More Countries Join Global Petroleum Release

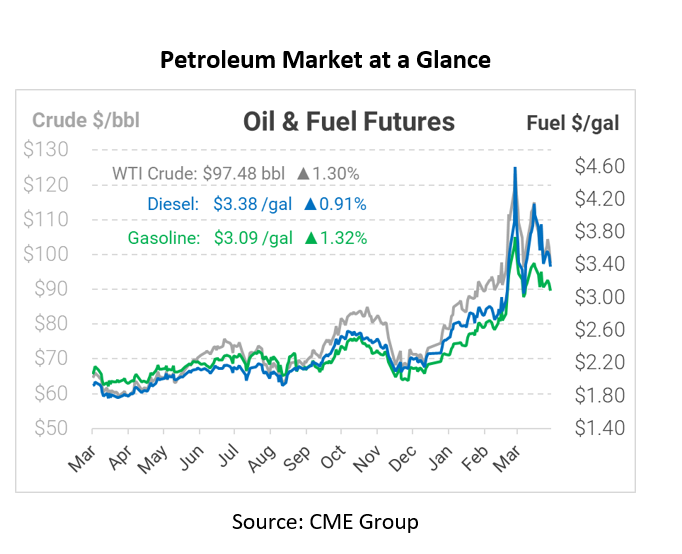

Oil is trading lower today as news of new countries joining with the United States in a massive strategic oil release is taking pressure off markets. Along with the United States, the International Energy Agency countries, including Japan, have joined in the fight to stop the rise of oil prices globally, in hopes that their efforts will make a positive impact. Collectively, the IEA has announced 120 million barrels so far, half of which is comprised of the 60 million barrels committed earlier by the US.

With supplies already tight globally, the new release announced Wednesday will hopefully clear some of the clouds surrounding the energy market. The US has more than doubled planned releases with Biden’s announcement of selling 180 million barrels. The 31 countries represented by the IEA decided on this release yesterday, making it the second coordinated release in one month and fifth all-time in the agency’s history. While the timing of when the releases will start to take place per country is still unknown, many are expecting these governments to make the announcement within the week.

Out of the past three releases between the United States and the IEA, the US has provided around half of the total volume. Japan’s cuts will be the second-largest contribution, totaling 15 million barrels from various state and private reserves within the country. As of January, Japan held 470 million barrels in reserve, compared to America’s 560 million barrels currently in reserve.

Fundamentally, the releases will have a short-term effect. Selling inventory increases supply availability today, but the SPR must be refilled in the future when conditions improve. Goldman Sachs has increased its 2023 outlook, noting that supply will remain structurally short while governments will increase demand as they refill stocks. But for the short-term outlook, any and all help that the United States and the IEA are receiving is sure to make people happier at the pump for the next few months until a more permanent solution can be reached, such as Iranian sanctions being lifted or OPEC increasing supply.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.