Week in Review – March 25, 2022

Headlines this week included the European Union considering a Russian oil ban, possible gas price stimulus checks on the way for Americans, the potential for a global diesel shortage, and western leaders meeting over the Ukraine crisis. In an attempt to further isolate Russia from the world, President Biden and EU nation leaders met this week to solidify their response to Ukraine. Ukraine’s deputy prime minister Iryna Vershchuk said there would be no surrender in the city of Mariupol, in turn putting more pressure on the EU to do something. The seaport, under siege since the beginning of the invasion, has a population of around 400,000 that are now in constant fear of being killed by Russian bombardments.

Three separate meetings of NATO, the EU, and the G7 revolved heavily around Russian sanctions, military aid, and additional pressure that could be applied. Along with NATO leaders, President Biden met in Brussels for emergency talks regarding Russia. Several European countries have vocally opposed broader energy sanctions, given the harsh economic impact on their economies. Countless European countries are heavily reliant on Russian energy products, and energy sanctions would not help the issue of rising prices around the world. Some leaders have suggested the possible complete oil embargo on Russia, but European countries such as Germany are heavily opposed.

On Tuesday, the world’s top energy traders warned that the world could see massive gas and diesel shortages due to the long-lasting effects of Russian sanctions. Executives making up the four largest energy traders in the world in Vitol, Gunvor, Mercuria, and Trafigura said that the natural gas market has become tough to manage due to margin calls. Given extreme volatility, traders are being required to post far more margin to trade oil – functionally meaning it costs more to play in the oil trading game. The changes are chewing through companies’ capital, putting financial stress on traders and speculators. Time will tell about what will happen, but it should not be expected that an immediate change will occur in the market.

Lastly, could gas price stimulus checks be on the way? According to many analysts, the answer could be yes. This week the House Democrats have introduced a series of three new bill proposals that would send direct payments to American citizens to help them deal with the rising price of gasoline. While the average of gasoline was much higher just a few weeks ago, the nation is still learning how to deal with these prices as many have begun traveling back and forth to work and vacation. Some are considering these new gas stimulus proposals similar to the one Americans saw last year when $1,400 checks were mailed out to help those during the COVID-19 pandemic. These ideas proposed by members of Congress would undoubtedly help Americans feel better moving forward, but nothing will get done unless a funding agreement can be reached.

Prices in Review

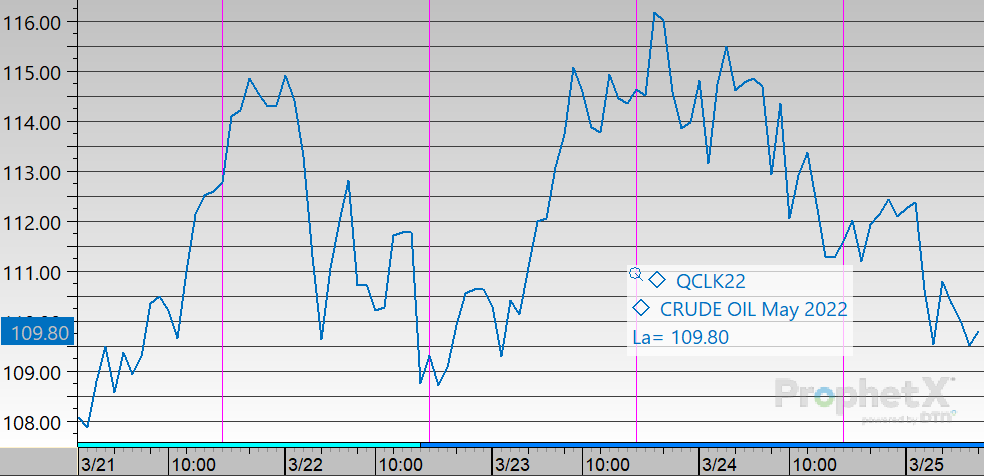

WTI Crude opened the week at $105.13. Prices were extremely volatile this week, spiking on Tuesday for the high of the week and then retreating again. Crude opened Friday at $111.75, an increase of $6.62 from Monday.

Diesel opened the week at $3.5920. Diesel was similar to crude, showing volatile trends throughout the week. Today diesel opened at $4.1550, an increase of $0.563 from Monday.

Gasoline opened the week at $3.2475. Prices started off lower at the start of the week, before picking up more volatile trends. Gasoline opened today at $3.3626, an increase of $0.1151 from Monday’s opening price.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.