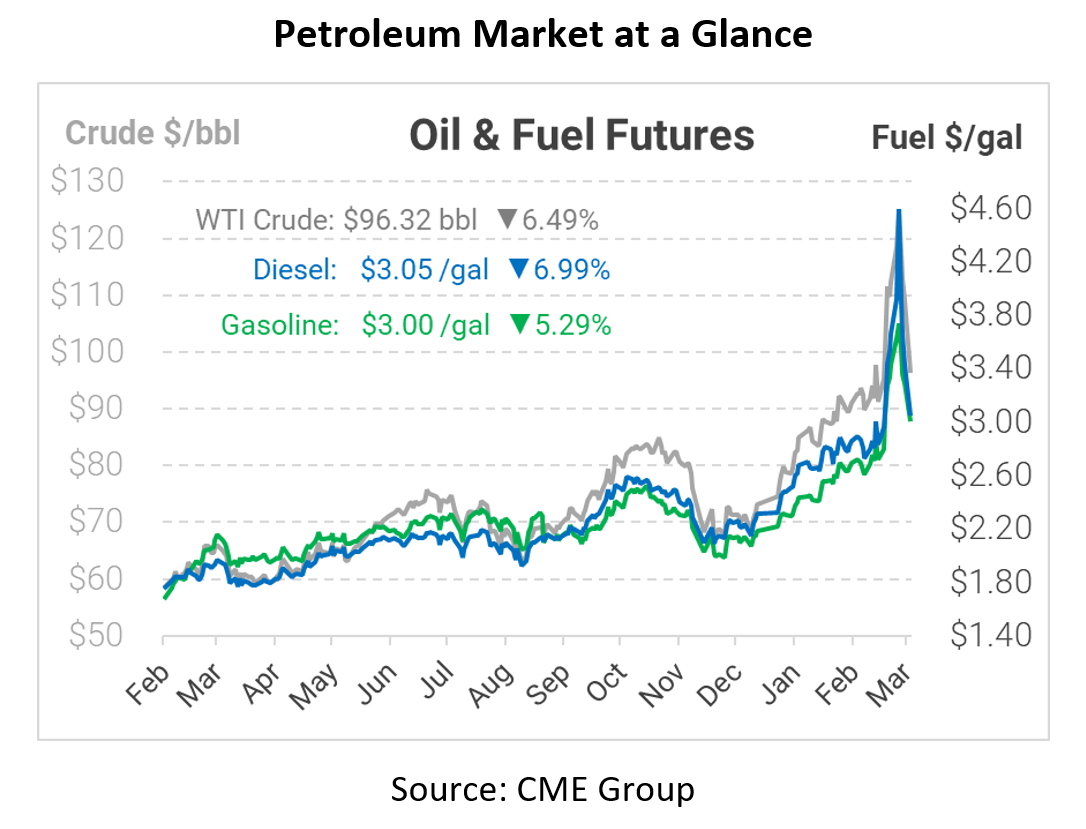

Good News for Gas Prices? Oil Falls Below $100

Oil prices are down following a swift pullback from the $120+ mark consumers saw last week. Specifically, this morning WTI crude is down to $96.32, with diesel and gasoline unwinding by 15-20 cents. Because of this massive price movement, the question now is whether we will see price pullbacks at the gas stations.

Often, retail prices are slow to react to changing market conditions. Retail fuel stations can keep prices higher even as wholesale fuel prices plummet, a phenomenon called “sticky pump” that we’ve covered before in FUELSNews. We can see this today– although wholesale fuel prices have fallen by 60-90 cents, the national average retail gasoline price recorded by AAA is $4.316, with prices relatively unchanged since Friday, which is a good indicator of leveling out. To stay up to date on AAA’s gas prices, click here. Sticky pump is a natural reaction based on how some retail companies set prices – as prices skyrocket, those same companies are also slower to pass on higher costs, to avoid losing market share to competitor stations. Those companies make less as prices rise, and recoup that margin as prices fall.

Today is the first time since March 1 that oil has dropped below the $100/bbl mark. Now that consumers see numbers in the $90-$97 range, they want to know if they will immediately feel relief for their wallets when filling up vehicles. The answer is: while it may not be as immediate as you want, prices will start to change at the pump. Analysts suggest that if crude prices hold around the $90’s that we will start to see around a 20-cent decrease per gallon. Prices would still be elevated compared to pre-invasion levels, but they would not be hovering around the record high numbers that emerged with the Russian invasion of Ukraine.

A 20-cent decrease per gallon at gas stations would be nice, but it may not last for long. With spring and summer quickly racing toward us and demand recovering, we may see prices climb back to the $4.50 level. Whether we see long-lasting relief at the pump or price spikes over the next few months, we will have to ride it out. These high prices don’t last forever; now, we play the waiting game.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.