies so heavily on Russia for their crude and natural gas imports. While there will be some worries from EU countries about isolating Russian energy goods, the president of the European Commission has pledged to help minimize the hardships that some countries may face in the wake of this decision.

The situation in Russia has not gotten any better in the past few weeks. This week, Russian forces stormed the last steel mill in Mariupol that was harboring resistance fighters. The new EU bans are intended to provide an insurmountable obstacle for Russian President Putin by cutting off oil customers and hindering its central bank, so time will tell if this latest round of sanctions will force Putin’s hand.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.