Putin Warns of Possible Ruble Export Pricing

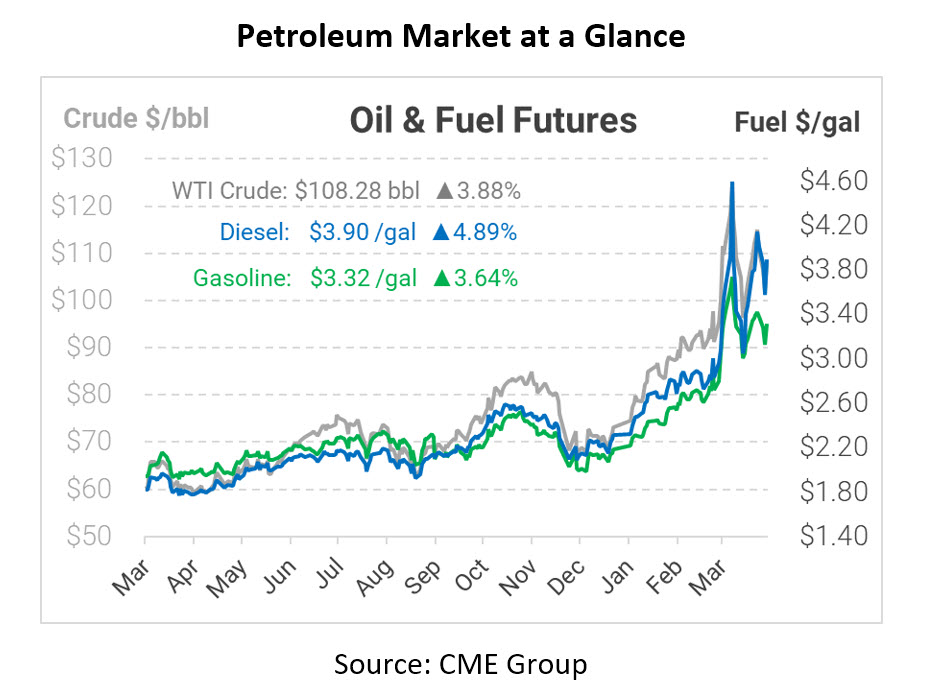

Prices are up this morning following the continued bombing of Ukrainian cities, despite Russia’s pledge this week to pull back from the city of Kyiv and increase mutual trust between itself and Ukraine. Russia continues facing economic hardship due to strict sanctions imposed by NATO countries. Now, in an attempt to make business painful for the West, Vladimir Putin has warned that all oil and gas exports going forward could be priced in rubles.

Reports this week have shown that Russia is facing the greatest economic crisis since 1991 and the fall of the Soviet Union. On March 23, Putin announced that all gas exports to “unfriendly countries” must be purchased in rubles, but he has now threatened to extend that decision to include all energy and commodity exports after his top law makers urged him to do so. By forcing countries to purchase rubles to buy gas, the move supports Russia’s cratering currency and will slightly reduce the pain of western sanctions.

The move is a signal to western countries that Russia is committed to its approach and is looking for ways to undermine sanctions. Importers in Europe have noted that since contracts are denominated in dollars and euros, the requirement is a contract breach. Germany, Europe’s largest economy, sent an early warning sign out that they may be headed for a supply emergency. Germany currently imports the majority of its energy products from Russia, with 55% of its natural gas imported from Russia just last year.

According to Russian officials, this movement to change pricing to the ruble would be “in our interests and the interests of our partners.” As of now, it’s unclear how western institutions will acquire the rubles, adding complexity to supply chains. Deals will have to occur with non-sanctioned Russian banks, which may be hesitant to accept dollars and euros in exchange due to sanctions. Russia has said this would be a “gradual shift” in order to ease the transition.

For many years the Russian government has tried to lessen the reliance on the U.S. dollar and other currencies, and it seems that now they will try to move toward this goal once and for all. US consumers benefit from “dollar hegemony”, which gives the US a kickback to the dollar every time a barrel of oil is purchased. Nearly all oil is priced in dollars, giving US firms (who naturally hold mostly dollars) more stability and control. Should the USD’s hegemony subside, US consumers could end up paying more at the pump, since the change would introduce currency risk and exchange rates on top of other normal market factors. The immediate and long-term impacts of this decision by Putin are yet to be seen, but energy markets will likely see some volatility should the transition of payments be made official.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.