Are Retail Fuel Prices “Stuck”?

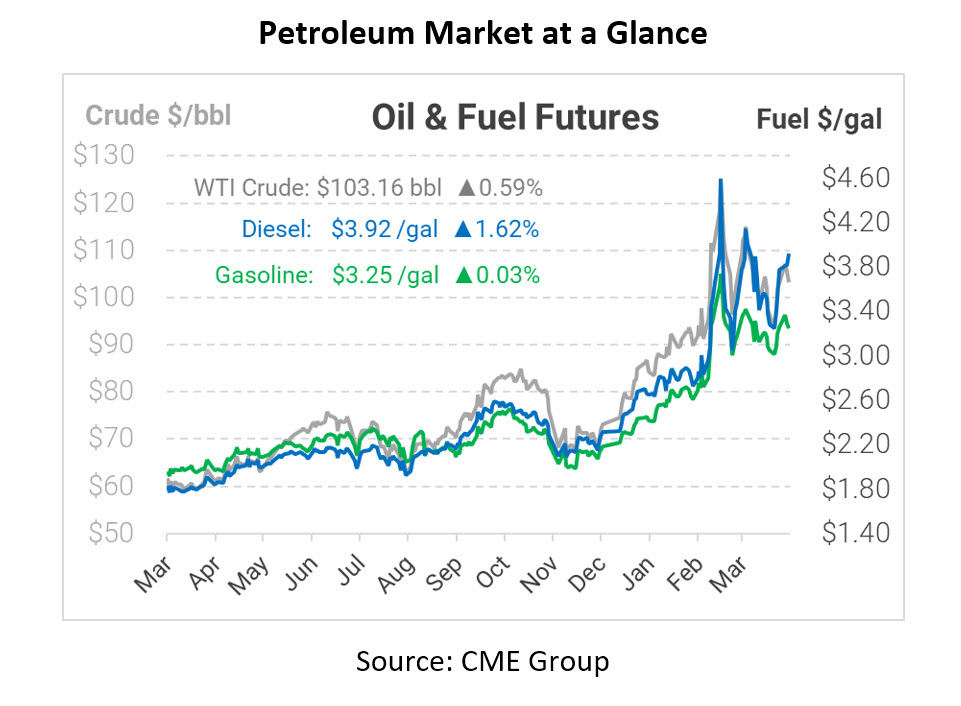

Over the past few weeks, oil markets have seen high volatility – a factor that makes it difficult to keep up with all the changes. Crude oil prices fell below $100/bbl last week, only to springboard once again this week. At the retail level, though, the volatility has felt more like a persistent, nagging high. So are retail prices stuck too high, or are they merely smoothing out the underlying volatility at the wholesale level?

According to AAA, the national average of regular unleaded gasoline today is $4.114. The value has hovered above the $4/gallon mark for some time now. Last week we saw WTI crude oil drop below $95/bbl briefly, marking the lowest price since February. While some saw gas stations posting prices around $3.50 during that time, today we are again reading signs of gasoline as high as $5/gallon in some states.

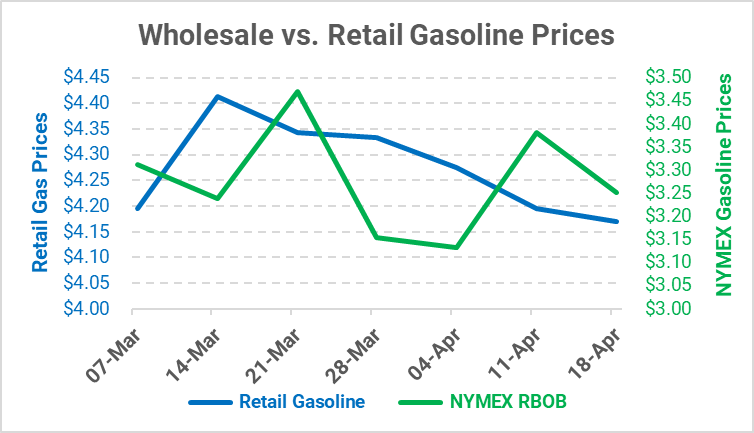

Although retail prices feel “stuck” at a level that’s too high, when you put the volatile NYMEX prices and retail prices side-by-side, you can see that both have been moving roughly in lock-step. NYMEX gasoline prices peaked at around $3.45 in mid-March, fell close to $3.10, and are currently around $3.25. Retail prices similarly peaked at $4.40 but have gently fallen to the current $4.15 level. While wholesale buyers have enjoyed more time at lower prices, they’ve also seen more volatility. Conversely, retail fuel stations are hesitant to jerk prices around so much since it alienates customers; they’ve kept price changes to a minimum while following the broader trend.

Typically, when wholesale prices fall, retail prices are slow to follow. This phenomenon, sometimes called “sticky pump”, causes rack-to-retail spreads to expand – increasing the value of buying fuel in bulk while making fleet card purchases more expensive. With so much attention on gas prices right now, though, it seems retail stations are being careful to track the market.

So why do prices feel like they’re so stubbornly high? Supply is limited, and last week’s crude stock inventory fell by 8 million barrels (according to the Energy Information Administration). With inventory levels continuing to drop and not enough product being pumped out to meet the freshly arrived summer demand window, it’s no surprise that prices are still above $3/gal at the wholesale level and $4 at the retail level.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.