Recap: What Happened This Week? And What Happens Next?

As we close the second full week since Russia invaded Ukraine, it’s worth looking back at all of the impacts the invasion has had. Of course, any lookback would be incomplete without considering the tragic loss of life and human suffering caused by the attack; our hearts are with the families who have lost loved ones and been displaced from their homes. The past week has been a roller coaster for markets, moving up and down in historic swings.

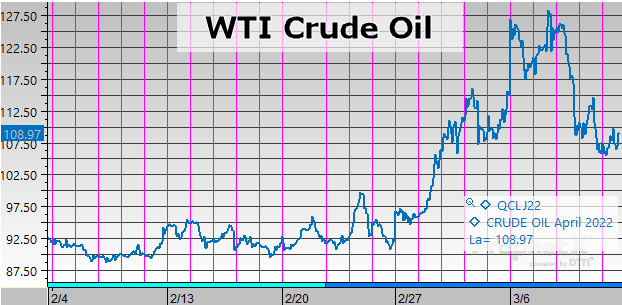

With oil far below its mid-week peaks, the burning question is whether the worst is behind us. Assuming that the Russia-Ukraine conflict continues for the next several months, prices may get worse before they get better. Markets shot higher because traders feared a complete shutdown of Russian oil exports, but now they’re pricing in at least some possibility of the conflict ending sooner. Prolonged sanctions will slowly drain Russia’s economy, cratering its long-term oil production capabilities. Put another way – the longer this conflict continues, the higher the risk that Russia will never be able to restore all of its oil production, creating a long-term supply crunch.

Is it possible to avoid this outcome? Of course. Putin could capitulate and withdraw, or Ukraine could accept their terms and end the conflict immediately. Neither scenario seems likely, but they’re both possible. The damage to Russia’s economy so far is based on sentiments, not law – traders are choosing to avoid Russian oil even though it’s not sanctioned. Lifting sanctions would allow those traders to resume buying cheap Russian oil with a clean(er) conscience. If the conflict ended tomorrow, oil would return to normal in relatively short order; that won’t be true if this conflict lasts many months.

Prices This Week

Crude oil was propelled to over $125 per barrel, starting rumors that crude could continue to its 2008 peak of $145 ($189 in inflation-adjusted dollars). Although Russia’s invasion has continued unabated and sanctions have not been removed, oil saw a massive sell-off on Wednesday morning on a single headline hinting that Ukraine may be willing to accept some of Russia’s terms. Crude oil crashed by $15 within a few hours. Since then, price swings of $2-$3 per day have felt relatively tame.

Diesel is the commodity that everyone is talking about. ULSD contracts hit a record high above $4.60 this week, far surpassing the 2008 record of $3.90 (though not the inflation-adjusted record, which is over $5/gal). While crude fell $15/bbl (roughly 35 cents per gallon), diesel prices completely collapsed, closing almost a full dollar below its previous day’s close.

To put that into downstream context, a 7,500-gallon load of diesel went from roughly $35,000 (before pipeline and terminal fees, freight, and tax) to just $27,000 overnight. The same load of fuel would have cost less than $10,000 in 2020 (again, before fees, freight, and tax). Even the smallest headlines are having profound impacts on diesel since Russia is a key supplier of heavy crude oil blends used to make the product.

Although not quite so dynamic as diesel, gasoline prices have seen their fair share of pain, as US consumers know all too well. Gasoline climbed to a peak of $3.80, well below diesel prices but still high. Reports of record-high retail prices have been prominent in the news, and consumers are beginning to cut back on trips to avoid high costs. This morning, prices are around $3.30, more than 50 cents above the pre-invasion price.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.