Russian Aggression Spurs 3-Wk High, Possible New Sanctions

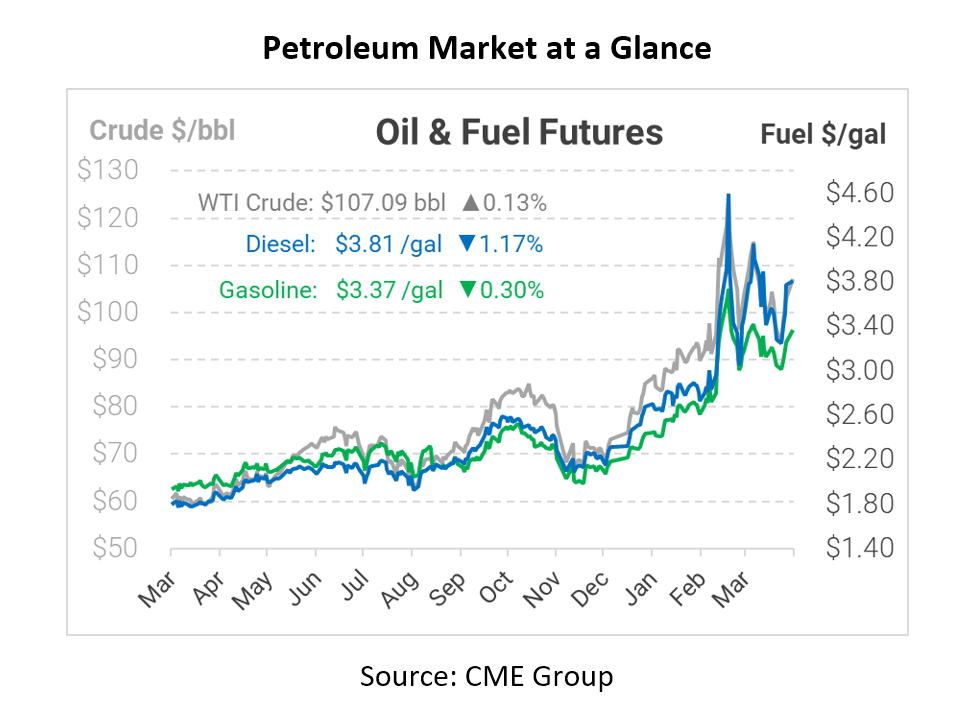

This morning, crude oil prices climbed near 3-week highs as global supply fears grow. The crisis in Ukraine continues to worsen, increasing the risk of additional Western sanctions on Russian oil. WTI crude opened at $107.03, diesel at $3.8570, and gasoline at $3.3922.

Before the Easter weekend, futures contracts gained around 2.5% when the European Union reported drafting plans to sanction even more Russian energy exports. While many were on board with new penalties, Germany opposed a complete embargo on Russia. “New” sanction ideas came swiftly after Russian forces all but completely seized the city of Mariupol amidst heavy casualties. With demand picking up worldwide as summer rolls around, a deepening Ukrainian conflict does not bode well for supply.

The International Energy Agency (IEA) warned that there could be around a 3 MMbpd loss of Russian oil from May through the end of the summer – though Saudi Arabia and other OPEC members have protested that number as misleadingly high. As Russian oil output continues to slide, the oil and gas market will likely stay bullish this week. Additional supply is limited, but US producers are slowly beginning to help balance out the embargoed Russian supply. Higher prices continue to hit consumers as they fill up their vehicles. Some companies, such as Uber, are even charging a temporary fuel surcharge to help their drivers manage the situation.

Although markets are tight, there are some glimmers of optimism. After plummeting to decade lows, diesel days of supply – representing total inventories divided by daily demand – has climbed higher over the past few weeks. Days of supply fell to around 26 days in March, the lowest level since 2008, but is now closer to 29 days of supply. Although still historically low, the trends are moving the right way – and with refiners using over 90% of their total capacity to produce gasoline and diesel, supplies should continue to improve gradually. Still, even a minor disruption could send prices soaring higher, so it’s important for companies to have a solid plan in place to mitigate the effect of higher prices.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.