Sanctions, Sanctions, And More Sanctions

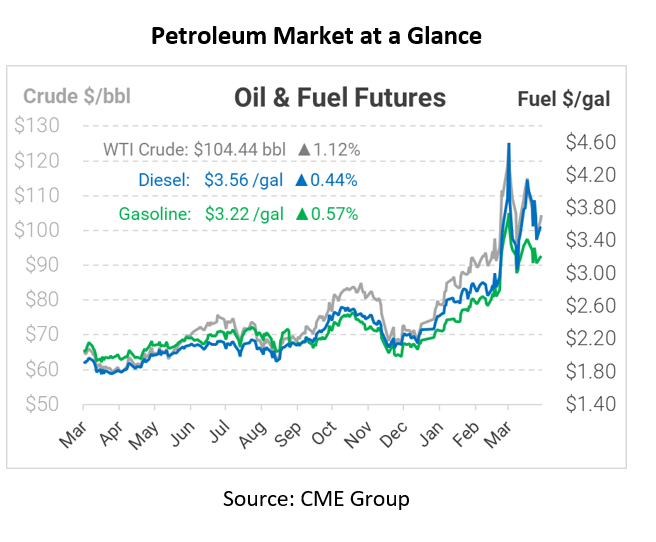

After world leaders such as Biden and French President Macron have called Putin and the Russians “war criminals” for their crimes in Ukraine, more sanctions are now on the way. Markets are reacting this morning by elevating slightly due to concerns that new United States and European sanctions will make supply even tighter, leading to uncertainty about what will happen next.

At first sanctions on Russia were diverse, but now governments are thinking about how they can target Russian energy more effectively. The EU is planning to ban Russian coal, tightening the squeeze and moving closer to Russia’s oil & gas industry. According to reports, the Russian government is expected to bring in around $9.6B in revenue from energy sales in April.

Lawmakers want to cut Russia off further but have to do so without severely impacting their own economies. French President Macron has backed a full ban on Russia’s coal and oil industry, while Germany has voiced concerns that natural gas bans would send their economy into a recession. The US is also tightening restrictions on Russia’s ability to use US reserves to pay sovereign debt. While the finance ministry in Russia will not disclose just how much money they have lost due to sanctions, it is expected that the number is quite high.

Increasing sanctions are a response to new atrocities seen in Bucha, a suburb of Kyiv. So far, sanctions have failed to deter Russian aggression, forcing western countries to search for ways to increase the pain without harming their own economies. For oil markets, this means that sanctions are not over and will not be any time soon, so markets will remain tight for the foreseeable future.

This article is part of Daily Market News & Insights

Tagged: Kyiv, Russia, sanctions, Ukraine, war criminals

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.